“Especially as this track record means the FTSE 250 firm is a good example of how investing in well-financed, well-run, cash generative companies can help investors protect their wealth from inflation.

“This will be an acute concern for many portfolio-builders given the combination of record-low interest rates, a yield on the benchmark UK 10-year Government bond of just 1.00% and fresh increases in British inflation rates in May.

“On the consumer price index (CPI), inflation rose to 2.9%, up from 2.7% in April and the fastest rate of growth since summer 2013.

“On the retail price index (RPI), inflation increased to 3.7%, up from 3.5% and the highest reading since February 2012.

“There is no guarantee that inflation will trend much higher from here, because fresh weakness in the oil price and any rally in the pound would eliminate two key reasons why prices are ticking higher.

“But the Bank of England has a mandate to hold inflation at around the 2% mark and Governor Mark Carney seems in no hurry to increase interest rates and boost returns on cash for diligent savers.

“Income-seekers with a tolerance for risk may therefore find themselves looking elsewhere and dividends from companies are one possible option – and this is why Halma’s results today are noteworthy.

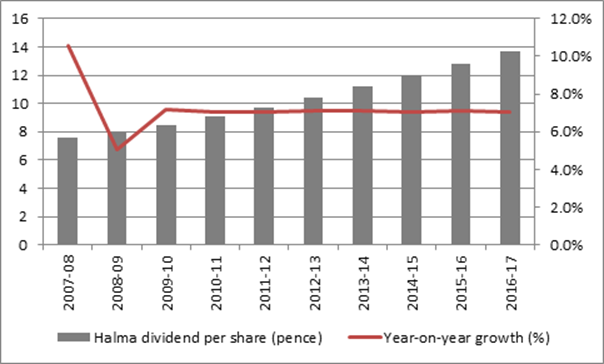

“A 7% increase in the Amersham-headquartered company’s full-year dividend to 13.71p means the historic dividend yield is just 1.3% but the stunning record of 38 straight increases in the pay-out of at least 5% mean the shares have been excellent long-term performers.

Source: Company accounts

“While Halma has occasionally been buffeted by wider market forces, such as the bear market of 2007-09, its strong business model (driven by regulatory requirements regarding health and safety), high margins and healthy cash flow mean it has provided strong total returns over time, combining capital growth and dividends, helping investors protect their wealth from the ravages of inflation.

| Last 10 years | Last 38 years |

Change in retail price index (%) | 270% | 388% |

|

|

|

Change in Halma share price (%) | 7,531% | 42,597% |

Total return from Halma share price (%) | 15,082% | 105,811% |

Source: Thomson Reuters Datastream

“This is not to say the past will be a certain guide to the future but Halma does show that the stock market can be a get-rich-slowly tool, when it works well, when it is used properly and when a company management team puts customers first, in the knowledge they are there to manage the business and its operating assets and not the share price.”