If you are covering HSBC’s results, below is some analysis from Russ Mould, investment director at AJ Bell:

“Another 4.5% gain in HSBC’s shares, even after a messy and complex set of figures, intensifies the pain which many fund managers are suffering as “expensive defensives” fall out of favour and potential “value” sectors like banks start to move higher.

“Even after a surge from barely 400p a share to north of 600p, HSBC’s £118 billion market cap compares to stated shareholders’ equity (or asset value) of £150 billion (assuming a sterling/dollar cross rate of $1.25).

“Stocks which trade at a discount to asset, or book, value, are the territory of contrarian, value funds and investors, who are having a field day as expensive stocks like Reckitt Benckiser, Shire and Unilever falter after even the tiniest disappointment in sales or profits, while the downtrodden, unloved banks motor higher despite a further round of ugly numbers.

“On a stated basis, HSBC’s third-quarter earnings fell 86% but anyone prepared to be forgiving and ignore no fewer than ten large “one-off” items will point to the adjusted pre-tax profit number, which rose 7%.

“Key negative items included a $1.7 billion loss on a Brazilian disposal, $1 billion of restructuring costs and $456 million of customer compensation payments (presumably PPI related). In addition, loans and deposits continue to fall year-on-year.

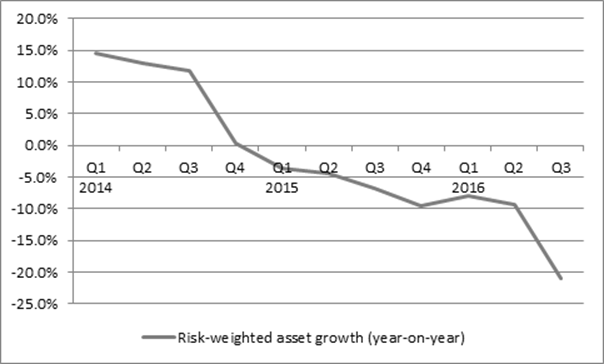

“However, the share price is rising because HSBC may be shrinking its way back to health – the Brazilian disposal means risk-weighted assets continue to fall sharply (see chart below), key regulatory ratios like Common Tier 1 Equity continue to improve and loan impairment charges remain low at just $453 million for the quarter.

“The quality of the Q3 numbers may therefore be low and what growth there is may be coming from cost-cutting but it does at least seem as if the risks are falling as the balance sheet shrinks and this may be all it takes to underpin the stock, at least while it trades on less than one times book value.”

Source: HSBC Accounts