“Shares in Apple trade some 10% below their March all-time highs amid gathering concern that the iPhone X has failed to spark a major upgrade cycle in the smartphone market, as its high price tag and evolutionary rather than revolutionary nature has persuaded even hardened Apple-holics to wait to replace their cherished devices.

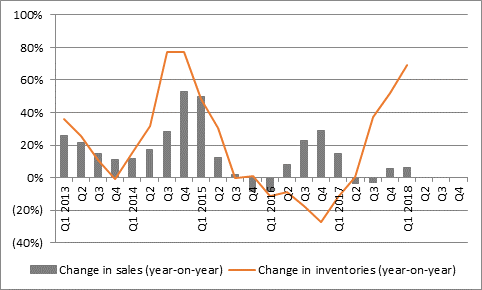

“These worries have been fuelled by comments from leading component suppliers, notably leading silicon chip foundry (or subcontract manufacturer), TSMC, whose own shares have wobbled on the Taipei stock exchange after its comments about softer demand from (unspecified) smartphone customers. TSMC’s dilemma can be clearly seen in its balance sheet.

“Growth in inventories – finished parts – has soared and outstripped growth in sales. This would suggest that key customers have over-ordered and now pulled back their requirements for future quarters.

Source: TSMC accounts

“Admittedly, TSMC’s accounts showed a similar inventory bulge in summer 2014 – but that came ahead of the September 2014 launch of iPhone 6, in preparation for the product’s release.

“TSMC has made similar preparations this time, getting parts ready for the release of iPhone 8 and iPhone X in September 2017- but this time the company has continued to accumulate stockpiles of finished silicon chips after their launch.

“One possible conclusion is that a big customer is suffering a sales disappointment of its own and the most logical candidate is Apple, given its size, product launch timetable and the surprising fact that iPhone unit volumes have not grown at a double-digit rate since the third quarter of calendar 2015.

“However, all may not be lost for Apple’s second quarter for three reasons.

Data from consultant GfK asserts that global smartphone volume shipments fell 2% year-on-year in Q1 2017 to 347 million. However, a 21% jump in average selling prices means that global industry revenues still rose 18%.

In addition, Apple’s services revenue continues to mushroom, as the ecosystem of apps and developers continues to flourish. In the first quarter of Apple’s fiscal year, revenues from services and “other” (which includes the Apple Watch) came to $14 billion or 16% of the group total.

Apple still has $286 billion in cash and cash equivalents on its balance sheet, so it can ramp up both its dividends and share buyback programme, should it choose to do so. Since the initiation of such payments and cash returns in the first calendar quarter of 2013, Apple has returned $160 billion to shareholders in buybacks and paid out $61 billion in dividends – equivalent to 25% of its current market capitalisation – and during that time its net cash pile has grown by a sixth to $163 billion.

“Sceptics will argue that Apple has taken on $122 billion in debt to fund the dividends and buybacks, potentially leaving itself with some awkward liabilities at some stage, especially if anything goes wrong with profits. They will also assert that they would rather buy Apple for the excellence of its products and services rather than financial gimmicks such as buybacks, whose long-term benefit to stakeholders and stockholders remain open to debate.

“Bulls will counter the firm only took on the debt because lofty US taxes left its cash trapped overseas, adding that the Trump tax cuts and reforms solve that problem.

“As such, Apple’s second quarter should be a fascinating litmus test for two reasons:

Bulls of tech stocks, and US equities more generally, have argued that bumper corporate earnings would provide the next leg up in the Dow Jones, S&P 500 and NASDAQ Composite indices. They have been correct in that first-quarter earnings have been excellent, rising 20% year-on-year, according to numbers from Standard & Poor’s, to top consensus estimates of 15-17% growth.

Bulls of tech stocks, and US equities more generally, have also argued that the Trump tax cuts would unleash a torrent of fresh share buybacks as cash-rich firms deployed their capital in an shareholder-friendly manner. This has also come to pass, with companies such as drug developer AbbVie and silicon chipmaker Broadcom unveiling bumper new buyback programmes, worth $7.5 billion and $12.5 billion respectively.

“Yet US stocks did not rise last week and the S&P 500 benchmark still trades some 7% below its January all-time high. This suggests that last year’s strong run in US stocks, as the Trump tax plan was anticipated, has gone a long way to pricing in a lot of good news already – Standard & Poor’s estimates have profits per share for the S&P 500 rising by 40% from 2017 to 2019.

“This might give bulls of US stocks at least some pause for thought, so it will be interesting to see what Apple’s shares do after its results on Tuesday night.

“For the record, the consensus earnings per share estimate is $2.69 for Q2, up from $2.10 a year ago.

“Apple has guided to revenues between $60 billion and $62 billion, with a gross margin of 35.0% to 35.5%, operating costs of $7.6 billion to $7.7 billion and a tax charge of 15%, down from 25% in the same quarter a year ago.”