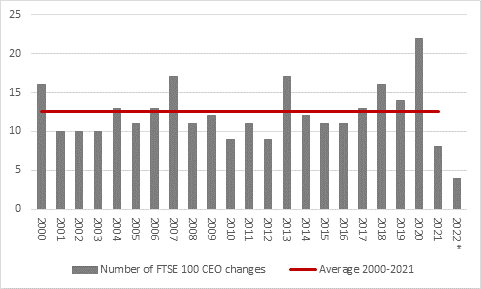

“FTSE 100 chief executives and football club managers are both in the results business, one group in terms of profits and share prices and the other in terms of points and league positions, but in 2021 it looks like shareholders and boardrooms showed a lot more patience that football club executives and supporters,” says AJ Bell investment director Russ Mould. “Only seven FTSE 100 firms saw a change in chief executive (with four more announcing appointments that will come into effect in 2022), the lowest figure this millennium, while a new manager pitched up at no fewer than 49 of the 92 Premiership and Football League clubs in 2021, with 13 of those 49 getting in a new man (and they were all men) on two occasions.

Source: Company accounts

“There were eight changes at the top overall within the FTSE 100 in 2021, thanks to two changes at Lloyds, where interim boss (and chief financial officer) William Chalmers took the reins on an interim basis in May when Antonio Horta-Osorio left the bank after a decade in charge to take up the chairman’s role at Credit Suisse and then stepped aside in August once Charlie Nunn took the helm.

“That compares to the average of 12 to 13 changes in FTSE 100 CEO since 2000 and the previous low for this millennium of nine new bosses in each of 2010 and 2021. Four more changes in CEO were announced in 2021 but they only become effective in 2022 and in one of those instances – Johnson Matthey – the firm has dropped out of the FTSE index subsequent to the appointment of a new leader.

|

Announced and effective in 2021 |

|||

|

Company |

In |

Out |

|

|

Rio Tinto |

Jakob Stausholm |

Jean-Sebastian Jacques |

01-Jan-21 |

|

Entain |

Jette Nygaard-Andersen |

Shay Segev |

21-Jan-21 |

|

Lloyds |

William Chalmers (interim) |

Antonio Horta-Osorio |

01-May-21 |

|

AVEVA |

Peter Herweck |

Craig Hayman |

01-May-21 |

|

Smiths Group |

Paul Keel |

Andy Reynolds-Smith |

25-May-21 |

|

Glencore |

Gary Nagle |

Ivan Glasenberg |

01-Jul-21 |

|

Lloyds |

Charlie Nunn |

William Chalmers (interim) |

16-Aug-21 |

|

Barclays |

C.S. Venkatakrishnan |

Jes Staley |

01-Nov-21 |

|

|

|

|

|

|

Announced but only effective in 2022 |

|||

|

Burberry |

Jonathan Akeroyd |

Marco Gobbetti |

01-Apr-22 |

|

Anglo American |

Duncan Wanblad |

Mark Cutifani |

19-Apr-22 |

|

Johnson Matthey |

Liam Condon |

Robert MacLeod |

01-Mar-22 |

|

Taylor Wimpey |

|

Pete Redfern |

TBC |

Source: Company accounts

“In many ways a quiet year in 2021 makes sense in light of the frenzied boardoom activity of 2020, when there were 22 changes of CEO (and another three announced that would come into effect in 2021). That was the highest figure since 2000.

“It also makes sense in that 2021 was perhaps a less challenging year that 2020. Even if it was by no means all plain sailing, 2021 did at least see the global economy start to grow again after the sharp, but deep, recession of 2020 as vaccines began to work, lockdowns were (for the most part) ended and governments and central banks continued to provide monetary and fiscal stimulus respectively. The lowly number of changes in 2010 and 2012 came in the wake of the financial crisis of 2007-09 when new bosses were able to make their mark without having to firefight at the same time.

“In some cases the change in FTSE 100 leaders was pretty smooth in 2021, notably at mining and trading giant Glencore where there has been a gradual changing of the guard among senior executives and Ivan Glasenberg retired after 18 years running the firm. Antonio Horta-Osorio had flagged his intention to step down in 2020, many months before the formal announcement.

“By contrast, Shay Segev surprised shareholders by jumping ship to join sports streaming services provider DAZN and Craig Hayman’s decision to return to the USA was a nasty shock for investors in AVEVA, where Peter Herweck was seconded in from major shareholder Schneider Electric of France. Jean-Sebastian Jacques’ position at Rio Tinto had been rendered untenable after the miner inexcusably blew up a sacred Aboriginal site in Australia while Barclays’ Jes Staley had to walk the plank after the Financial Conduct Authority and the Prudential Regulatory Authority declared they did not fully accept his description of his relationship with Jeffrey Epstein. Mr Staley had already pushed his luck when he tried to hunt down a whistleblower and had to pay a fine in 2018 and this time his luck ran out.

“As a result of these changes, the average tenure of a FTSE 100 CEO is now 70 months, or just under six years. Barclays’ C.S. Venkatakrishnan is the newbie, having taken over the top job in November, while fourteen bosses have been in their post for more than a decade. Three of those – Next’s Simon Wolfson, Dechra Pharmaceuticals’ Ian Page and Ocado’s Tim Steiner, have run their charges for more than 20 years.

|

The fourteen FTSE 100 bosses to have served for at least ten years* |

|||

|

Company |

CEO |

Started |

Years in charge |

|

Next |

Simon Wolfson |

May-2001 |

20.7 |

|

Dechra Pharmaceuticals |

Ian Page |

Nov-2001 |

20.2 |

|

Ocado |

Tim Steiner |

Jan-2002 |

20.0 |

|

JD Sports Fashion |

Peter Cowgill |

Mar-2004 |

17.9 |

|

B & M European Value Retail |

Simon Arora |

Jan-2005 |

17.0 |

|

Halma |

Andrew Williams |

Feb-2005 |

16.9 |

|

Associated British Foods |

George Weston |

Apr-2005 |

16.8 |

|

Taylor Wimpey |

Peter Redfern |

Jul-2006 |

15.5 |

|

Berkeley |

Rob Perrins |

Sep-2009 |

12.3 |

|

RELX |

Erik Engstrom |

Nov-2009 |

12.2 |

|

DS Smith |

Miles Roberts |

May-2010 |

11.7 |

|

United Utilities |

Steve Mogford |

Mar-2011 |

10.9 |

|

SEGRO |

David Sleath |

Apr-2011 |

10.7 |

|

Polymetal |

Vitaly Nesis |

Sep-2011 |

10.3 |

Source: Company accounts. *As of 4 January 2022

“The average FTSE 100 boss’ tenure of nearly six years must make football managers green with envy. Only five of the 92 gaffers across the Premiership, Championship, League One and League Two can beat that and their average time in the dug-out is barely 20 months, or 1.7 years.

|

The 14 longest-serving British football club managers |

|||

|

Club |

Manager / coach |

Started |

Years in charge |

|

Harrogate Town |

Simon Weaver |

May-2009 |

12.6 |

|

Burnley |

Sean Dyche |

Oct-2012 |

9.2 |

|

Wycombe Wanderers |

Gareth Ainsworth |

Nov-2012 |

9.1 |

|

Accrington Stanley |

John Coleman |

Sep-2014 |

7.3 |

|

Liverpool |

Juergen Klopp |

Oct-2015 |

6.2 |

|

Manchester City |

Pep Guardiola |

Jul-2016 |

5.5 |

|

Crewe Alexandra |

David Artell |

Jan-2017 |

5.0 |

|

Blackburn |

Tony Mowbray |

Feb-2017 |

4.9 |

|

Coventry City |

Mark Robins |

Mar-2017 |

4.8 |

|

Rotherham United |

Paul Warne |

Apr-2017 |

4.7 |

|

Oxford United |

Karl Robinson |

Mar-2018 |

3.8 |

|

Exeter City |

Matt Taylor |

Jun-2018 |

3.6 |

|

Leeds United |

Marcelo Bielsa |

Jun-2018 |

3.5 |

|

Cheltenham Town |

Michael Duff |

Sep-2018 |

3.3 |

Source: Utilita Football Yearbook, club websites, BBC Sport website

“The further you go down the league pyramid, the greater the pressure seems to be, perhaps because the prospect of relegation to non-league football is such a dreadful one for club chairmen, boardrooms and supporters to contemplate. Even if clubs such as Luton, Lincoln, Mansfield, Oxford, Hartlepool and Newport have managed to bounce back and regain league status, many more have not managed the return trip, including York City, Stockport, Halifax, Kettering, Aldershot, Darlington, Chesterfield, Wrexham, Torquay, Chester, Darlington, Hereford, Maidstone and Grimsby.

|

Average tenure for current incumbents |

|||

|

|

Days |

Months |

Years |

|

FTSE 100 CEO |

2,136 |

70 |

5.9 |

|

|

|

|

|

|

Premier League |

815 |

26.8 |

2.2 |

|

Championship |

517 |

17.0 |

1.4 |

|

League One |

749 |

24.6 |

2.1 |

|

League Two |

483 |

15.9 |

1.3 |

|

AVERAGE |

630 |

20.7 |

1.7 |

Source: Company accounts, Utilita Football Yearbook, club websites, BBC Sport website

“Granted, not all clubs change boss voluntarily. Some retire, as was the case at Crystal Palace, and some jump ship to go elsewhere, as happened at Everton, Wolves, Plymouth and others. Nevertheless the usual fate of a manager is the sack and seventeen League Two clubs changed manager in 2021 (four of them on two occasions), compared to ten in the Premiership, 11 in the Championship and 11 in League One.

“As a result, the average Premier League manager seems to get the most chance to prove their worth, at 2.2 years on average, compared to just 1.3 years in League Two. The overall average for a football manager of just under two years is already being bettered by 81 bosses within the FTSE 100.

“Two seasons was all Cherie Lunghi got in the 1980s series The Manageress where she played Gabrielle Benson, the manager of a team in the men’s Second Division (as it was then, Championship as it is now). That is one glass ceiling which women have yet to break in the UK, even if ten FTSE 100 firms have female chief executives or, in the case of the Pershing Square and Scottish Mortgage investment trust, chairs of the board.

|

Company |

CEO / chair |

Started |

Years in charge |

|

Severn Trent |

Liv Garfield |

Apr-2014 |

7.7 |

|

Pershing Square |

Anne Farlow (chair) |

Oct-2014 |

7.3 |

|

Whitbread |

Alison Brittain |

Jan-2016 |

6.0 |

|

GlaxoSmithKline |

Emma Walmsley |

Apr-2017 |

4.8 |

|

ITV |

Carolyn McCall |

Jan-2018 |

4.0 |

|

Scottish Mortgage |

Fiona McBain (chair) |

Jun-2018 |

3.5 |

|

NatWest Group |

Alison Rose |

Nov-2019 |

2.2 |

|

Aviva |

Amanda Blanc |

Jul-2020 |

1.5 |

|

Admiral Group |

Milena Mondini de Focatiis |

Dec-2020 |

1.0 |

|

Entain |

Jette Nygaard-Andersen |

Jan-2021 |

1.0 |

Source: Company accounts