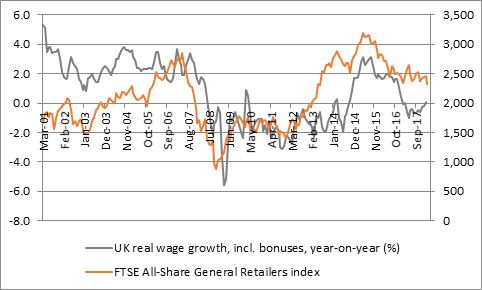

“In February wage growth, including bonuses, outpaced inflation, as measured by the consumer price index, for the first time since January 2017.

“That puts some welcome additional spending power into consumers’ pockets and the FTSE All-Share General Retailers index has tended to do best when wage growth has been outpacing inflation and do worst when pay increases have lagged increases in the cost of living.

Source: ONS, Thomson Reuters Datastream

“Another sector to benefit may be Travel & Leisure, although this grouping has done better than retailers of late, despite how inflation has eroded consumers’ real spending power. This backs up the comments expressed last year by Next’s boss, Lord Simon Wolfson, about how consumers were spending more on experiences and less on ‘stuff’ so it will be interesting to see if shoppers do start to buy clothes and more material goods once more, if this increase in real, inflation-adjusted wage growth becomes a trend.

“If it does, that would provide some welcome relief to the General Retailers sector, which has fallen by just over 7% so far this year, to leave it ranked just 28th out of the 39 industrial groupings which comprise the FTSE All-Share index. (see table below)

“That said, the increase in real wages was just 0.1% in February, so no-one is likely to be getting carried away, especially as higher wages are not a zero sum game for retailers. Many have been, and will be, affected by increases in the national minimum wage and the Living Wage, while they may not welcome any increase in interest rates from the Bank of England either, as that would be designed to cool the economy, not heat it up, by increasing the cost of mortgages and borrowing more generally. Nor is the challenge posed by the internet for bricks-and-mortar retail sites likely to go away in a hurry.

“Nevertheless, the latest wage growth figure does look like good news for the UK’s retailers and any sustained improvement could boost a sector where bad news has been the norm for some time.”

Rank | FTSE All-Share Sector | Performance in 2018 % |

1 | Automobiles & Parts | 38.6 |

2 | Technology Hardware & Equipment | 34.5 |

3 | Food & Drug Retailers | 9.4 |

4 | Chemicals | 5.2 |

5 | Industrial Transportation | 4.5 |

6 | General Industrials | 3.3 |

7 | Aerospace & Defence | 2.4 |

8 | Health Care Equipment & Services | 1.2 |

9 | Forestry & Paper | 0.5 |

10 | Pharmaceuticals & Biotechnology | -0.7 |

11 | Electronic & Electrical Equipment | -0.9 |

12 | Electricity | -1.1 |

13 | Industrial Engineering | -1.4 |

14 | Nonlife Insurance | -1.5 |

15 | Financial Services | -1.8 |

16 | Life Insurance | -3.3 |

17 | Media | -3.4 |

18 | Real Estate Investment & Services | -4.0 |

19 | Real Estate Investment Trusts | -4.1 |

20 | Industrial Metals & Mining | -4.3 |

21 | Oil & Gas Producers | -4.5 |

22 | Equity Investment Instruments | -4.6 |

23 | Travel & Leisure | -5.0 |

24 | Personal Goods | -5.5 |

25 | Oil Equipment, Services & Distribution | -5.8 |

| FTSE All-Share | -6.2 |

26 | Support Services | -7.1 |

27 | Banks | -7.2 |

28 | General Retailers | -7.2 |

29 | Construction & Materials | -7.3 |

30 | Mining | -7.7 |

31 | Gas, Water & Multi-utilities | -7.8 |

32 | Beverages | -9.0 |

33 | Leisure Goods | -9.2 |

34 | Fixed Line Telecommunications | -10.7 |

35 | Household Goods & Home Construction | -10.9 |

36 | Mobile Telecommunications | -12.6 |

37 | Food Producers | -13.2 |

38 | Tobacco | -20.2 |

39 | Software & Computer Services | -26.2 |

Source: Thomson Reuters Datastream