Russ Mould, investment director at AJ Bell, comments:

“Fulham Shore has warned of a slowdown in trading in July and August across its Franca Manca and Real Greek sites (of which there are now a combined total of 56), most notably in the London suburbs.

“The impact of this slowdown in the top line is being worsened by short-term costs associated with the ongoing opening programme and investment in existing sites to keep them competitive. As a result, management expects its preferred profit metric will come in below market forecasts, even if earnings are still forecast to grow year on year.

“Unlike Tasty and Comptoir, Fulham Shore is not slowing down its rate of expansion. The firm still intends to open a total of 15 restaurants this year (having already opened 10).

“By contrast Tasty slashed its planned opening programme from 15 sites to seven sites in response to its March trading alert, while Comptoir cut back to four sites in 2017 and four more in 2018.

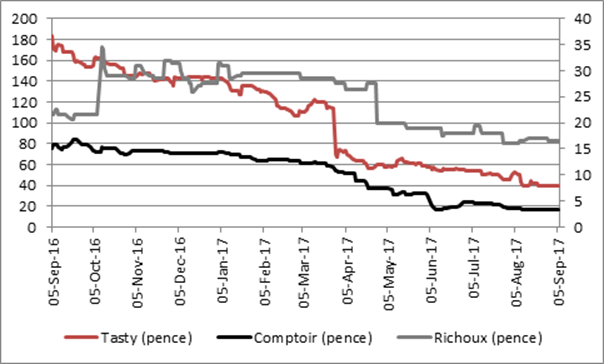

Source: Thomson Reuters Datastream

“Even more mature groups such as Frankie & Benny’s and Chiquitos owner Restaurant Group has been finding the going tough, with the FTSE 250 firm launching a major overhaul of menus and pricing points under new boss Andy McCue in response to disappointing trading in 2016 and early 2017.

“Casual dining chains can be terrific investments, especially when they are in their expansion phase and their brand(s) and venues become fashionable – Restaurant itself is an example of this, as are eventual takeover target Carluccios and also the Patisserie chain.

“However, the stock market is also littered with restaurant chains whose star fell as quickly as it rose, as diners proved fickle and moved swiftly on to the next name or concept – FishWorks was one such failure.

“Besides the normal challenges posed by fashion, restaurateurs have several other challenges on their plate at the moment. These include

Higher costs, owing to the introduction of the National Living Wage and increased minimum wage

The weaker pound, which is increasing import costs of some raw materials (a trend which prompted site retrenchment across the popular Jamie’s Italian chain for example)

Price pressure and competition from online delivery services. While delivery services such as Deliveroo and others can drive volumes, and thus brand recognition, the margin on such business is often thin at best, while Just Eat specialises in working with independent outlets.

High levels of consumer debt could start to curb consumers’ appetite for eating out, especially as wage growth continues to run below inflation.

“Whether Fulham Shore’s problems are company-specific or indicative of a wider problem in the restaurant industry (and for that matter any business dependent on discretionary consumer spending, be it retail, travel or media) remains to be seen.

But it has to be a concern that the group is the fourth casual dining specialist to warn this year, suggesting that consumer sentiment may not be as strong as bulls of the UK economy would like to think.“