“Shipping services group Clarkson continues to ride the global economic recovery to great effect and the FTSE 250 is raising profits guidance for 2021 for the second time in two months,” says AJ Bell Investment Director Russ Mould. “The shares are sailing back toward their all-time highs although analysts are forecasting that profits will sag slightly in 2022 through to 2023, presumably due to the view that 2021 was a bit of a freak year owing to the global supply chain disruption caused by the pandemic. But the shares could steam higher if the global economic recovery proves stronger than expected, emission regulations further tighten supply in the shipping market and Clarkson’s customers continue to adopt its Sea/ technology platform.

“Clarkson is more than just a ship-broker. The company continues to develop value-added services such as research data and financial services, to help smooth out the effect of the shipping cycle, and its latest innovation is its Sea/ service, which enables clients to monitor fleet performance, book vessels and pay for them, all on the same platform.

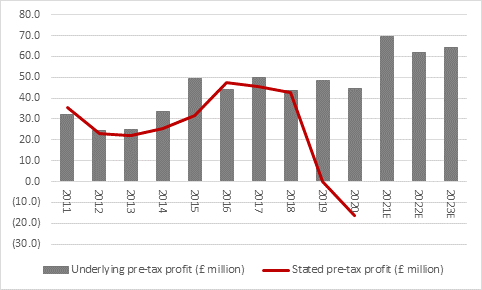

“Strong performance in broking prompted chief executive Andi Case to upgrade profit forecasts in both December and now January but the financial services arm has done well, too. Management now expects underlying pre-tax income to exceed £69 million, against prior expectations of £65 million and 2020’s £44.4 million.

Source: Company accounts, Marketscreener, consensus analysts' forecasts, management guidance for 2021E

“This shows that Clarkson is about more than just broking. The FTSE 250 member continues to develop value-added services such as research data and financial services, to help smooth out the effect of the shipping cycle, and its latest innovation is its Sea/ service, which enables clients to monitor fleet performance, book vessels and pay for them, all on the same platform.

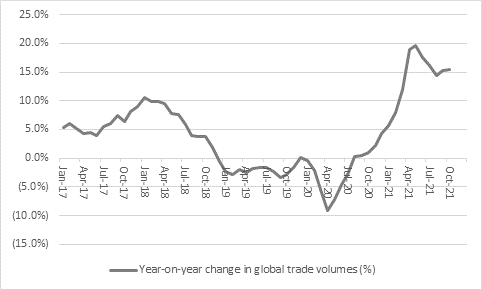

“Nevertheless, analysts believe that profits in 2022 and 2023 will come in below 2021’s levels. This presumably reflects the view that 2021 was boosted by one-off factors, such as a dip in air cargo volumes that boosted demand for seaborne trade, chaos outside ports around the world and a rebound in trade volumes after 2020’s pandemic-induced recession, thanks in no small part to fiscal stimulus from Governments and monetary stimulus from central banks. According to data from the CPB Netherlands Bureau for Economic Policy Analysis, global trade volumes have been growing at a double-digit rate since March, on an annual basis.

Source: www.cpb.nl

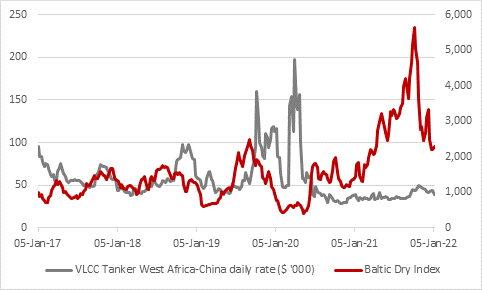

“However, the rate of increase has begun to slacken and there has been a softening in daily rates for ships ranging from Very Large Crude Carriers (VLCCs), which transport oil around the globe, to dry bulk ships, which carry iron ore, grains and commodities, as well as steel and other non-liquid products. Daily VLCC rates are down by three-quarters from their panic peak of 2000 and the Baltic Dry Index has dropped by more than half since the autumn.

Source: Refinitiv data

“This may be capping analysts’ near-term forecasts and the shipping industry is notoriously volatile. A profit warning badly holed Clarkson’s shares in 2019, thanks to lower oil prices and lower tanker rates, unhelpful currency movements and concerns over the threat to global trade posed by tariffs between the US and China.

“But investors might like to keep a close eye on Clarkson even if they do not own the shares.

“Some 85% of world trade is carried on ships, so the company is a fair guide to global economic health.

“In addition, the shipping industry has a distinct cycle all of its own, which could yet boost Clarkson’s long-term earnings power.

“New environmental regulations for tankers regarding sulphur emissions could force some ships to be scrapped, or at least taken off the water as they are refitted. Moreover, a fallow decade for ship owners means order books for new vessels have collapsed. A strong economic upturn could yet prompt an imbalance between demand for ships and supply of them, boosting shipping rates and also demand for Clarkson’s broking, financing and data services.”