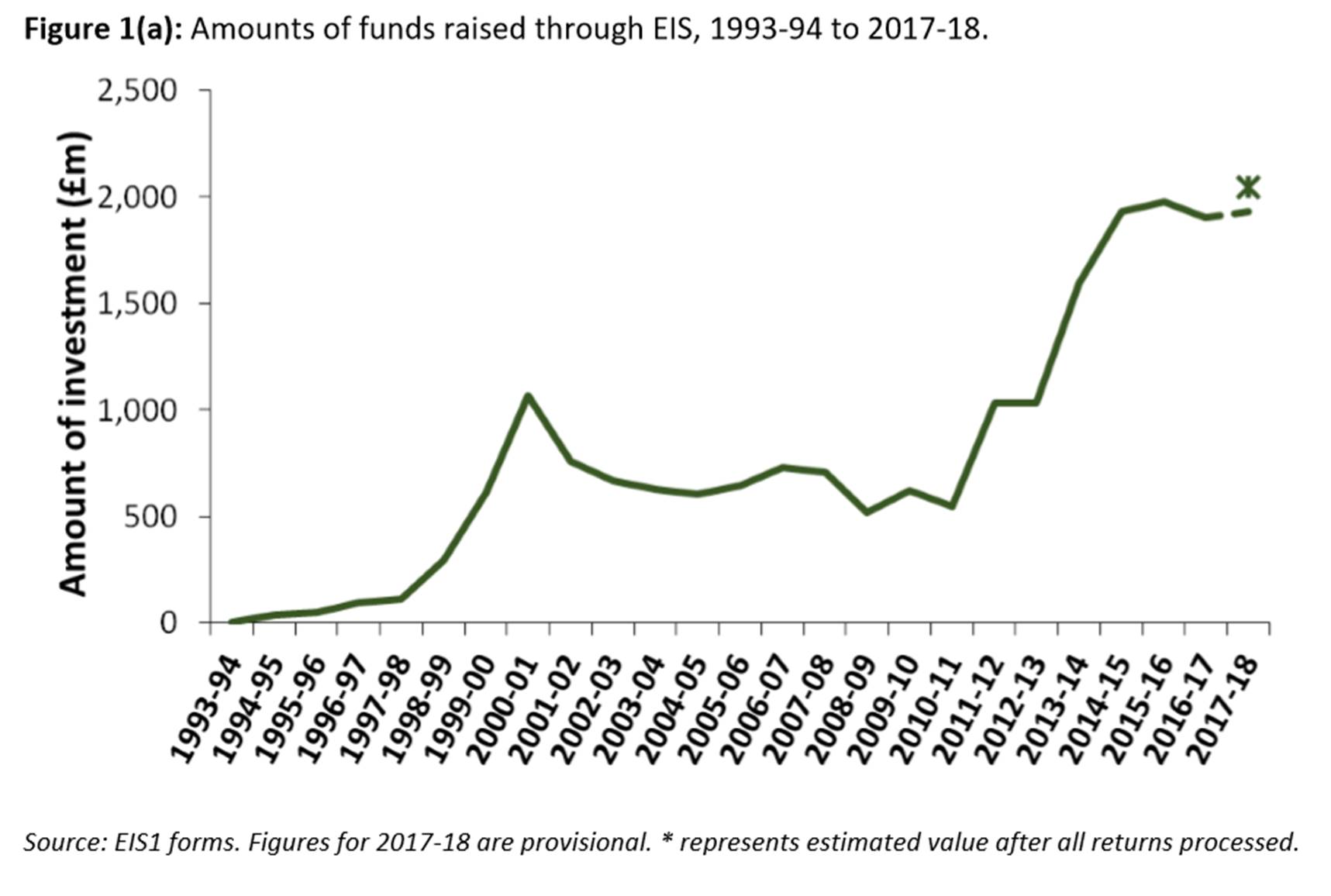

• New data reveals £20 billion has been ploughed into companies through Enterprise Investment Schemes (EIS) since they launched in 1993/94

• Over £1.9 billion raised through EIS in 2017/18, with investments of up to £1 million potentially boosted by 30% tax relief

• Seed Enterprise Investment Schemes (SEIS) have helped raise over £1 billion since launching in 2012/13, benefiting 12,900 companies. Investments up to £100,000 qualify for 50% tax relief

• Huge spike in EIS investments since 2010 coincides with period when pension tax allowances have been eroded – see graph below

Tom Selby, senior analyst at AJ Bell, comments:

“The last decade or so has seen a boom in EIS investments, with savers scrabbling to benefit from the 30% tax relief on offer.

“Companies based in London and the South East have perhaps unsurprisingly been the biggest winners, scooping up two-thirds of the available EIS investment cash in 2017/18. A similar trend has been reported where companies seek funding through the Seed Enterprise Investment Scheme.

“Clearly the increase in tax relief on EIS investments from 20% to 30% in 2011/12 will have had a significant impact on demand in recent years. However, there are two other developments that have contributed to the burgeoning EIS and SEIS markets.

“At the lower end, the rise of crowdfunding websites such as Seedrs and Crowdcube makes it easier than ever for those with small funds to dip their toes in the world of direct investment. When it comes to SEIS, for example, over half (58%) of investors claiming tax relief invested £10,000 or less, with over 1 in 10 investing £500 or less.

“At the other end of the spectrum, the dramatic erosion of pension tax relief allowances since 2010 is likely to have encouraged many wealthier investors to seek alternative homes for their hard-earned cash.

“In particular the cut in the lifetime allowance from £1.8 million to £1,055,000, the reduction in the annual allowance from £255,000 to £40,000, and the introduction of the hideously complex annual allowance taper will inevitably have pushed many to seek out savings alternatives. In this environment the 30% tax relief on offer through EIS and 50% through SEIS are understandably attractive.

“Investors considering going down this route need to make sure they understand the rules and the risks they are taking.

“The incentives on offer through EIS and SEIS exist because the companies are generally start-ups and therefore have a higher chance of failure. As such, it is possible that you will get back less than you put in initially – even when generous tax benefits are taken into account.”