“Next Tuesday’s indicative review of the FTSE indices could well show that Electrocomponents and Dechra Pharmaceuticals are both poised to enter the FTSE 100 for the first time and they look likely to do so at the expense of Johnson Matthey and Darktrace,” says AJ Bell investment director Russ Mould.

“Nothing it set in stone, since the final review of market valuations will be released on 1 December and any changes will become effective on 20 December. But Electrocomponents and Dechra are currently ranked 87th and 88th by market cap, enough for automatic promotion, while Johnson Matthey and Darktrace rank 114th and 127th, positions that leave them in line for automatic relegation.

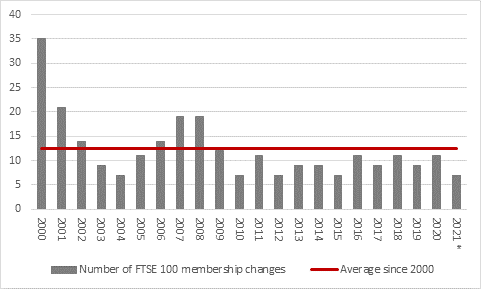

“If these two changes come to pass, that would take the total to nine for 2021. That would make for a relatively quiet year. Since 2000, only 2004, 2010, 2012 and 2015 have seen a lower number – seven, on all four occasions – and the average of the past 21 years is between 12 and 13 changes a year.

Source: FTSE Russell

“A total of nine possible changes comes nowhere near this century’s high of 35, recorded in 2000, or the next peak of 19 in 2007 and 2008. Looking at those rather ominous dates, which registered market tops and signalled substantial eventual retreats in the FTSE 100, perhaps investors should welcome the stability and lack of volatility.

“Two changes have resulted from the acquisition of RSA and then Morrisons, while a third results from a decision by the index compiler regarding the nationality of Just Eat Takeaway.com.”

POSSIBLE DEMOTIONS

Darktrace

“Darktrace is a very recent entrant, having stepped up once the private equity bid for Morrisons became effective in October.

“The company only floated in April 2021 and its shares have done well, more than doubling from their 250p offer price, thanks to management raising guidance for the year to June 2021 and then ratcheting up expectations for fiscal 2022.

“But sales of stock by major shareholders and long-term backers KKR, Summit and Balderton Capital at 750p in October and Vitruvian Partners at 580p in October have hit sentiment hard, even though Darktrace remains one of the fastest-growing cybersecurity firms out here.

“The shares peaked at 985p in September and it has been downhill all the way since. Even now, sceptics could argue that a market cap of £4.6 billion prices in a lot of the company’s growth potential, since analysts are currently forecasting sales of around £290 million for the year to June 2022 and do not expect the Cambridge firm to make a profit on a statutory basis until at least 2025.”

Johnson Matthey

“Johnson Matthey was a founder member of the FTSE 100 all the way back in 1984 and this could be the chemicals and precious metals specialist’s second demotion to the FTSE 250, following that of December 1984.

“This month’s profit warning and decision to scrap its electric vehicle batteries venture, writing off substantial investments in the process, has taken its toll on Johnson Matthey, whose management will be hoping it does not take as long for the firm to return to favour and recapture its FTSE 100 status as it did last time. Johnson Matthey re-entered the FTSE 100 nearly 18 years after its demotion, in June 2002, since when it has been ever present in the UK’s premier index.

“Should the stock drop into the FTSE 250, that would leave just 25 of the FTSE 100’s founder members still in the index. Only 14 still have the same name and of those only nine have been ever-present since 3 January 1984.”

|

Founder FTSE 100 members still in the index |

Nine have been ever-present |

|

Associated British Foods |

Out Mar-00, In May-00; Out Sep-00, In Dec-00 |

|

Barclays |

|

|

Barratt Development |

Out Jul-84, In Jun-07; Out Dec-07, In Mar-14; Out Sep-14, In Dec-14 |

|

Johnson Matthey |

Out Dec-84, In Jun-02 |

|

Land Securities |

|

|

Legal & General |

|

|

Lloyds Bank |

|

|

Pearson |

|

|

Royal Bank of Scotland |

|

|

Sainsbury |

|

|

Smith & Nephew |

Out Jun-97, In Jul-01 |

|

Standard Chartered |

Out Apr-88, In Jan-89; Out Jan-91, In Dec-92 |

|

Tesco |

|

|

Unilever |

|

|

Whitbread |

Out Mar-00, In Dec-02; Out Dec-05, In Dec-06; Out Jun-09, In Sept-09 |

Source: FTSE Russell

POSSIBLE PROMOTIONS

Dechra Pharmaceuticals

“Shares in veterinary pharmaceuticals expert, Dechra, are trading close to their all-time highs and the company is on the verge of promotion to the FTSE 100 for the very first time.

“September’s full-year results were strong, as they reaffirmed Dechra’s knack for outperforming its addressable market, which itself has a strong long-term growth record. The popularity of lockdown pets may also be helping and there is every sign that owners continue to take great care over the welfare of their companion animals.

“Chief executive Ian Page has said it is still too early to tell if the actual number of pets has gone up thanks to the pandemic and lockdowns but spending on pets does seem to have increased.

“Full-year sales to June 2021 rose 21%, while underlying operating profit rose 29% and management hiked the dividend by 18%. Organic sales growth was 16% as acquisitions added the rest, notably the Osurnia and Mirataz products.

“Around a fifth of revenues in 2021 came from new products, to suggest a good return on the investment made in research and development, and the firm continues to work on a diabetes treatment for cats and dogs, with launch expected in 2026.

“Dechra has supplemented good organic growth with 17 acquisitions in the past decade, as the market remains a fragmented one, with the top five players holding a market share of barely 40% between them, and Dechra may well be in the market for further purchases.”

Electrocomponents

“After a gain of more than 40% in the year to date, shares in Electrocomponents are trading at an all-time high.

“The electrical equipment and components supplier is benefiting from the upturn in economic activity and also its own strategic initiatives. The company has long since turned itself from a catalogue-based distributor into a leading omni-channel player with a strong digital offering. Under the Destination 2025 strategy, management is targeting sales growth twice as fast as that of the underlying market and operating margins in the mid-teens, up from the 12.0% recorded (on an adjusted basis) in the fiscal first half to September 2021.

“In that first half, sales rose 31% year-on-year on a like-for-like basis and by 24% against the tougher comparison of 2019. Pre-tax profit almost doubled.

“The balance sheet has very little debt and cash flow is strong, so acquisitions could supplement organic growth, while management also has a clear Environmental, Social and Governance (ESG) framework. It is their ambition to reach Net Zero from their own operations by 2030 and across its entire supply chain by 2025. The supply chain is one potential area on near-term concern in a different way, given rising freight costs and the stresses and strains of product availability, but so far the company seems to be coping well.”

Appendix: How promotion and relegation are assessed

• All of the major FTSE indices are reviewed on a quarterly basis. They are set according to share prices from the close of business on the Tuesday before the first Friday of the review month (in this case Tuesday 30 November). The changes will be announced after the close on Wednesday 1 December and come into effect as of the market opening on Monday 21 December.

• In general, a stock will be promoted into the FTSE100 at the quarterly review if it rises to 90th position, or above (by market capitalisation) and a stock will be demoted if it falls to 111th (by market value), providing it fulfils the other criteria, such as free float and a presence on the Main Market.