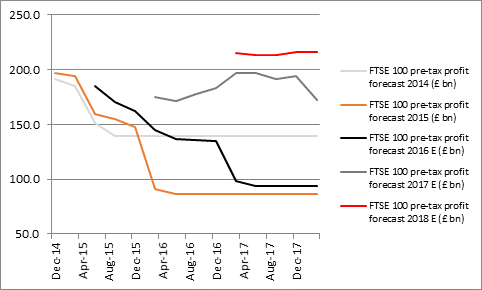

“Short-term share price movements are driven by sentiment but long-term valuations are driven by profits and above all cash flow, so investors will be hoping for a boost to earnings momentum this results season if the FTSE 100 is to make renewed gains.

“The bad news is that aggregate profit estimates for the FTSE 100 remained largely unchanged in the first quarter, at around £217 billion for 2018. This may help to explain why the index has failed to make fresh progress this year after the rip-roaring end to 2017, which carried over briefly into January and saw the benchmark set a new all-time high.

“The good news is they are not going down in the face of an increase in the value of the pound, which lowers the value of overseas earnings once they are translated back into sterling.

“Analysts’ estimates are therefore holding on to the upgrades pushed through in the fourth quarter of last year that came from the Trump tax cuts in the USA and hopes for a synchronised global economic recovery.

“This absence of net profit downgrades compares favourably to 2014, 2015, 2016 and also 2017, when more write-downs and conduct costs at the banks dragged the final total down right at the end.

Source: Digital Look, analysts’ consensus pre-tax profit forecasts

“The mix of the FTSE 100’s earnings progress remains reliant upon financials (notably banks) and oils in particular.

“The surge in the price of crude to its late-2014 highs north of $70 a barrel at least underpins forecasts for that sector (also an important payer of dividends).

“The consensus forecast for flat profits for the miners catches the eye and may offer some scope for upside, if the global synchronised recovery appears as many seem to expect and sanctions against Russia squeeze certain metals prices higher.

|

| 2018E |

|

|

Percentage of forecast FTSE 100 profits |

| Percentage of forecast FTSE 100 profits growth | ||

Financials | 25% |

| Financials | 30% |

Consumer Staples | 14% |

| Oil & Gas | 25% |

Oil & Gas | 14% |

| Health Care | 17% |

Mining | 14% |

| Consumer Staples | 15% |

Consumer Discretionary | 10% |

| Consumer Discretionary | 7% |

Industrial goods & services | 8% |

| Industrial goods & services | 4% |

Health Care | 8% |

| Utilities | 2% |

Telecoms | 3% |

| Technology | 1% |

Utilities | 3% |

| Telecoms | 1% |

Technology | 1% |

| Mining | 0% |

Real estate | 0% |

| Real estate | -2% |

Source: Digital Look, analysts’ consensus pre-tax profit forecasts

“This week will be a good test for the miners, as Rio Tinto and BHP Billiton both release quarterly production updates, while the updates due from Unilever and Reckitt Benckiser this week and British American Tobacco next week, will help to establish whether Consumer Staples can produce healthy earnings growth – although a lot of the gain expected here stems from Imperial Brands and Primark-owner Associated British Foods; the latter hosts its AGM next Tuesday.

“Luckily technology is only a minor contributor, as both Micro Focus and Sage have already disappointed by issuing profit warnings.”