“It may be a small-cap stock but greetings cards, crafting, gifts and gift wrapping specialist IG Design is dishing out a big profit warning,” says AJ Bell Investment Director Russ Mould. “Management’s forecast that operating margins could drop by around two percentage points, rather than rise by more than one percentage point as analysts had been expecting, implies that operating earnings could come in more than 40% below current forecasts.

“That helps to explain why the shares are down so sharply, although it is less clear why IG Design’s profit disappointment is such a big surprise.

“After all, management cites supply chain problems, higher sea freight costs and higher raw material and wage costs, all of which could linger into the company’s financial year to March 2023.

“None of these are news as such, so this goes to show how careful investors must be when gauging the impact of higher inflation upon businesses and how they are able to cope and defend their profit margins – or indeed whether they are able to defend their profit margins, because in this case IG Design is finding it hard to cut costs or raise prices quickly enough to cover the input inflation.

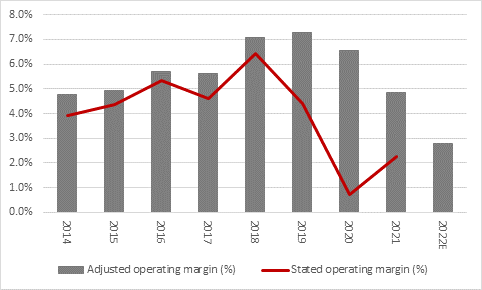

“The company’s operating margins were already pretty thin – 4.8% on an adjusted basis and 2.2% on a stated basis – and provided little protection in the event that anything unexpected went wrong.

Source: Company accounts, mid-point of new management guidance for 2022E. Financial year to March. Company known as International Greetings until June 2016

“And it is just possible that today’s profit alert has its origins in the 2018 purchase of the American business Impact Innovations, for an upfront price of £56.5 million in cash, supplemented by a £15.4 million share award to the purchase’s then CEO John Dammermann and his wife and a £27.9 million investment in stock and working capital, for an all-in cost of just under £100 million.

“The rationale of the deal looked clear. Enhanced scale and market share in the US, the chance to cross-sell to giant retailers such as Wal-Mart and Kroger and a targeted $5 million in cost efficiencies within three years all looked supportive of analysts’ view that the transaction would be help to increase profits going forward.

“The subsequent purchase in 2020 of America’s CSS Industries for £90 million, including debt, further broadened IG Design’s range of customers and products but the purchase of Impact also brought with it two potential dangers, both of which may now have come crashing home.

“First, Impact’s seasonal décor business meant its revenues and profits were more seasonal than those of IG Design, with a huge slant towards Thanksgiving and Christmas in the calendar fourth quarter, which traditionally generated some 85% of Impact’s annual sales. In this respect, any supply-chain disruption could have hardly come at a worse time, even if CSS’ focus on every-day gifting meant 43% of total group sales came at Xmas in fiscal 2021, down from 56% the year before.

“Second, Wal-Mart represented around of fifth of IG Design’s sales following completion of the deal in 2018. This may well have been a good thing in terms of the volumes but it did leave IG Design to negotiate with a much, much bigger firm on issues such as volume and price and the British firm may have started to find it hard to recoup higher costs as a result, especially as other major customers include Tesco, Lidl and Carrefour, all of whom are likely to use their scale and market share to drive a hard bargain. Two-thirds of sales come from 20 customers, many of whom will be a lot bigger than IG Design.

“Since IG Design outsources around two-thirds of its product, that could leave the firm as the meat in the sandwich between its suppliers and its customers, something which could be pressuring those thin margins and the root cause of the big profit disappointment.

“Investors may also need to ponder the shares’ valuation ahead of today’s announcement. IG Design has a lot going for it – ambitious plans to grow sales organically and by means of acquisition, a goal to double earnings before interest taxes depreciation and amortisation, a solid balance sheet and a blue-chip customer base – but before today’s alert analysts had pencilled in 24p of earning per share (EPS) for the year to March 2022.

“At last night’s close, a share price of 441p put the shares on 18.4 times forward earnings – a premium to the UK market’s 14-times multiple. That premium may have factored in the growth potential and the healthy balance sheet, but acquisitions always come with risk and it also paid little heed to the relatively lowly profit margin.”