“Despite concerns over the testing and quality assurance expert’s exposure to the global resources industry – and, ironically, some niggles over the quality of its accounting, given the reappearance of more supposedly ‘exceptional’ costs – investors are taking this as a positive sign and a show of confidence in the company’s competitive position and future prospects.

Source: Company accounts

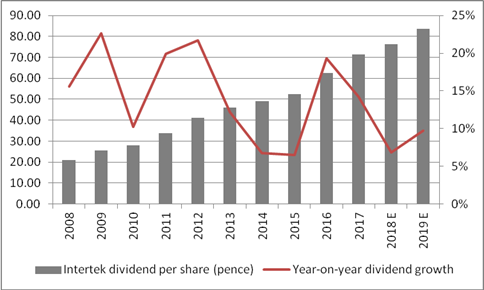

“Intertek’s streak of dividend increases dates back to 2004 and analysts expect the company to add to its run in 2018 and 2019.

“Even though the forecast yield for 2018 of 1.5% may not look exciting a rising dividend should drag a share price higher over time, providing the growth can be maintained without causing financial stress at the company, in the form of underinvestment in the business or taking on debt to pay it.

“In 2008, Intertek’s dividend was 20.8p and the price on 1 March 2008 was 889p – for a 2.3% yield.

“But had investors bought at 880p and held on they would now be banking a 71.3p dividend for an 8.1% yield on the price paid.

“That basic maths shows why dividend growth is so powerful.

“Throw in the power of dividend reinvestment and it becomes clear that targeting firms that are capable of consistent dividend growth is the secret to long-term investment success.

“From 1 March 2008 to 1 March 2018, Intertek’s shares rose by 440%. Add in dividend reinvestment and the total return becomes 538% over the same period – and both figures are way higher than the 22% capital gain and 79% total return generated by the FTSE 100 over the same time frame.

| Value at 1-Mar-08 | Value at 1-Mar-18 | Capital gain | Total return* |

|

|

|

|

|

Intertek | 889p | 4,854p | 440% | 539% |

FTSE 100 | 5,114 | 7,176 | 22% | 79% |

Source: Thomson Reuters Datastream. *Includes dividend reinvestment

“This is how stock markets are supposed to work, as get rich-slowly-schemes (when they go well). This allows the investor to turn time into money, through the identification of firms with a good strategy, strong competitive position, a smart management team whose interests are aligned in the long-term with those of shareholders and sound finances.

“However, patience is required and there will be times when the share price gyrates. Intertek trades on a lofty earnings multiple – some 26 times earnings for 2018 and 24 times for 2019.

“Such multiples do imply that Intertek’s status as a company capable of generating steady growth and offering good visibility (and thus quality) of profits, and doing so in a relatively low-risk way, is already quite well understood.

“The PE ratio simply measures the number of years it will take a company to earn its market capitalisation in profits (assuming that they do not grow) so

“But investors need to make sure they are comfortable working on the sort of time horizon implied by the PE (or that the companies will keep growing or both) to pay this sort of multiple for the quality on offer.”