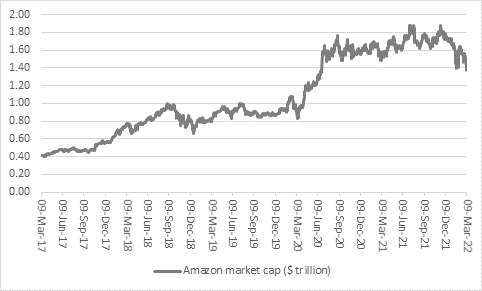

“Spurred on by a 26% drop in the stock’s market value since the all-time high of July 2021, Amazon’s management is looking to instil fresh confidence with a 20-for-1 stock split and a $10 billion share buyback – the first direct distributions of cash back to the company’s shareholders since its 1997 stock market listing,” says AJ Bell Investment Director Russ Mould. “A 2.4% gain in the share price suggests that some investors may be buying into the show of confidence, but the company may need to do more than start managing its share price as intently as it manages its customer services if the shares are to roar higher again, especially as the fourth-quarter numbers raised as many questions as they did answers.

Source: Refinitiv data

“Even allowing for those spotty year-end numbers, investors should consider the following questions before they decide that the Amazon buyback is the sort of signal that they should be following:

• To what degree is this financial engineering rather than investment in the service proposition and competitive position of the company? The bull case for Amazon has long been that it will win customers and take share, demolish the opposition and then jack up prices when it has a dominant market position, turning itself into a wildly profitable cash machine. It is the service offering that has made Amazon such a compelling long-term investment thus far, so would the money not be better spent there?

• Are Amazon executives buying stock with their own cash rather just the company’s funds? Surely that would be a much more powerful signal still that they feel real value is there to be had?

“In addition, investors might like to apply the two tests laid down by Warren Buffett in his 2012 letter to shareholders in his Berkshire Hathaway investment vehicle.

‘Charlie [Munger] and I favour repurchases when two conditions are met: first, a company has ample funds to take care of the operational liquidity and needs of its business; second, its stock is selling at a material discount to the company's intrinsic business value, conservatively calculated.’

“At first glance Amazon passes the first of Buffett’s tests easily, because at the end of 2021 it had $42 billion in cash on its balance sheet, with another $42 billion in liquid securities on top of that trove.

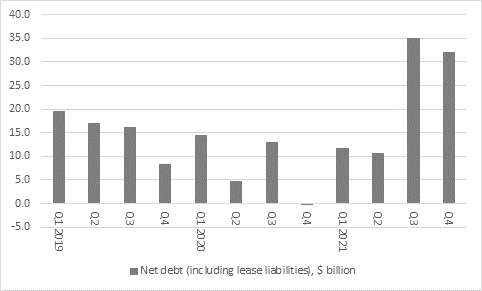

“However, cash flow has been negative five times in six quarters as margins have come under pressure and Amazon has taken on extra liabilities, too, in the form of cheap debt and leased assets.

“Borrowings have risen to $48.7 billion from $23.5 billion since the end of 2018 and lease liabilities have surged to $67.7 billion from $9.7 billion over the same period.

“Once those lease liabilities are included, Amazon has gone from a net cash position of $8.1 billion to a net debt of $32 billion.

Source: Company accounts

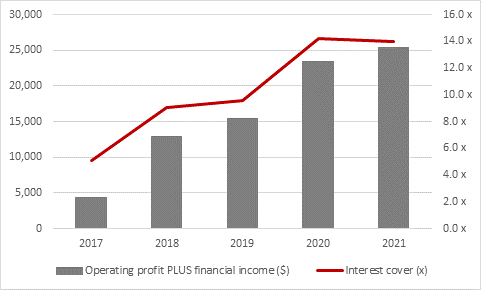

“Ultimately, however, even that figure only represents a gearing ratio of 23%, while annual operating profit of $24.9 billion and interest income of $448 million covered the $1.8 billion in annual financial expense some 14 times over. That means Amazon’s finances do look robust, although 2021’s slide in operating margins and profits late in the year needs to be watched, as any unexpected, sustained decline could mean interest cover starts to erode.

Source: Company accounts

“The second test is trickier, as Amazon’s valuation still looks very rich.

“A market cap of $1.4 trillion still dwarfs shareholders’ funds, or net assets, of $138 billion.

“It also means Amazon is no bargain on a near-term earnings basis. That $1.4 trillion market cap compares to 2022 consensus net profit estimates of $38.4 billion and thus leaves the stock on a forward price/earnings ratio of some 36.5 times. The S&P 500 overall currently trades on 19.6 times earnings for 2022, according to research from S&P Global.”

APPENDIX: Six reasons why Amazon’s fourth-quarter results were a lot worse than they looked

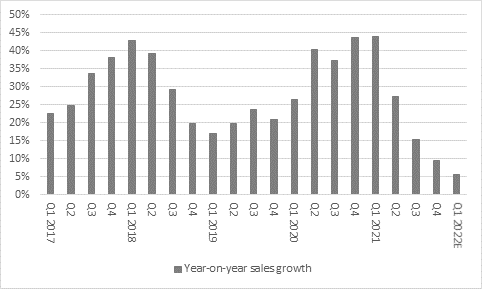

1. Sales growth slowed to 9.4% year-on-year in Q4 and the mid-point of management’s guidance for Q1 revenues coming in between $112 billion and $117 billion implies a 5.5% year-on-year advance. That is a massive deceleration from the rates to which investors have been accustomed and both the Q4 result and Q1 guidance represent a miss relative to analysts’ expectations.

Source: Company accounts, mid-point of management guidance for Q1 2022E

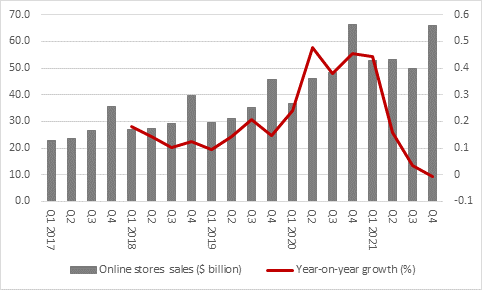

2. Online stores sales fell year-on-year in the fourth quarter, with a decline of 0.6%. This is the main reason for the overall sales slowdown. Maybe shoppers are looking to get out and about a bit more, maybe they are using other websites and stores to ensure local favourites are not crushed by a multi-national behemoth or maybe the law of large numbers is taking over, but a $1.4 trillion market cap is implicitly demanding a lot more than that from what is still the Amazon’s biggest revenue stream on a divisional basis.

Source: Company accounts

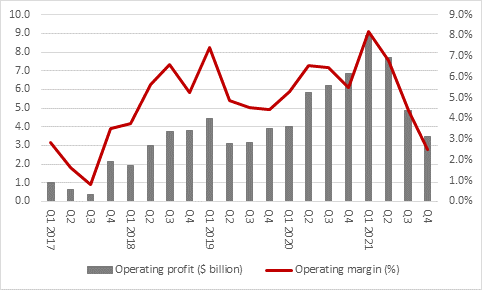

3. Operating profit halved in the fourth quarter of 2021 as the rate of sales growth slowed and cost pressures told, in the form of wages, fuel, shipping and supply chain disruption. That was the second straight year-on-year drop in operating profit and Amazon’s operating return on sales retreated to 2.5%, its lowest level since Q3 2017.

Source: Company accounts

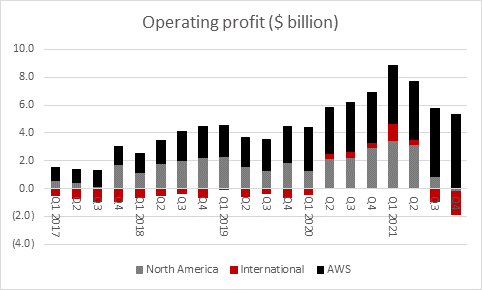

4. North America went into loss in the fourth quarter and International was in the red for the whole year. North America had not made a quarterly loss since Amazon first published operating profit by division back in 2015. International made a maiden annual profit in 2020 but slipped back into loss in 2021. Again, this shows the cost pressures which face the online delivery businesses and flags the importance to Amazon of its cloud computing operation AWS, which generated three-quarters of group operating profit in 2021 overall and all of it and more in the final three months of the year. That high-quality business is the core of Amazon and in many ways the foundations upon which it rests.

Source: Company accounts

5. The fourth quarter numbers were flattered – and rescued – by an $11.8 billion pre-tax financial gain on the company’s shareholding in Rivian Automotive. Rivian floated at $78 a share in November and the shares roared above $170 but they have since sagged to $60. The capital gain puts a nice gloss on the numbers and helps Amazon exceed consensus forecasts – after it had lowered expectations with a conservative outlook statement alongside the third-quarter results in October.

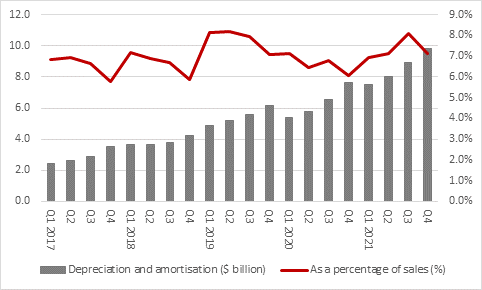

6. Profits guidance for the first quarter implies a further big drop and even though it is flattered by an accounting change. Management steered first quarter operating profit forecasts to between $3 billion and $6 billion. The $4.5 billion mid-point of that range compares to $8.9 billion and implies a third straight year-on-year drop. Moreover, that forecast assumes a $1 billion drop in depreciation expense as Amazon now believes its servers and networking equipment will last longer than previously assumed. Even on a sales base north of $100 billion a quarter a $1 billion drop in depreciation charges equates to around one percentage of operating margin, a significant number when management forecasts imply around a 4% operating margin for Q1 2022. Such accounting sleight of hand is not an ideal way of ensuring profit forecasts are met and the lofty valuation really requires a higher-quality source of earnings than that, if it is to be sustained.

Source: Company accounts