“The sharp rally in the FTSE 100 since the low of 23 March is inevitably begging the question as to whether markets are nearing (or even past) the bottom after the savage sell-off that dates back to 24 February. Many will have their doubts, not least because history suggests market downturns are usually littered with rallies that turn out to be no more than vicious, bear-market traps,” says Russ Mould, investment director at AJ Bell.

“That said, the sudden nature of the downturn means that it is tempting to think the rebound could be equally sharp. The price collapse of February and March, coupled with a surge in VIX, or ‘fear index’, to new highs implies that sentiment has already switched from greed to fear. That is usually as good a starting point as any for some contrarian value-hunting but there are other signals which investors can use if they are looking for signs that we may be coming through the worst.

1. Slowdown in the number of new COVID-19 cases

“The first thing that markets are looking for is a slowdown in the number of new COVID-19 cases on a global basis (and not just for narrow, self-interested reasons but more importantly simply for the greater good). A slowdown and then a peak in new cases could give markets more of a chance to work out the duration and depth of the damage done to corporate earnings and cash flows and then in turn to assess whether the share price falls seen so far adequately reflect this or not (even if this again pales next to the importance of individuals’ health).

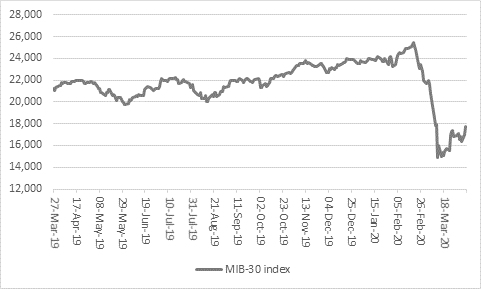

“Tracking the momentum in new cases via the mainstream print and online media is one way to do this but another way might be to look at Italy. The country remains, for the moment at least, in the eye of the storm so far as Europe is concerned and all eyes are on how quickly the outbreak can be contained. It is therefore intriguing to note how Milan’s MIB-30 index hit a bottom on 12 March and has since advanced by 19% in a fairly orderly fashion. This could just be wishful thinking but it could be something so this is a trend to note.

Source: Refinitiv data

2. Dr Copper

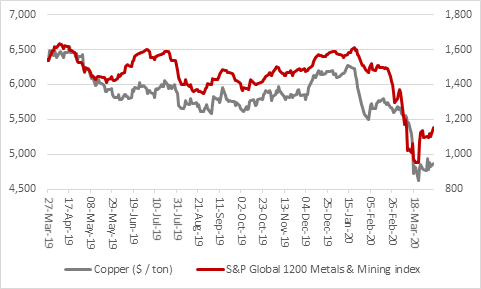

“More tangibly, it would be nice to see some improvement in the price of copper and for that matter other industrial metals such as aluminium. Copper’s ubiquity, as well as its malleability and conductivity, means it is used heavily in industry so a rebound in activity should show up quickly. Even though the global Mining sector is trying to forge a rally, the bad news is that copper is still stuck well below $5,000 a ton.

Source: Refinitiv data

3. Transport stocks

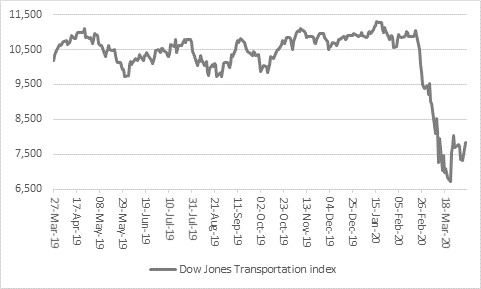

“Transport stocks are also a good barometer. If goods are selling, then shelves need to be restocked and those products have to be shipped. If they are not selling then freight volumes suffer. Transport stocks have lagged for a while. The rally since 23 March is a good start - the Dow Jones Transportation index is up 17% from its low - but the transports have yet fully to prove they have broken out of reverse gear, especially as the American benchmark has dipped back below 8,00. It would be a welcome sign if it broke above that level – and stayed there.

Source: Refinitiv data

4. Junk bonds

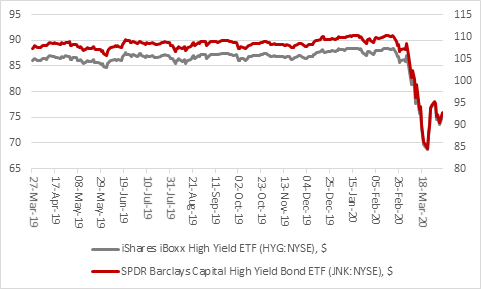

“Another good guide to both economic activity but also financial markets’ appetite for risk are junk bonds. The risks involved mean they trade quite like equity. And the Federal Reserve is currently barred from buying them so you could argue that junk bonds are not a rigged market, unlike Government and investment-grade bonds, when central bank interference means we have little or no price discovery.

“Junk bonds can be tracked quickly and easy – for free – via the price of two US-quoted exchange-traded funds, which glory in the tickers HYG and JNK. Both are trying to recover lost ground and if they can do so under their own steam, without central bank interference, that could perhaps be a sign that markets are starting to think we are coming out of the other side of the outbreak.

Source: Refinitiv data

5. Sixth sense

“Perhaps the most reliable sign of a market bottom is the least tangible of all. This is my fifth major bear market, after 1990-92, 1998, 2000-03 and 2007-09. With the benefit of hindsight, the biggest buy signal of all was the absence of people asking whether it was time to buy, as this signified total capitulation. Investors can use their own judgement as to whether we at the point where the towels are being throw in or not.”