“Few will quibble with his energy, drive or vision (even if they may give some oil and rival auto executives plenty of sleepless nights) and it is unlikely that the speed at which his company is burning cash would cause investors and analysts to fret quite so much were it not for Tesla’s $52 billion market cap, which put it on a par with General Motors – a firm which sold 715,794 vehicles in America alone in Q1, when Tesla shipped cars 29,980 worldwide.

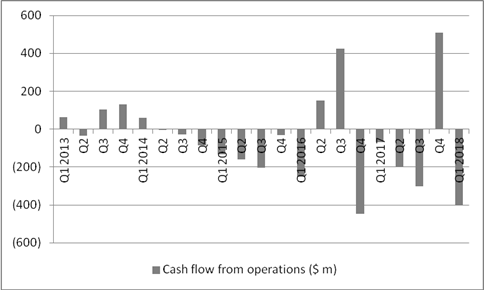

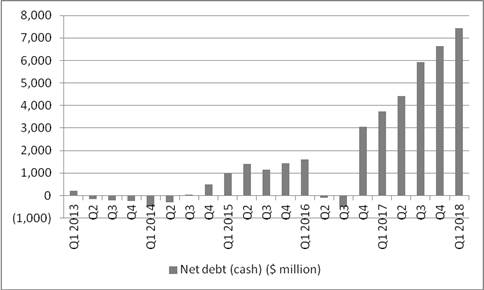

“That valuation leaves shareholders with little downside protection and the company’s $7.4 billion net debt pile and dwindling cash resources mean the pressure is on Mr Musk and his colleagues to resolve the Model 3 production problems as fast as they can. Nor will testy conference calls help the company’s case if – or when – it needs to access equity or debt markets for fresh funding, something which seems quite possible given the company’s current cash flow profile.

Source: Tesla accounts

Source: Tesla accounts

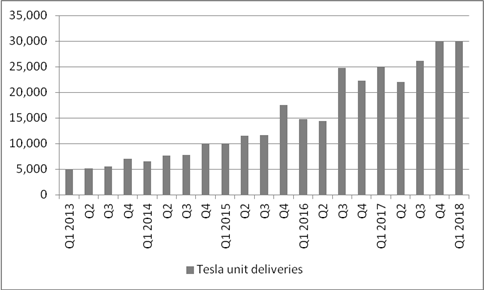

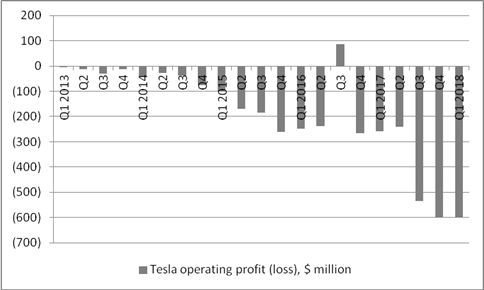

“True believers will find some comfort in these numbers, although they will have to look quite hard, given that Tesla loses almost $20,000 for every car it currently makes at the operating level, to show just how desperately it needs to ramp up volumes to aid overheard recovery at its manufacturing sites and start to get both operational and financial gearing working for it, rather than against it as they are at the moment.

Unit shipments grew once more, reaching 29,980 against 29,870 in the fourth quarter and 25,051 a year ago.

Source: Tesla accounts

Operating losses, though heavy at $597 million, did not worsen in the first quarter compared to the fourth, to raise hopes that this may be as bad as it gets for Tesla

Source: Tesla accounts

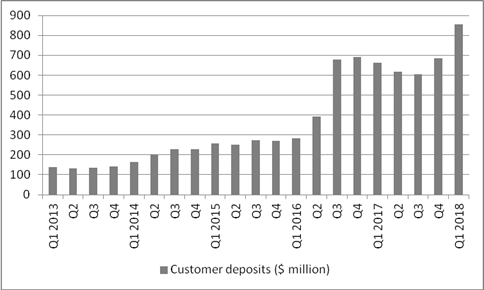

Shareholders and analysts may be getting edgy but customers are keeping the faith. Customer deposits on Tesla’s balance sheet rose by 28% year-on-year to $854 million, to suggest that orders are still rolling in (albeit after a worrying blip in summer 2017).

Source: Tesla accounts

“The diminishing $2.7 billion cash position does mean that the clock is ticking for Tesla, especially as Q1’s net cash outflow from operations of $398 million comes before capital investment of $666 million.

“Moody’s downgrade of Tesla’s debt does suggest the firm’s position is precarious and investors now just need to hope that Mr Musk can deliver on his production volume targets, although the market’s reaction to the figures released by Spotify, Snap and Tesla suggest that shareholders are becoming less tolerant of very highly-valued ’jam-tomorrow’ stories and are looking for some jam (or profit and cash flow) today instead, as shown by the warm reception given to Apple’s buyback and dividend plans.”