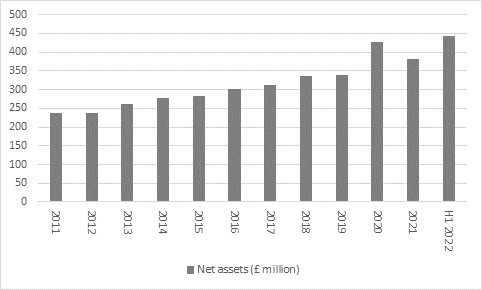

“Pubs-to-hotels group Fuller Smith & Turner’s trading update reveals a dip in business during the run-up to Christmas period, thanks to the latest viral variant, but the share price seems unconcerned,” says AJ Bell Investment Director Russ Mould. “It is hardly a surprise that Omicron deterred, or prevented, thirsty and hungry people from heading to the pub and the shares are already down by some 45% from their 2019 pre-pandemic high. A lot of bad news is already in the share price, especially as Fuller Smith & Turner’s £428 million market capitalisation compares to net assets on its balance sheet of £441 million as of the end of the first half.

“That means the shares are trading marginally below book value. Book value should grow as profits recover. In addition, only £29 million of those net assets are intangibles and the firm has not revalued the bulk of its pub assets since 1999 so that £441 million figure is likely to be conservative, again to suggest that Fuller Smith & Turner’s shares are cheap and have plenty of asset backing.

Source: Company accounts. Financial year to September.

“Patient, contrarian investors might therefore view the stock as a contrarian, value pick. Yes, trading is clearly tough as sales fell by 28% compared to 2019 on a like-for-like basis in the four weeks to 1 January and dropped 19% in the April-December period when 2021 is compared to two years ago.

“Other challenges lurk above and beyond Omicron. Staff shortages, carbon dioxide shortages, input cost inflation and wage inflation are all issues to consider. But Fuller Smith & Turner has a well-tended estate of pubs and hotels in prime metropolitan and rural sites in the South East of the UK, notably London, and it takes little imagination to see business coming back strongly as workers and commuters return to offices and tourists to the nation’s capital and beauty spots.

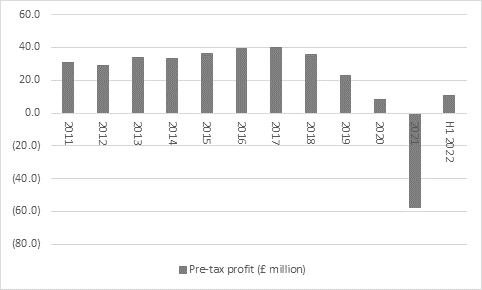

“Chief executive Simon Emeny and team can already see an uptick in footfall as Government restrictions ease and higher food and drink volumes will flow through just as quickly to the bottom line as a drop in customer numbers drained profits in 2020 and 2021.

Source: Company accounts. Financial year to March.

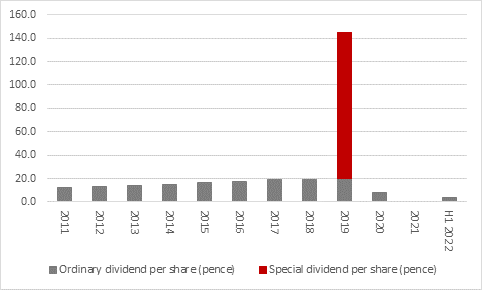

“The collapse in profits in 2021 forced management to cancel dividend payments just two years after a bumper special distribution of 125p a share.

Source: Company accounts. Financial year to March.

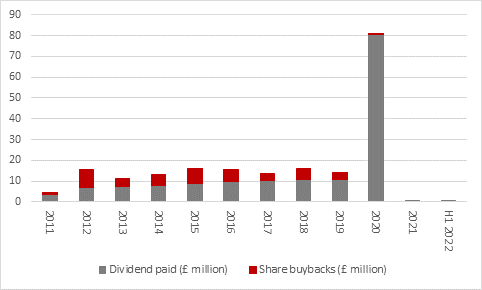

“Fullers also ran regular share buyback schemes before the pandemic hit. Between 2011 and 2020 the company returned more than £200 million to shareholders via a mixture of buybacks and dividends.

“While it would be rash to expect such bumper returns in the near future, given the uncertainties which still face the business, that figure represents almost half of the current market capitalisation, to again hint at the long-term potential offered by, and perhaps value that lies within, the company and its shares.”

Source: Company accounts. Financial year to March.