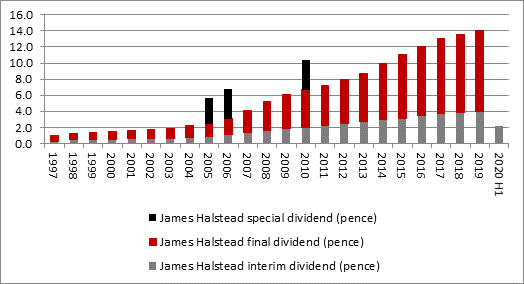

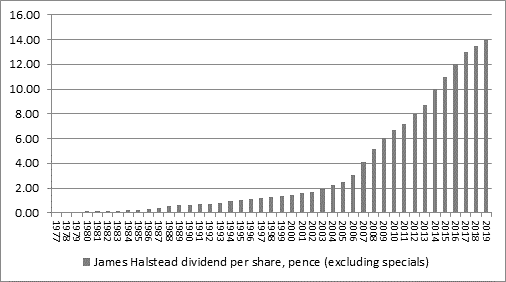

“Given how well the company is run and how solidly it is financed, it was always going to take something extraordinary to break James Halstead’s phenomenal run of increases in its dividend and the viral outbreak has just proved it,” says Russ Mould, AJ Bell Investment Director. “The floorings expert has trimmed back its interim payment to 2.125p a share from 4p. This does not mean the growth streak in the annual payment, which dates back to 1977, is over for certain. If circumstances permit, James Halstead will consider a second interim dividend in August and the final dividend could make up the slack but for the moment the company is prudently hunkering down.

Source: Company accounts

“This is not to say that Halstead could not afford to increase the interim dividend. The balance sheet shows £64 million of cash and no debt, with lease obligations of £7.2 million and a pension liability of £19.4 million, for a net cash position of £37.4 million.

“Meanwhile, the first-half was very profitable, with an operating return on sales of 20%, and cash conversion was excellent, as James Halstead turned an operating profit of £25 million into post-tax free cash flow of £19 million. That comfortably covers £1.3 million in lease payments and a £1.1 million contribution to the pension fund, while still leaving plenty of room for what would have been an interim dividend payment in excess of £8 million.

“The reduced interim payment comes to around £4.4 million as CEO Mark Halstead and the board sought to strike a balance between meeting the requirements of shareholders – which include 60% of the company’s workforce – and not showing a cloth ear to wider social concerns at a time when everyone’s health is the most important consideration.

“An extended three-week Easter break for staff at one production facility shows that management is aware of these concerns, but the flooring specialist will be able to help in another way too. Although retail and hospitality are big markets for the AIM-quoted company, James Halstead is an official key supplier to the NHS, having supplied the organisation for over 70 years, and £67 million of inventory help to meet the immediate requirements of the health services in the UK and beyond.”

Source: Company accounts