“The near- and long-term implications of the pandemic remain open to debate, but increased home working, higher demand for homes and offices that fulfil the need for more space and air, more calls for urban and suburban sites that make it easier to get to work and ever-higher levels online activity are all possible results – and few firms are well placed to provide solutions as Henry Boot,” says AJ Bell Investment Director, Russ Mould. “The South Yorkshire firm’s upbeat trading statement is therefore perfectly understandable, as its expertise in land development, construction, residential property and logistics sites means the valuation of its assets continues to rise, thanks to strong demand from investment, industrial and private buyers.

“Roughly half of group revenues come from construction services, equipment and the A69 Road Link, just under 40% from property development (both residential and commercial) and the rest from land development.

“Investors will learn more when the company reports its first-half results in September, but Henry Boot ended 2020 with a 16,607-acre land bank capable of delivering more than 88,000 residential homes, as well as build-to-rent sites in Sheffield and Manchester and logistics and warehousing sites in Yorkshire, Derbyshire, Lancashire, as well as Enfield and Luton.

“Henry Boot, where the non-executive chairman Jamie Boot is a descendant of the company’s founder, is clearly building on that firm asset backing as management sees stronger-than-expected trading.

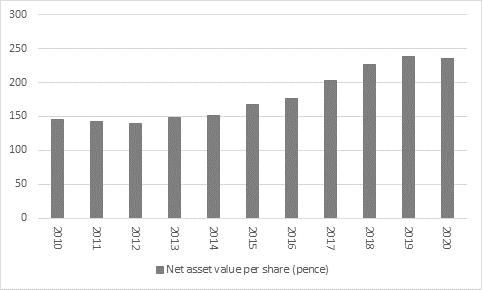

Source: Company accounts

“The 135-year-old firm therefore looks capable of adding to a consistent record of growth in asset value, helped by this year’s £2.6 million residential land sale and the purchase of industrial estates in Manchester and Welwyn Garden City for £12 million.

“As Henry Boot’s longevity suggests, it manages its assets carefully and expects to end the first half with just £13 million in net debt, which is no doubt a further plus in the eyes of cautious, long-term investors.

“Net asset value per share at the end of 2020 was 235p, so the shares trade at a premium to that of nearly 20%. That prices in some of the future growth that Henry Boot looks capable of generating, although the shares do trade a fifth below their 2018 all-time high. It is also worth noting that the private equity bid for St Modwen, a firm that also offers exposure to land development, residential building and logistics sites, came in at nearly 1.3 times historic net asset value per share.”