“Ferguson’s chief executive Kevin Murphy must be wondering quite what he has to do to make investors happy, as huge jumps in first-half sales and profits, a 15% boost to the dividend and a $1 billion expansion of the company’s buyback programme is making no difference to the share price at all,” says AJ Bell Investment Director Russ Mould. “May’s move to a primary listing in the USA – which means the shares will no longer be eligible for inclusion in the FTSE 100 – may be one reason for the muted response, but nagging worries about an economic slowdown in the USA thanks to soaring commodity prices, tighter monetary policy and the absence of further fiscal stimulus from Congress may also have a role to play.

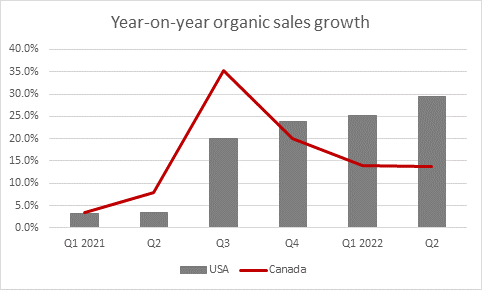

“Following 2017’s sale of its Scandinavian operations and 2021’s disposal of the UK business, Ferguson gets the around 90% of its sales from the USA, with the rest coming from Canada. Both markets continue to show strong growth as they bounce back from the recession of 2020 and the ongoing impact of the pandemic in 2020.

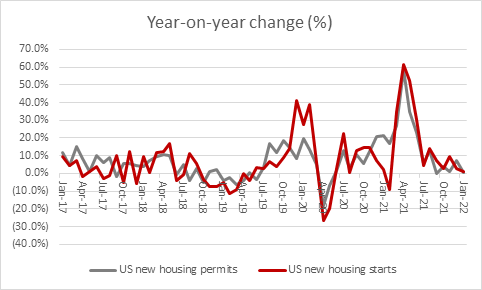

“In the USA, sales into the residential property market remain strong, buoyed by ongoing growth in new housing starts and new housing permits, while the minority of sales which come from non-residential projects also continue to grow nicely for the plumbers’ merchant.

Source: Company accounts. Financial year to July.

“Central bankers and economists may be less than thrilled to hear Ferguson flag how price inflation ‘in the high teens’ is helping the firm to defend its profit margins in the face of higher input costs, as lumber prices remain strong and labour markets tight. Yet those conditions could yet become problematic if they persist. Housing permits and starts are beginning to slow down and, at 3.85%, the US 30-year mortgage rate is nearing its highest levels since 2019, so the prospect of higher interest costs may start to deter would-be house buyers too.

Source: FRED – St. Louis Federal Reserve database

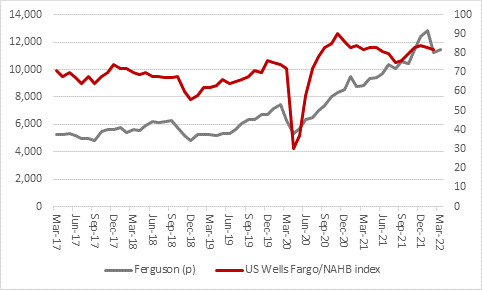

“The headline Wells Fargo/NAHB housebuilding industry survey for the US peaked in late 2020 and that may have begun to weigh on Ferguson’s shares, since residential sales generate around 55% of total revenues with the rest coming from commercial and industrial buildings as well as utilities and waterworks. If the Federal Reserve gets aggressive on interest rates that could dampen activity and sentiment toward the stock, although it is still by no means impossible that the Fed backs away from its vaguely tough talk and takes its chances with inflation, if the US economy really slows or financial markets turn turtle.

Source: NAHB, Refinitiv data

“Ferguson’s management still seems plenty confident enough in the future, judging by the enhanced cash returns approved by the board.

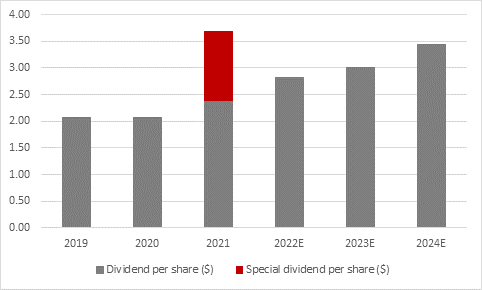

“An interim ordinary dividend of around $0.84 per share represents a hike of 15% compared to the same time a year ago and analysts’ expectation for an 18% increase in the full-year payment to $2.83. That hefty increase remains perfectly possible even if the base for comparison for sales, profits and cash flow gets tougher in the second half.

Source: Company accounts, Marketscreener, analysts' consensus forecasts. Financial year to July.

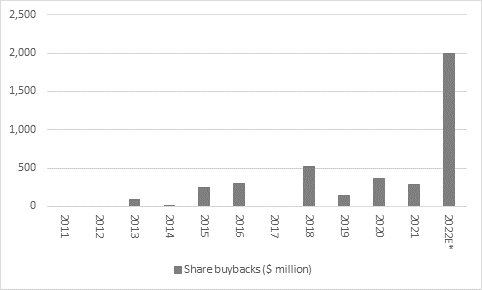

“Besides the dividend, Ferguson continues to return cash to investors via a share buyback programme, which will now run to $2 billion, compared to the prior plan of $1 billion. The company has already bought back $649 million-worth of shares.

Source: Company accounts. Financial year to July. *Assumes whole $2 billion buyback carried out in fiscal 2022

“But buybacks only really add value if the shares are bought back when they are cheap and ideally trading below intrinsic value. Ferguson’s management originally devised the plan to switch the primary listing to New York from London because the company’s stock was trading at a marked valuation discount to its major US peers, Home Depot, Kohl’s and Lowe’s. The relisting plan has already worked in that respect, as the discount as closed, but that may mean Ferguson’s buyback scheme adds less value than it would have otherwise done.”

|

|

PE |

PE |

EV/Sales |

EV/Sales |

EV/EBIT |

EV/EBIT |

Dividend |

yield |

|

|

2022E |

2023E |

2022E |

2023E |

2022E |

2023E |

2022E |

2023E |

|

Ferguson |

14.4 x |

15.3 x |

135% |

136% |

13.8 x |

14.8 x |

2.4% |

2.5% |

|

|

|

|

|

|

|

|

|

|

|

Home Depot |

19.9 x |

18.5 x |

250% |

240% |

16.5 x |

15.7 x |

2.3% |

2.5% |

|

Lowe's |

16.8 x |

15.2 x |

184% |

179% |

14.3 x |

13.8 x |

1.5% |

1.6% |

|

Kohl's |

8.3 x |

7.7 x |

52% |

51% |

6.8 x |

6.9 x |

3.5% |

3.8% |

Source: Marketscreener, consensus analysts' forecasts