An unexpected sharp 14% fall in first-half pre-tax income is clobbering shares in Card Factory as the greetings card and gift wrap specialist wrestles with the issues which are facing so many retailers:

the weak pound increasing import costs

the National Living Wage increasing labour costs

the need to invest in the business to recondition it for the digital age

fragile consumer confidence

Russ Mould, investment director at AJ Bell, comments:

“Despite the obvious headwinds, the share price plunge could be an over-reaction.

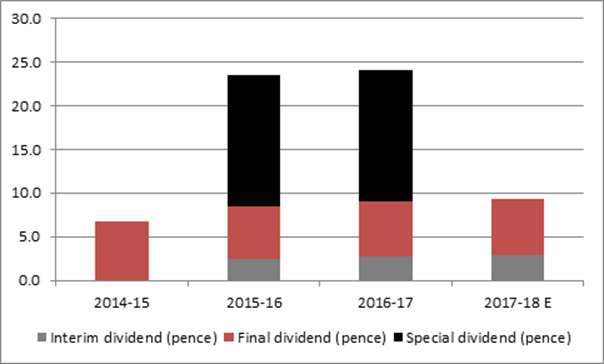

“Chief executive Karen Hubbard, and the Board, have shown confidence in the Wakefield company’s prospects – and above all its cash flow – by sanctioning a 3.6% increase in the interim dividend to 2.9p and offering the prospect of further special dividends.

“Assuming that full-year earnings per share fall by 14% as well, that would give a number of 17.0p – a figure that covers the consensus full-year dividend forecast of 9.37p by a relatively comfortable 1.8 times. That alone would be enough for a 4.2% yield.

“If Card Factory pays a third straight annual special dividend of 15p since its 2014 flotation the yield would be above 10% after today’s crunching share price fall, and such a prospect is not impossible, assuming the full-year profit decline matches that of the first half.

Source: Company accounts, analysts' consensus forecasts, Digital Look

“This is because net debt is low at £146 million (although there are also lease commitments of £170 million) and interest cover is more than 24 times.

“And while earnings would not cover a 24.37p total dividend, worth some £58 million in total, free cash flow could do so almost to the penny, giving operating free cash flow (OpFcF) cover of one times.

| 2017E | Forecast |

|

| H1 2017 | Historic | 2017-18 E |

| Dividend | Dividend | 2017E | OpFcF | Net debt/(cash) | Net debt/(cash) | Interest |

| yield (%) | cover (x) | PE (x) | cover (x) | £ million | equity (%) | cover (x) |

Regular dividend | 4.2% | 1.81 x | 13.1 x | 2.58 x | 145.4 | 59.6% | 24.6 x |

Regular + special dividend | 10.9% | 0.70 x | 13.1 x | 0.99 x | 145.4 | 59.6% | 24.6 x |

Source: Company accounts, Digital Look, consensus analysts’ forecasts. Company has lease commitments of £169.6 million over and above the net debt numbers.

“Even if the special dividend comes in lower than 15p, the yield may still catch the eye of patient income investors, although some investors may worry that Card Factory is simply the latest consumer-facing company to caution about trading – and if times are getting tougher it would be easy for shoppers to economise by not buying a greetings card (or sending an e-card) and just buying the present.”