· Investors put £3bn into ethical funds over the past year

· Effect of ethical awareness filters through to investments

· Top funds don’t sacrifice on performance

Laura Suter, personal finance analyst at investment platform AJ Bell, comments:

“Over the past year almost £3bn of money has poured into ethical funds, as more investors start to plump for greener portfolios. Lots of research has shown younger people are more concerned with their investments being ethical and having an environmental slant to them than previous generations. Our own customer research shows that millennials are more likely to rank ethical investing as ‘fairly important’ or ‘important’ than Baby Boomers. It’s also likely that as people increasingly become more environmentally conscious in their lives this will filter through to their investments.

“The argument against ethical funds has usually been that going green comes at a cost – with ESG funds likely to underperform their mainstream peers. It’s always difficult to compare returns on ethical or ESG funds because they cover such a broad church of investments.

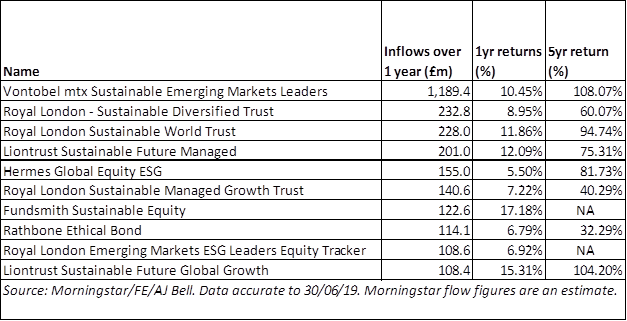

“However, when you look at the top 10 funds by inflows and compare each one to their benchmark return over five years, all but one that have five-year figures have outperformed their respective benchmark. The only one that didn’t was Hermes Global Equity, which narrowly missed the returns of the MSCI World over that period. Some have impressively beaten their benchmark, such as the Liontrust Sustainable Future Global Growth fund, which returned more than 104% over five years compared to the MSCI AC World index return of 86%.

“One area to be wary of as there is more investor interest in ESG funds is ‘greenwashing’ of funds, where asset managers just attempt to capture some of the interest and inflows by badging a fund as ‘ethical’. The onus is on investors to really dig into what the fund manager is doing to incorporate ESG into the portfolio selection, or whether they are just paying lip service to the idea.”

Top 10 ethical funds by inflows over the past year