• A key recession indicator flashed red this week

• The 2 year US Treasury note briefly traded at a yield higher than the 10 year bond

• This has been a reliable indicator of previous US recessions

• How investors can protect their portfolios

Laith Khalaf, head of investment analysis at AJ Bell, comments:

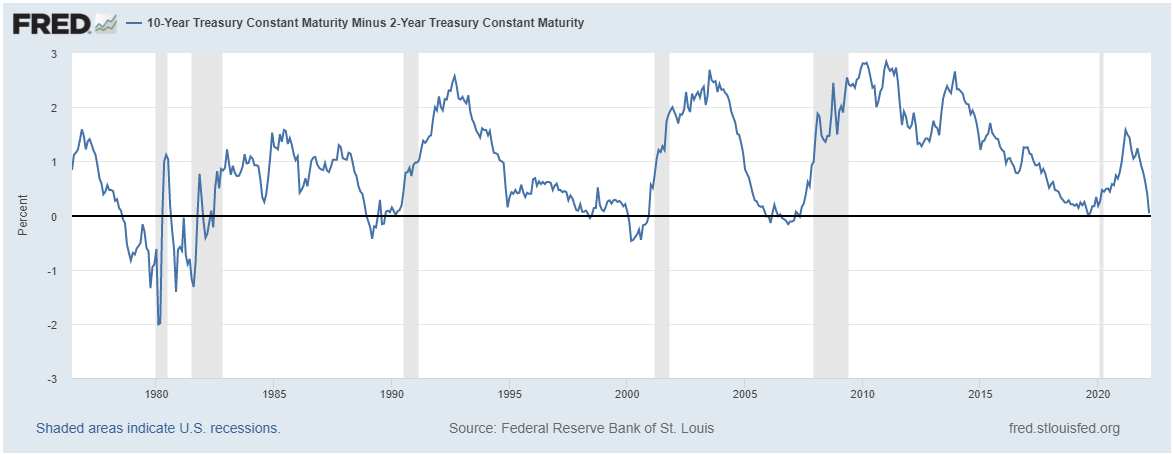

“A key part of the US yield curve briefly inverted this week when the 2 year Treasury note traded at a higher yield than the 10 year bond. That suggests the bond market thinks that in the longer term economic growth is shaky, and more concerningly, this yield curve inversion has been a key indicator of US recessions in the past, as the chart below shows. The chart shows the gap between the yield on the ten year and the two year bond, and anything below the x axis means the 2 year bond is yielding more. This isn’t just an issue for US investors; the US economy is so influential that if it tips into recession it will have a knock on impact across the globe.

“The last time the yield curve inverted in this way was in August 2019, and sure enough, a recession followed in the US the following year. However that recession was clearly caused by the emergence of COVID, which markets certainly couldn’t have predicted. What we will never know is whether a recession would have taken place in 2020, even if the pandemic had never happened.

“The chance of a recession has been elevated by the Ukraine crisis, and the heightened pressure on businesses and consumers that will result from higher energy and food prices. Central banks are expected to raise interest rates aggressively this year to deal with inflation, but tighter policy also puts the brakes on economic growth, which is probably one of the reasons the yield curve has inverted. The bond market is essentially saying that the combined effect of inflationary pressures and interest hikes might tip the economy into recession.

“The traditional assets that investors might normally turn to in order to protect their portfolios from recession don’t look particularly appealing right now. While cash rates look set to rise this year, they are still woefully behind the rate of inflation, which means cash savers will find their money’s buying power going backwards. Bonds are yielding more than they were, but in rising interest rate environment, prices could well fall further, offering a more attractive entry point into fixed income assets further down the line.

“Gold might be one asset investors could turn to, through an ETC like iShares Physical Gold. Rising interest rates aren’t a positive for the gold price because gold pays no income, but it’s likely to rally in any flight to safety. It acts a bit differently to other assets, so works as a bit of diversification in a portfolio.

“Investors might also turn to conservative multi-asset funds like Personal Assets Trust, Ruffer Total Return or Rathbone Total Return. Rather than invest across a range of assets and manage the allocation yourself, these funds do it for you. They focus on capital preservation, and while they’ll never shoot the lights out if markets are roaring away, they offer downside protection when things take a turn for the worse.

“Investors should be careful not to throw the baby out with the bathwater, and should avoid making wholesale changes to their portfolio. While yield curve inversion has been a reliable indicator of recessions in the past, there is no guarantee this indicator will prove correct this time around. That’s particularly the case given the extremely volatile situation in Ukraine, and the fact that bond markets have been hugely distorted by central bank quantitative easing schemes. However, it may be prudent to make some adjustments, just in case the bond market is reading the room correctly.”