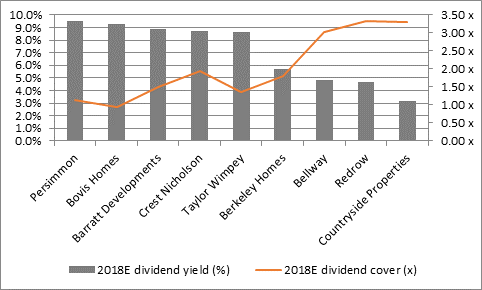

“The combination of a fat dividend yield and a relatively lowly valuation on earnings reflects ongoing concerns amongst investors over near-term cost pressures but also the long-term prospects for the UK housing market.

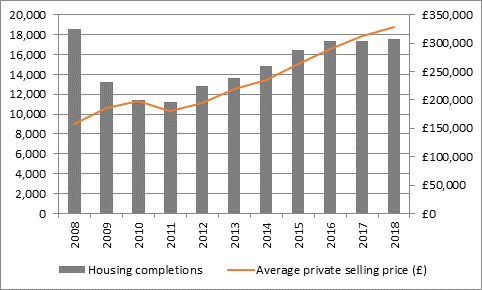

“The imbalance between demand for housing and the supply of dwellings seems as acute as ever – even though Barratt’s completions have reached a 10-year high at 17,579 homes – yet mortgage applications have fallen year-on-year for eight consecutive months.

Source: Company accounts. Financial year to June.

“While demand may not be a problem, affordability may be. The Bank of England has already warned of the increase in properties sold on the basis of a 95% loan-to-value ratio and an increase in the number of homes sold at 4.5 times income, a threshold where the central bank has imposed a cap on how much banks can lend.

“Would-be buyers are having to go to their financial limits to get their chosen property – and that is before interest rates start to rise (not that they are guaranteed to do so).

“This may help to explain why even dividend yields of around 9% for stocks such as Barratt and Persimmon are offering relatively little support to their share prices, as investors wonder whether such pay-outs can be sustained, despite the net cash piles which the builders continue to nurture.

Source: Digital Look, consensus analysts’ forecasts

“Barratt’s management does not seem to share these concerns, given its plans to pay out regular dividend covered some 2.5 times by profits and a further £175 million special dividend for each of the next two year (equivalent to a further 17.3p per share). In addition, the FTSE 100 firm has just spent £934 million on buying land for future development, equivalent to a further 20,951 plots.

“All eyes will now switch to the company’s actual full-year results on 5 September for its more detailed look at the housing market and its own future trading prospects.”