• Over 500,000 people have stopped working since the Coronavirus pandemic began, with the majority (493,000) aged 50 years and over, official data shows (Movements out of work for those aged over 50 years since the start of the coronavirus pandemic - Office for National Statistics (ons.gov.uk))

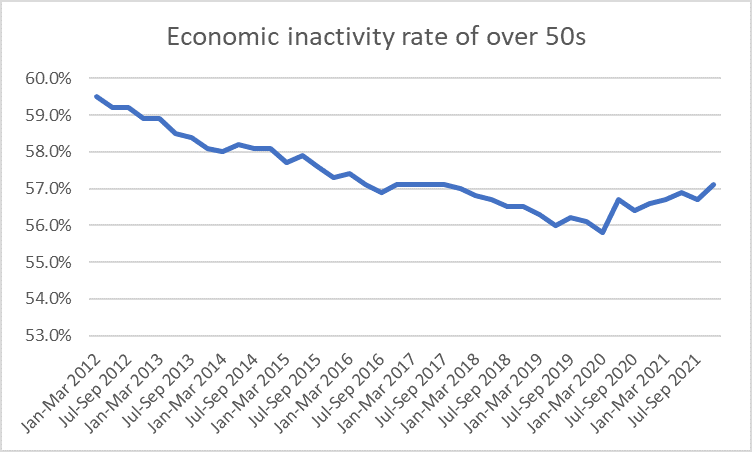

• Prior to the pandemic the proportion of over 50s who were economically inactive had declined steadily (see graph at end of press release)

• Those aged 60 years and over were more likely to be funding their retirement or time out of work from a private pension (66%) than those in their 50s (29%) (Reasons for workers aged over 50 years leaving employment since the start of the coronavirus pandemic - Office for National Statistics)

• Retirement is the most frequently given reason for leaving work during the pandemic (47%), with those age 60 or over more likely to report this (58%) than those in their 50s (28%)

o A saver with a £100,000 pension pot at age 50 who withdraws £5,000 a year would risk running out of money by their 75th birthday

o Average life expectancy at age 50 is around 84 for a man and 85 for a woman – meaning the chances of running out of money in retirement are high

o A 60-year-old with a £100,000 pension pot who withdraws £5,000 a year could run out of money at age 85, with a 1-in-4 chance they will live into their 90s

• For those who can afford to, delaying accessing your pension will also give your retirement pot more time to grow and thus boost your income

o If a 50-year-old with a £100,000 pension pot holds off on accessing it for 10 years and enjoys annual investment growth of 4%, by age 60 the fund could be worth around £148,000

o This could generate an annual income of £6,300 until age 90*

Tom Selby, head of retirement policy at AJ Bell, comments:

“As the UK emerges slowly from the pandemic and headlong into a cost-of-living crisis, we see an economy that has been stripped of almost half a million older workers.

“While there are various reasons for people aged 50 and over exiting the labour market – including taking on care responsibilities, falling ill or wanting a change of lifestyle – retirement remains the primary driver.

“For some this retirement will be voluntary, while for others it may have been forced upon them early due to economic or personal circumstances.

“Unsurprisingly, those who are older are more likely to be funding their retirement or time out of work from their private pension. Nonetheless, almost 3 in 10 (29%) of those who left the labour market during the pandemic are using their pension pot to sustain them.

“The implications of mass early retirement could be seismic and there is a real danger tens of thousands of people risk sleepwalking into hard times in later life.”

Things to think about when accessing your pension

“If you are accessing your pension early it’s important to consider the sustainability of your withdrawal strategy.

“Take a 50-year-old with a £100,000 pension pot. If they take £5,000 a year from their fund, rising by inflation each year, their pension could run dry by age 75.

“If they don’t have any other income sources, this would leave them living on the state pension for the rest of their life – which could be 20 years or more.

“If instead they held off until age 60 to draw a pension income – which is still an early retirement by modern standards – and enjoy 4% annual investment growth, they could have a fund worth around £148,000, potentially allowing them to take an income of around £6,300 a year for 30 years.

“If they kept contributing between age 50 and 60 their fund and income could be even bigger.

“What is possible will depend on your circumstances, and in some cases delaying retirement may not be an option. But it is vital to understand the implications of taking an income early and ensuring that your withdrawals are sustainable.”

MPAA impact

“Anyone accessing their pension as a stop gap with plans to rebuild their fund should also consider the impact of the money purchase annual allowance (MPAA).

“This reduces the amount someone who has flexibly accessed taxable income from their pot can save in a pension from £40,000 to just £4,000.

“There are ways to avoid the MPAA, including just taking your 25% tax-free cash or, for those with any pensions worth £10,000 or less, extinguishing the entire fund as a small pot lump sum.”

Source: Office for National Statistics

*All calculations assume annual investment growth of 4%; withdrawals increase in line with the Bank of England’s long-term inflation target of 2%; tax-free cash has already been taken