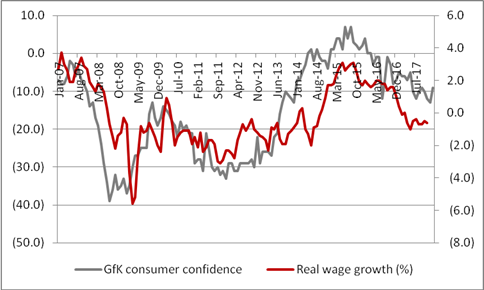

“Each reading showed a marked improvement in January when compared to December, although it may take a sustained acceleration in wage growth – or a notable drop in inflation – for the momentum to be maintained as the GfK readings do seem to closely track real (inflation-adjusted) wage increases.

Source: GfK, Office for National Statistics

“Wage growth has crept up to 2.5% and inflation, using the consumer price index (CPI) as a benchmark, eased a little in December to 3.0%, possibly helped by gains in the pound which have begun to dampen down the cost of imported goods. Sterling has advanced further since so it will be interesting to see if this offsets the impact of higher oil and fuel prices and gives a further lift to consumer sentiment and possibly spending patterns.

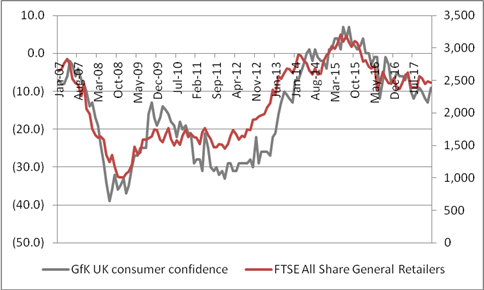

“Investors in retail stocks will be hoping so, as the GfK consumer sentiment data does look to broadly correlate with the performance of the FTSE All-Share General Retailers index.

Source: GfK, Thomson Reuters Datastream

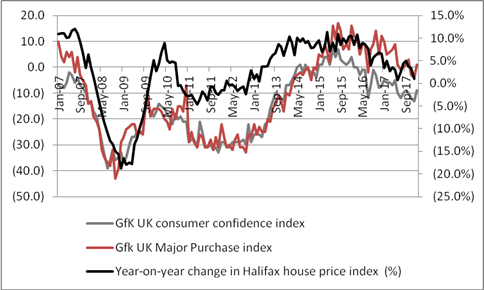

“Housebuilders and their shareholders may also draw succour from the latest GfK Major Purchase sub-index, especially after this week’s disappointing mortgage applications data, which came in at a three-year low. It is hard to think of any purchase that is bigger than a house and so it is logical that UK house prices and this piece of GfK data seem to have some relationship. An sustained uptick in sentiment may therefore see a spring upturn in mortgage activity and house prices, though again that may well depend on how wage growth and inflation pan out as 2018 develops.”

Source: GfK, Halifax Building Society