“You can never say any investment is as safe as houses and the builders’ share prices are trading well below their peaks, thanks to worries over rising interest rates, a narrowing of the Help to Buy scheme, the end of the stamp duty tax break, the cladding tax and wider concerns over an economic slowdown thanks to higher energy prices in the wake of the Russian invasion of Ukraine,” says AJ Bell Investment Director Russ Mould. “But Vistry and Persimmon are both buying land hand over fist as they look to meet long-term demand in what still feels like an undersupplied market and even after these purchases both firms feel able to return plenty of cash to shareholders, via dividends.

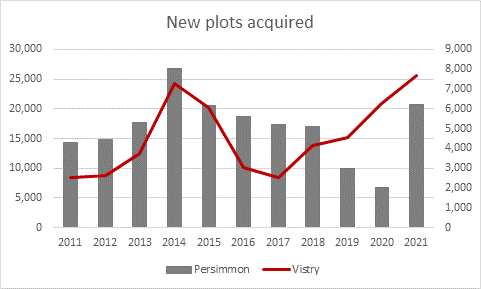

“Persimmon bought 20,750 new plots of land, its highest figure since 2014, and Vistry added 7,667, the highest figure since the Great Financial crisis and housing downturn of 2009. Neither move suggests either firm is losing confidence in the housing market’s long-term prospects even if, in Vistry’s case, Help to Buy was involved in only 21% of completions at its housebuilding operations, down from 36% in 2020.

Source: Company accounts

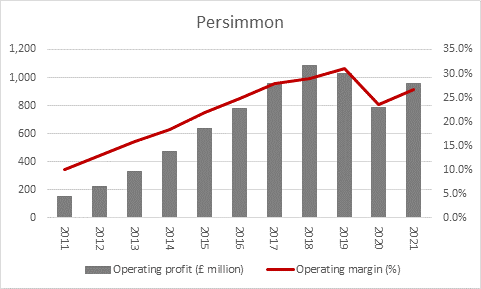

“Despite this investment, both firms still ended 2021 with net cash balance sheets, Persimmon having £1.25 billion in net liquidity and Vistry some £235 million. Volume completions are recovery from 2020’s downturn and so are profit margins, as both firms seek efficiencies and generate higher prices, to help the compensate for increased raw material and labour costs. Vistry is also seeing increased returns from its Partnerships and regeneration work, which resulted from 2020’s deal with Galliford Try.

“Vistry’s housebuilding arm completed 6,551 dwellings with an average selling price of £305,000, while mixed-tenure sites contributed 2,088 at an average of £237,000 and Partnerships 2,441 at around £190,000 a pop.

“Boosted by the additional income streams Vistry’s stated operating profit comfortably exceeded the pre-pandemic peak and Persimmon is within touching distance of its 2018 high.

Source: Company accounts

“Both firms are awaiting to see what the new cladding tax means and the potential cost of helping leaseholders with the homes that are still equipped with unsuitable cladding. Vistry has taken provisions of some £25 million and is preparing for a further £30 million to £50 million, while Persimmon set aside some £75 million in 2020.

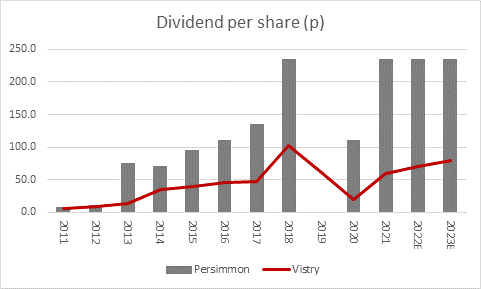

“Even so, both firms feel sufficiently optimistic, and flush, to keep returning cash to shareholders.

“Vistry declared a full-year dividend of 60p per share and Persimmon is back on track with its plans to return 235p a share a year to its shareholders, after a hiatus caused by the pandemic.

“That means Vistry is going to give shareholders around £133 million in cash to its shareholders and Persimmon some £750 million, thanks to those payments. Vistry has now returned £512 million to investors since 2011 and Persimmon some £4.1 billion.

Source: Company accounts. Marketscreener, consensus analysts’ forecasts

“Those figures put Persimmon on a forward dividend yield for 2022 of 9.5% and Vistry on 6.9%. Both may tempt income seekers, even as interest rates potentially crawl higher.

“In addition, Vistry shares are back trading at below one times book, or net asset, value per share. Granted, some caution is required here as £548 million of stated book value of £2.3 billion is goodwill relating to the Galliford Try transaction. But even adjusting for that, Vistry trades on just 1.2 times historic book value, toward the lower end of the range which analysts use a rule of thumb for assessing the builders’ valuations – one times or below book value looks potentially cheap and two times or more potentially expensive.”

|

|

Historic |

2022E |

2022E |

2022E |

|

|

Price/NAV(x) |

PE (x) |

Dividend yield (%) |

Dividend cover (x) |

|

Crest Nicholson |

0.93 x |

7.7 x |

5.3% |

2.44 x |

|

Vistry |

0.94 x |

7.5 x |

6.9% |

1.93 x |

|

Redrow |

1.04 x |

7.7 x |

4.4% |

2.96 x |

|

Bellway |

1.13 x |

7.4 x |

4.5% |

2.98 x |

|

Barratt Developments |

1.18 x |

7.6 x |

6.6% |

2.00 x |

|

Taylor Wimpey |

1.31 x |

7.8 x |

8.1% |

1.58 x |

|

Countryside Properties |

1.44 x |

10.3 x |

2.9% |

3.33 x |

|

Berkeley Homes |

1.48 x |

10.1 x |

9.9% |

1.00 x |

|

Persimmon |

2.17 x |

9.6 x |

9.5% |

1.09 x |

|

AVERAGE |

1.34 x |

9.8 x |

7.4% |

1.60 x |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts