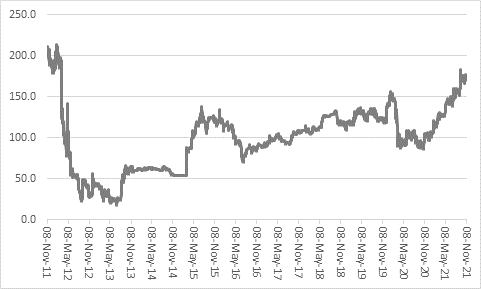

“March 2012 is the last time that Harworth’s shares traded above 180p apiece but the Rotherham-based firm is moving back toward that mark after another sale that points to the value that lies within its portfolio of property assets,” says AJ Bell Investment Director Russ Mould. “The brownfield site regeneration expert has sold its Kellingley site near Selby in Yorkshire for £54 million, compared to the last valuation on its books of £31 million.

Source: Refinitiv data

“The former colliery came under Harworth’s control in 2016 after its closure and planning permission was granted in 2017 and then again in 2019 for a mixed-use development of industrial and warehousing space.

“The sale price will be particularly pleasing to shareholders for three reasons.

“First, Kellingley has raised £54 million even though it is not in the list of ten largest sites by value in the last set of annual report and accounts (and the FTSE All-Share index member’s market capitalisation is £571 million).

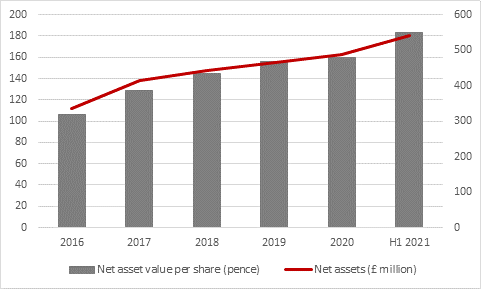

“Second, the premium to the stated book value is a strong clue that there could yet be upside potential in the value of Harworth’s overall portfolio. The last stated net asset value (NAV) per share number is 183.2p, as per the 2021 first-half results, but there could yet be upside to that (and therefore the share price, which currently trades almost at par with NAV).

“Third, the sale is a further affirmation of the company’s strategy. Since 2015’s change in name from Coalfield Resources, £150 million acquisition of Harworth Estates Property Group (HPEG) and simplification of its corporate structure the company has focused on brownfield site regeneration for development and investment purposes. The aim is to drive a combination of capital gains and income through the development and sale of some assets and the retention of others for rental income. Warehouses and industrial sites are two areas of expertise and residential property is another. Harworth has sold land to many different housebuilders, including Bellway for the first time ever in 2020, and its expertise in affordable homes in the North and the Midlands leaves it strategically well placed, especially if the pandemic persuades would-be house buyers to move from major metropolitan areas to more suburban ones.

“Since the 2015 purchase of the 75% of HPEG that it did not own, net asset valuer per share has risen from 106p to 183.2p. Today’s deal hints at further upside to come and chief executive Lynda Shillaw, at the helm since November 2020, will no doubt look to recycle the capital into fresh land purchases as she pursues the strategy to double the size of the business within five to seven years, a plan first outlined alongside the first-half results in September.”

Source: Refinitiv data