• Next week’s inflation announcement will confirm how much the basic and flat-rate state pensions will rise by in 2022/23

• This will mark the first time in a decade the state pension hasn’t increased in line with the ‘triple-lock’

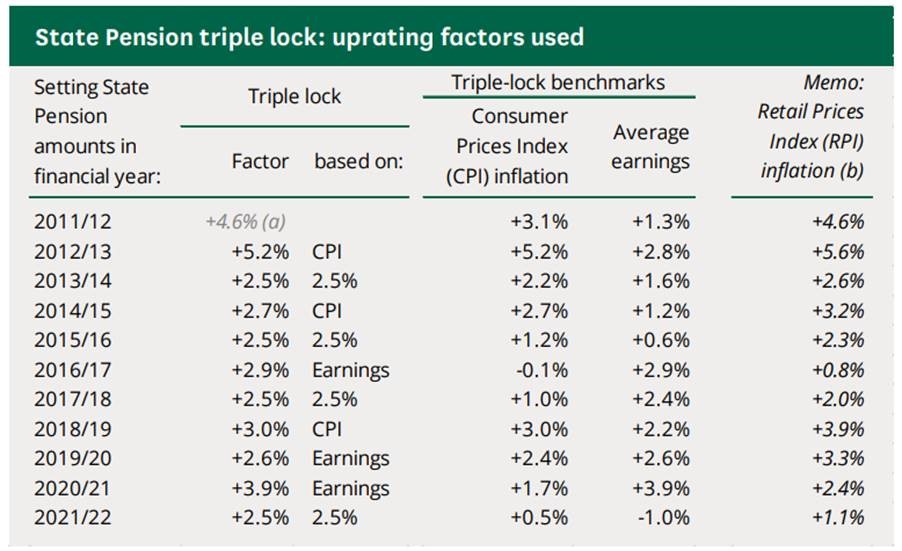

o The triple-lock guarantees the state pension increases by the highest of average earnings, inflation or 2.5%

o However, a post-lockdown spike in average earnings in 2021 saw the Government suspend the earnings element for next year

o As a result, the state pension will instead rise by the highest of average inflation or 2.5%

• Since the triple-lock was introduced:

o The basic state pension has increased in value by 35%, from £102.15 per week in 2011/12 to £137.60 per week in 2021/22

o The flat-rate state pension, first introduced in April 2016, has increased in value by 15%, from £155.65 per week in 2016/17 to £179.60 per week in 2021/22

• Average earnings surged by 8.3% in the three months to July 2021:

o This would have increased the basic state pension to £149 per week and the flat-rate state pension to £194.50 per week*

Tom Selby, head of retirement policy at AJ Bell, comments: “Since its introduction in 2011/12 the state pension triple-lock has dramatically boosted retirement incomes for millions of people.

“However, in 2022/23 the state pension will rise in line with the highest of inflation or 2.5% only, with CPI for September historically the figure used. This will therefore confirm just how much the Government’s decision to axe the earnings element of the policy will cost retirees.

“Average earnings for the three months to July 2021 – the figure historically used for the triple-lock – rose by a staggering 8.3%.

“This jump can primarily be explained by labour market distortions caused by the pandemic, with average earnings plummeting in 2020 as society locked down and then rebounding in 2021 as restrictions have eased.

“If average earnings had been used for the 2022/23 state pension uplifts, the basic state pension would have increased by £11.40 per week and the flat-rate state pension by £14.90 per week.

“This would have been a boon to retirees but at a significant cost to the Exchequer in a year when lots of people faced huge uncertainty over their pay and employment.

“According to the Office for Budget Responsibility, every 1 percentage point rise in the state pension costs the Treasury around £900 million. This implies an 8.3% increase would have cost over £7 billion compared to freezing the state pension and over £5 billion versus a 2.5% rise.

“Despite being a central part of the Conservative Party manifesto, the triple-lock was viewed as too expensive a pledge to maintain – although it is due to be reinstated after next year.”

*Weekly figures rounded to the nearest 5p