If you are covering the ECB’s decision to taper its QE programme, below is some commentary from Russ Mould, investment director at AJ Bell:

“The European Central Bank’s decision to start tapering its Quantitative Easing programme may revive nasty memories of the “Taper Tantrum” provoked in 2013 by the US Federal Reserve’s first tentative step to towards tightening monetary policy. However, today’s statement is so laced with caveats President Mario Draghi is clearly doing his best to keep financial markets sweet.

“The ECB announced it would, as expected, extend its QE scheme from March 2017 to December 2017, having already moved beyond the initial September 2016 deadline outlined when the programme was launched back in January 2015.

“The monthly amount injected into the financial system will be cut from €80 billion a month to €60 billion in a first tapering of the Eurozone’s monetary stimulus scheme, although the statement makes it clear that the size and time-line could both be extended if the overall economic outlook dims again and inflation towards the ECB’s 2% inflation target slows once more.

“This careful couching of the plan may be a nod to the market chaos caused by then Federal Reserve chairman Ben Bernanke’s hint in May 2013 that the US central bank was looking to taper its $85 billion a month QE scheme. The Fed finally made its first move in December and stopped adding to the programme in October 2014.

“In response to the ECB announcement, the euro is trading higher and Eurozone bond yields are rising (and thus prices falling). This is a repeat of what happened after the US tapering announcement, so it will be interesting to see if markets copy the violence of three years ago. Investors will be hoping not.

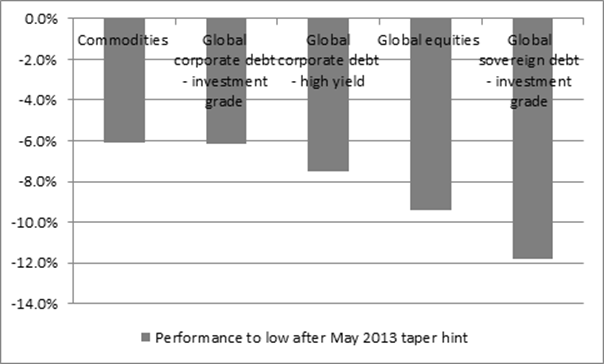

“Within a month of Bernanke’s May 2013 comment, global stock, bond and commodity prices had all dropped by between 6% and 12% (see chart 1 below).

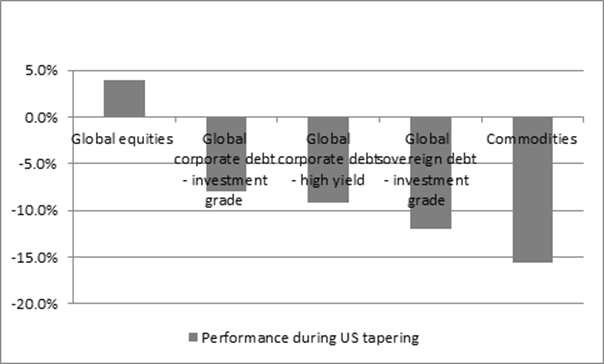

“Global stocks eventually regained their footing and made up all of the lost ground within a year. Equities did best among the major asset classes and Government bonds the worst – the latter makes sense as the tapering of QE removes a major buyer from the scene, or in the case of the ECB reduces its influence (see chart 2 below).

“It is good news that central banks do feel able to start tapering QE and tightening policy, as we would all like to see the cost of money normalise. But this will be the key test of whether the underlying economies are strong enough to stand on their own two feet or are too weak to fend off a fresh downturn, or even deflation, without either monetary or fiscal stimulus to support them.

“If the former proves to be the case, equities could make fresh gains and bonds fresh losses. If the latter scenario prevails, it is fixed-income which may resume its 30-year bull run and stocks that cede ground.”

Chart 1: Asset prices fell hard in the first month after the US QE tapering hint of May 2013:

Source: Thomson Reuters Datastream. Covers the period 21 May 2013 to 29 October 2014. All returns in sterling terms.

Chart 2: Stocks outperformed bonds as the US tapered fresh QE additions to zero:

Source: Thomson Reuters Datastream. Covers the period 21 May 2013 to 29 October 2014. All returns in sterling terms.