“Maybe they need to look at this through the eyes of the buyer of the St Modwen assets and ask themselves what the purchaser is seeing that they are not? The answer may be ‘value’ amid the torrent of cautious commentary on retail, property and the UK economy more generally.

“St Modwen has sold 27% of its retail property portfolio and it has received a sum which represents a 4% discount to the latest net asset value (NAV) for those assets shown in the company’s accounts.

“The discount price means it is naturally tempting to see this as bearish for retail property and stocks with exposure to the sector but there three good reasons to reconsider this view:

- With the greatest respect to the Longbridge and Wembley sites, they are probably second-tier assets so the meagre 4% discount to NAV suggests that first-tier assets sold to a trade buyer (and not a financial buyer, as is the case with one of the deals) could go for book value without any trouble.

- St. Modwen’s shares are already trading at a 9% discount to the company’s last published NAV per share figure of 450.9p which dates back to November 2017.

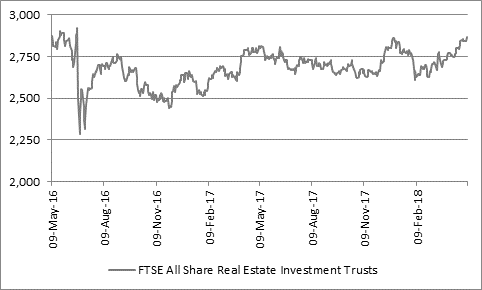

- Some of the real estate investment trusts (REITs) with the biggest retail exposure already trade at discounts to NAV of 22% to 50% and in many cases they will own prime, first-tier assets rather than secondary ones just as those sold by St Modwen today. Under such circumstances it is still possible to argue that the big REITs are cheap (or at least that a lot of the bad news is already well understood) - they last traded at similar discounts to NAV during the recession of the early 1990s and then they had to pay tax, whereas now they do not, so it can be argued the property plays look even better value now than they did then.

| Share price (p) | Historic NAV per share (p) | Premium / (discount) |

Safestore | 543.0 | 329.0 | 65.0% |

Big Yellow | 968.5 | 640.8 | 51.1% |

Londonmetric Property | 193.8 | 155.7 | 24.5% |

SEGRO | 638.0 | 556.0 | 14.7% |

Workspace | 1,108.0 | 1,014.0 | 9.3% |

A & J Mucklow | 552.0 | 506.0 | 9.1% |

Shaftesbury | 1,010.0 | 952.0 | 6.1% |

TRITAX Big Box | 150.7 | 142.2 | 5.9% |

Newriver | 283.5 | 297.0 | (4.5%) |

St. Modwen | 412.2 | 450.9 | (8.6%) |

CLS | 253.0 | 286.0 | (11.5%) |

Derwent London | 3,133.0 | 3,582.0 | (12.5%) |

Great Portland Estates | 701.2 | 813.0 | (13.8%) |

Capital & Counties | 278.9 | 334.0 | (16.5%) |

Hansteen | 103.6 | 130.6 | (20.7%) |

Town Centre Securities | 292.0 | 375.0 | (22.1%) |

British Land | 678.8 | 939.0 | (27.7%) |

Hammerson | 554.6 | 790.0 | (29.8%) |

Land Securities | 980.6 | 1,432.0 | (31.5%) |

INTU | 197.8 | 411.0 | (51.9%) |

Source: Company accounts, Thomson Reuters Datastream

“The problem is finding a catalyst which could unlock the value that may be there, especially as two bids in the sector (Hammerson-Intu and Klepierre-Hammerson) have already failed.

“Yet an Asian investor has already built a big stake in Shaftesbury, activist Elliott is now on Hammerson’s share register and the lower the pound goes the cheaper British property gets, at least for overseas buyers, despite all of the attractions that the UK offers, in terms of rule of law and central bank independence.

“Brexit does remain a huge question mark and it may be that the REITs are only reassessed when investors know what leaving the EU may mean and that may be March 2019, the end of the transitional period in December 2020, or later.

“But Columbia Threadneedle clearly feels it is getting value, and a decent yield, from its purchase today and the UK REIT sector has already started to move quietly higher, despite the downbeat commentary which it always seems to attract.”

Source: Thomson Reuters Datastream