“Under President Biden, America has proved ever-more reluctant to sanction new oil field exploration and the construction of new oil pipelines, but the White House might have to change its mind as the Russian invasion of Ukraine raises the stakes for energy security and drives oil and gas prices higher,” says AJ Bell Investment Director Russ Mould. “That could signal a fresh surge in investment and more business for oil equipment and services specialists like Hunting. The full-year results show that revenues fell, and the company made a loss in 2021 but chief executive Jim Johnson has already begun to flag an uptick in orders in the wake of higher oil and gas prices.

“Hunting is not a pure play on oil and gas, since around a fifth of revenues come from the steel, aviation, medical, telecoms and space sectors, although that diversification can at least help Hunting weather the vagaries of the oil industry’s spending cycles.

“But the company supplies its metal tools, valves, joints and components to both oil companies and oil equipment giants such as Schlumberger, Baker Hughes and Halliburton, who then use or provide kit that facilitates the extraction of oil and gas from wells.

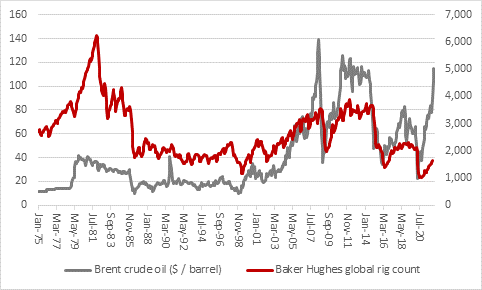

“The US rig count is up 60% year-on-year to 650 and the worldwide figure up 38% to 1,632, according to data from Baker Hughes, but neither figure is anywhere near their past highs, or the levels seen when oil last traded north of $100 a barrel.

Source: Refinitiv data, Baker Hughes

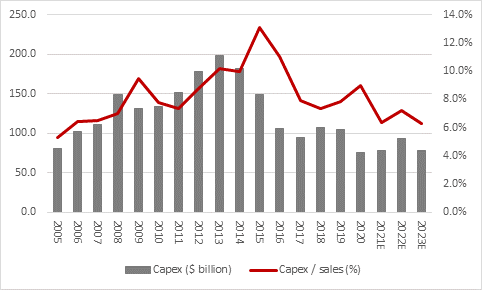

“This reflects political pushback on exploration work and reticence at major oil firms to invest in new projects, in the face of public pressure not to do so, less financing and support from banks and insurers and calls to divert cashflow away from hydrocarbons and toward the development of renewable and alternative sources of energy.

Source: Company accounts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Shell and TotalEnergies, Marketscreener, consensus analysts’ forecasts

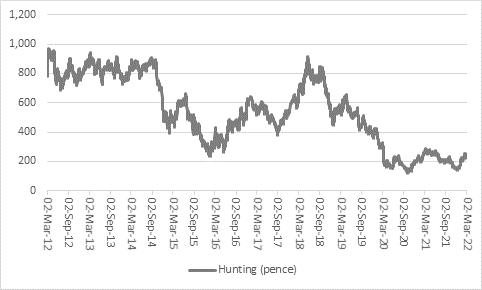

“Cutbacks in spending at oil firms have taken a toll on Hunting whose shares are not trading that much above ten-year lows.

Source: Refinitiv data

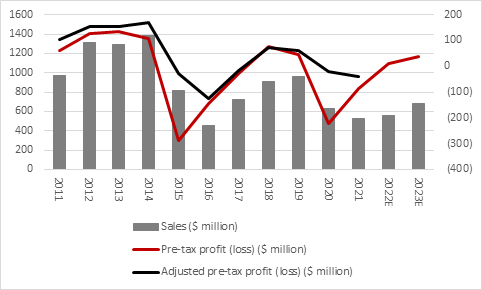

“That reflects a lengthy slump in sales and profits, the latest leg of which came in 2021. Revenues fell 17% year-on-year and Hunting made another pre-tax loss, even excluding $45 million in exceptional items.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“Analysts are pencilling in a return to the black in 2022 and 2023 but nothing like a move back to prior peaks when pre-tax earnings exceeded $100 million. Unlikely as such a recovery may seem right now, the burgeoning energy crisis could lead to short-term policy changes on Capitol Hill, and elsewhere, and anything like those numbers would surely leave Hunting’s stock looking very cheap, given the company’s market cap is some £375 million.

“Earnings per share (EPS) exceeded 40p in 2012, 2013 and 2018 and they got close in 2006. If they ever get there again then the shares would look very cheap, and they could catch the eye of some if EPS even gets back to that level.

“The shares may also come with a little downside protection, should oil and gas prices start to soften, and the investment boom fails to materialise.

“Hunting has a net cash balance sheet, which is helping it to weather the current downturn in its fortunes. And from an investment perspective, the market cap compares to net assets on the balance sheet of $871 million, or around £650 million at current exchange rates.

“Even stripping out goodwill and other intangible assets ($200 million, or £149 million) still leaves Hunting’s, the £375 million market cap means that Hunting’s shares are trading at a fraction of book, or net asset value.”