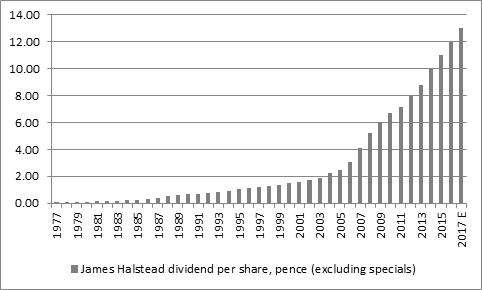

Source: Company accounts; for 2017, Digital Look, consensus analysts’ forecasts

Adjusting for stock splits in 2006, 2011 and 2012, James Halstead’s dividend has grown from 0.016p a share in 1977 to 12p for the year ending June 2016.

Today’s 7.1% interim payment hike to 3.75p paves the way for the 8% increase in the total dividend to 13p for the year to June 2017, further buffering Halstead’s reputation.

The shares may be down a fraction today, owing to chief executive Mark Halstead’s careful flagging of raw material cost pressures (themselves the result of the weaker pound) and broadly flat first-half profits.

But the Manchester-based firm’s export potential and a £51.6 million net cash pile help to support analysts’ forecasts of further dividend increases and mean James Halstead could, over time, add to a stunning long-term share price performance record.

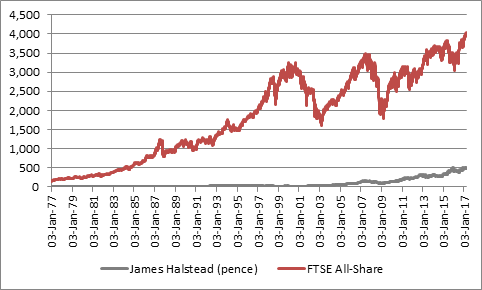

Since 1977 the shares have risen from 0.29p to 489p for 168,176% capital gain, which massively outpaces the 2,515% advance in the FTSE All-Share over the same period.

Source: Thomson Reuters Datastream

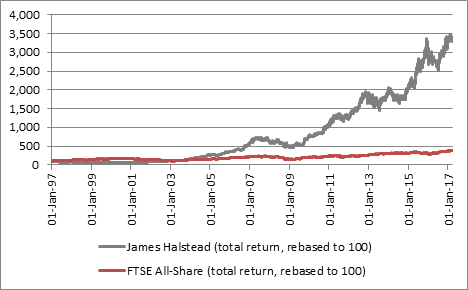

If a 40-years is too long for many of us to think about (even though it is the appropriate time horizon for investing for your pension), the numbers over the last 20 years are no less stunning.

Since 1997, James Halstead’s dividend has grown from 1.21p to 12p and its shares have soared from 40.4p to 488p.

That 1,108% gain beats the 97% advance in the FTSE All-Share over the same period hands down, while the total return (share price gain plus reinvested dividends) is 3,196% against 281% from the All-Share index.

Source: Thomson Reuters Datastream

Even if the past is no guarantee for the future, and purists would argue that James Halstead’s forecast dividend cover for the year to June 2017 is lower than ideal at 1.4 times, this shows three things

1) How reinvesting dividends over time lets compounding, the eighth wonder of the world, work in investors’ favour

2) How picking stocks with strong competitive positions, good management, a healthy balance sheet and consistently robust returns on capital can generate excellent portfolio returns for very patient investors prepared to take a very long-term view, who recognise the stock market can be a fine get-rich-slow mechanism when it works well and when it used properly (and not treated a fruit machine and source of potential near-term jackpots)

3) The importance of dividend growth. The 12p-a-share dividend of 2016 compares to James Halstead’s 1997 share price of 40.4p – the chances of Halstead’s shares staying unchanged over that period on what would now be a 30% yield backed by a net cash balance sheet would be pretty slim. Share prices grow into and are pulled along by rising dividends.