Russ Mould, investment director at AJ Bell, comments:

“Investors should think very carefully before punting the stock on bid rumours as buying solely in the hope of a takeover can be a mug’s game, no matter how strong the fear of missing out (FOMO) can be.

“The best long-term investors think like an owner and ask themselves the question “would I want to own the whole company?” This makes them consider a firm’s strategy, competitive position, financial strength, management acumen and the valuation of its shares before they take any kind of stake.

“If they spot a winner, the result could be a bid from a corporate rival, but that is a bonus, not the reason for the investment.

“And if all of those boxes cannot be ticked, investors need to ask themselves why would anyone else want to own it (forever) if they do not? It is possible that a bid may arrive but the downside risk of it not doing so could still outweigh the potential gains from any offer.

“Carillion’s interims do little to entice a bidder. They include a £200 million in fresh contract provisions, a worse-than-expected underlying profit performance and a downgrade to full-year revenue forecasts.

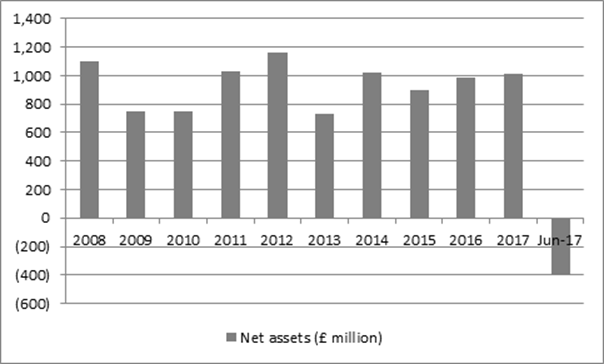

“More tellingly still, the stated £1.1 billion net loss for the year means the company’s net worth – or the amount of money that would be left for investors to share out in the (unlikely) event management simply decide to wind up the company and liquidate it – is now negative, to the tune of £405 million.

Source: Company accounts

“The assets side of the balance sheet is also essentially dominated by £1.6 billion of intangible assets – primarily goodwill from acquisitions, plus some customer contracts and intellectual property.

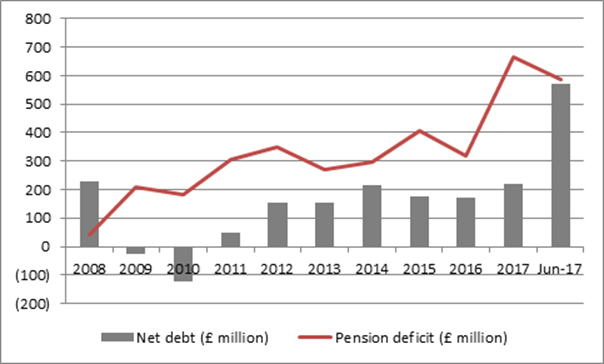

“The liabilities side is dominated by a mushrooming debt pile and the £587 million pension deficit, with the latter a particular potential deterrent to any would-be acquirer:

Source: Company accounts

“None of this is to say there is no chance of a bid – the rumoured Middle Eastern buyer may have an agenda of their own which is not driven by financial returns. But investors who fear they are missing out on a quick kill must at least consider what might happen if they buy the shares and the bid does not materialise, leaving them with a stake in a heavily-indebted company which may need to tap them for cash via a rights issue or placing simply to give it some breathing space.”