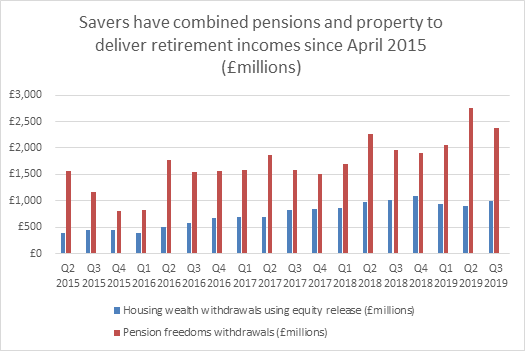

• Since the pension freedoms launched in April 2015, over £30billion has been flexibly withdrawn from retirement pots

• At the same time, homeowners have used property wealth to deliver £13billion in extra income via equity release

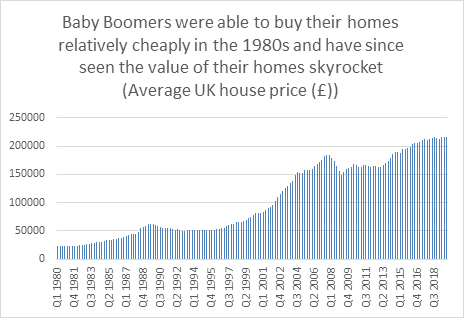

• Data suggests the Baby Boomer generation are cashing in gains made on properties to supplement retirement incomes

• Future generations unlikely to be able to release similar amounts from their homes (if they can get on the property ladder at all)

Tom Selby, senior analyst at AJ Bell, comments:

“As we approach the 5th anniversary of the introduction of pension freedoms, much of the debate has understandably focused on people’s defined contribution (DC) retirement pots and specifically the sustainability of the withdrawals they are making.

“But for most people DC pensions are just one part of their retirement strategy, with many using a variety of assets to generate an income in their later years. Baby Boomers in particular are more likely to have significant wealth locked in their homes, and since April 2015 over £13billion of this has been accessed through equity release.

“To put that in context, for every £1 of money flexibly withdrawn from pensions in the last four and a half years, about 44p has been generated from property wealth using equity release.

“This emphasises the multi-faceted nature of retirement planning for most people, with private and state pensions often combining with equity release and other financial products like ISAs to deliver an income.”

The end of the ‘my house is my pension’ era?

“This is likely to be a once-in-a-generation boom for equity release, however. Younger people are finding it increasingly difficult to get on the housing ladder, and even those that do are more likely to be lumbered with longer mortgage terms than their parents and grandparents.

“Furthermore, it is highly unlikely the rapid property price increases that burnished the retirement wealth of Baby Boomers will be repeated in the coming decades.

“Future retirees therefore need to factor in the possibility they don’t win the property lottery when building their savings plan as, in all likelihood, their house will not be their pension.”

Source: Nationwide House Price Index data

Source: Equity Release Council and HMRC data