“On the same day that Renewi – in theory offering a double-digit yield – is dishing out a profit warning and cutting its dividend and trading begins in Lyft, which will have a $24 billion valuation even though it is unlikely to turn a profit any time soon, Manchester-based flooring specialist James Halstead is again providing an example of how savers can use the stock market to manage risk and get rich slowly,” says Russ Mould, AJ Bell Investment Director.

“Renewi shows the dangers of buying stocks where the yield simply looks too good to be true and Lyft certainly promises excitement for shareholders, as the shares are likely to be volatile, given how the valuation isn’t backed by anything as tangible as cash flow.

“By contrast, James Halstead offers product innovation that underpins the firm’s strong competitive position, which in turn helps it produce operating margins of 20%. That strong return on sales drives cash flow, buffers a net-cash balance sheet and ultimately enables the firm to offer yet another increase in its interim dividend, this time by 4% to 4.0p.

“That leaves the £940 million cap company on track to add to its streak of consecutive annual dividend increases that stretches back to the late 1970s.”

Source: Company accounts. Financial year to June

Adjusting for stock splits in 2006, 2011 and 2012, James Halstead’s dividend has already grown from 0.016p a share in 1977 to 13.5p for the year ending June 2018.

The shares have gone sideways over the last 12 months, thanks to raw material cost pressures and uncertainty over Brexit, which management is looking to combat through some building of inventory and contingency planning across its supply chain.

James Halstead has also been able to cope with a 3% increase in costs (down from a 18% surge last year as sterling stabilised) thanks to manufacturing efficiencies but also sales mix, as product innovation has enabled the company to sell more value-added product.

Add this resilience to its £62.8 million net cash pile and the AIM-quoted company could yet add to its stunning long-term share price performance record.

Since 1977 the shares have risen from 0.29p to 447p for a 154,138% capital gain, which massively outpaces the 2,589% advance in the FTSE All-Share over the same period.

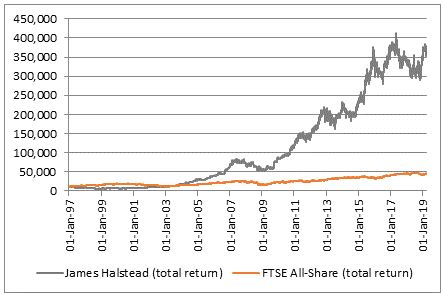

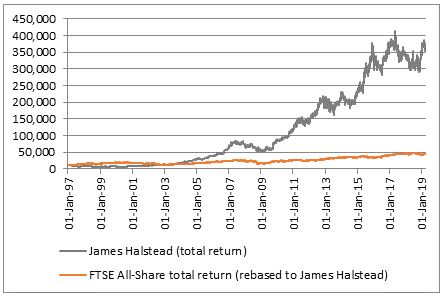

If 41 years is too long for many of us to think about (even though it is the appropriate time horizon for investing for your pension), the numbers over the last 20 years are no less stunning.

Since 1998, James Halstead’s dividend has grown from 1.28p to 13.5p (with more to come) and its shares have soared from 31.4p to 4447p.

That 1,441% gain beats the 66% advance in the FTSE All-Share over the same period hands down.

The figures are even more stunning in total return terms, once dividends are reinvested.

Since 1998, James Halstead has offered a total return of 3,112% compared to 309% from the FTSE All-Share.

Source: Refinitiv

Even if the past is no guarantee for the future, and purists would argue that James Halstead’s earnings cover for the dividend in the year to June 2019 is lower than ideal at 1.25 times, based on consensus earnings per share forecasts of 18.8p for earnings per share and 15p for the dividend, this shows two things

1) How picking stocks with strong competitive positions, good management, a healthy balance sheet and consistently robust returns on capital can generate excellent portfolio returns for very patient investors who are prepared to take a very long-term view. The stock market can be a fine get-rich-slow mechanism when it works well and when it used properly (and not treated a fruit machine and source of potential near-term jackpots)

2) The importance of dividend growth. The 15p-a-share forecast dividend for 2019 compares to James Halstead’s 1998 share price of 31.4p – the chances of Halstead’s shares staying unchanged over that period on what would now be a 47.7% dividend yield backed by a net cash balance sheet would be pretty slim. Share prices grow into and are pulled along by rising dividends.