“President Donald Trump has survived efforts to impeach and unseat him through a legal process, so his rival Democratic Party must now rely on the ballot box in the efforts to get rid of him, when Americans head to the polls on 3 November,” says Russ Mould, AJ Bell Investment Director. “Iowa’s farcical event mean they are not off to a particular good start here but as the party primaries move to New Hampshire, N and beyond, financial markets will start to take a greater interest in the identity of the rival who will face Trump and the Republicans in just under nine months’ time.

“Historic data shows that the Dow Jones Industrials index traditionally gets an attack of the nerves in the final year of a Presidency, especially if the incumbent is a Republican.

|

|

|

|

Dow Jones Industrials index performance |

||||

|

Inauguration |

President |

Party |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Term |

|

|

|

|

|

|

|

|

|

|

20-Jan-49 |

Truman |

Democrat |

13.6% |

21.3% |

10.3% |

5.8% |

60.8% |

|

20-Jan-53 |

Eisenhower |

Republican |

0.4% |

35.9% |

18.2% |

2.8% |

65.8% |

|

20-Jan-57 |

Eisenhower |

Republican |

(6.3%) |

33.2% |

8.1% |

(1.4%) |

32.9% |

|

20-Jan-61 |

Kennedy * |

Democrat |

10.5% |

(4.0%) |

14.9% |

15.8% |

41.1% |

|

20-Jan-65 |

Johnson |

Democrat |

10.3% |

(14.2%) |

3.9% |

5.8% |

4.0% |

|

20-Jan-69 |

Nixon |

Republican |

(16.5%) |

9.3% |

7.1% |

12.7% |

10.2% |

|

20-Jan-73 |

M. Nixon ** |

Republican |

(16.6%) |

(24.3%) |

46.7% |

1.0% |

(6.5%) |

|

20-Jan-77 |

Carter |

Democrat |

(19.0%) |

7.8% |

3.5% |

9.6% |

(0.9%) |

|

20-Jan-81 |

Reagan |

Republican |

(11.0%) |

26.6% |

17.6% |

(2.5%) |

29.1% |

|

20-Jan-85 |

Reagan |

Republican |

24.6% |

37.6% |

(10.7%) |

19.0% |

82.1% |

|

20-Jan-89 |

GHW.Bush |

Republican |

19.8% |

(1.2%) |

22.9% |

(0.4%) |

45.0% |

|

20-Jan-93 |

Clinton |

Democrat |

20.0% |

(0.6%) |

34.0% |

32.0% |

111.1% |

|

20-Jan-97 |

Clinton |

Democrat |

15.0% |

18.6% |

21.6% |

(6.7%) |

54.7% |

|

20-Jan-01 |

GW Bush |

Republican |

(7.7%) |

(12.1%) |

22.6% |

(0.5%) |

(1.1%) |

|

20-Jan-05 |

GW Bush |

Republican |

1.9% |

17.8% |

(3.7%) |

(34.3%) |

(24.1%) |

|

20-Jan-09 |

Obama |

Democrat |

33.4% |

11.5% |

7.6% |

7.3% |

71.7% |

|

20-Jan-13 |

Obama |

Democrat |

20.6% |

6.4% |

(10.0%) |

25.8% |

45.3% |

|

20-Jan-17 |

Trump *** |

Republican |

31.5% |

(5.2%) |

18.8% |

|

|

|

|

|

|

|

|

|

|

|

|

Average |

6.9% |

9.1% |

12.6% |

5.7% |

38.8% |

||

|

Average - Democrat |

13.1% |

5.8% |

10.7% |

11.9% |

48.5% |

||

|

Average - Republican |

2.0% |

11.8% |

14.3% |

(0.4%) |

25.9% |

||

Source: Refinitiv data. Based on calendar year from inauguration day (20 January) and the performance of the Dow Jones Industrials index

* John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson

** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford

*** Donald J. Trump’s fourth year concludes on 19 January 2021

“This may reflect nothing more than markets’ fears of any swing to the left under the Democrats. However, investors will see from the data that the Dow Jones has actually tended to do better under them than under the Grand Old Party. Nor should they forget that Trump was perceived as a risk to markets before his election in 2016, thanks in particular to his policies on trade and international relations.

“As such it may not pay to get too caught up in the identity of the winner of the Party races (which will conclude in July in Milwaukee, Wisconsin for the Democrats and in August in Charlotte, North Carolina for the Republicans) especially as other factors will continue to influence how US equities perform.

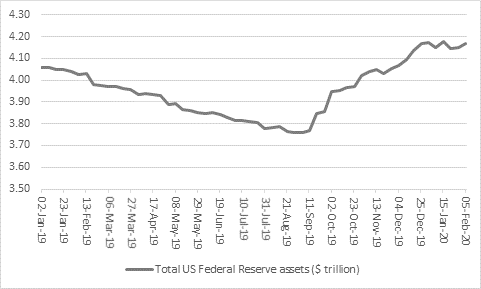

“Federal Reserve policy is one huge factor here and the central bank is independent. Some may be tempted to argue that it caved into Presidential pressure when it pushed through three interest rate cuts in 2019 but markets may be about to face their next test, as the Fed seems to be throttling back on the amount on the amount of fresh liquidity that it is providing to the inter-bank funding, or repo, arena.

Source: FRED – St. Louis Federal Reserve database

“In addition, corporate profits and especially cash flows drive equity valuations over the long term and they are largely (if not exclusively) the result of the broader economic cycle.

“Going back to the data, the impact of the wider macro backdrop upon US equity market performance seems pretty clear, even if investors are prepared to give credit to Ronald Reagan for the reforms he initiated to drag the US out of the mire in the early 1980s or even Trump for his 2017 tax cuts.

“The recessions of 1948-49, 1954-55, 1957-58 and 1960-61 did not unduly harm stock market performance under Truman, Eisenhower, Kennedy and Johnson but the Dow Jones sagged during the 1970-71 and 1973-75 downturns during the Nixon/Ford years. George W. Bush had nothing to do with the tech bust at the turn of the millennium or the collapse of the US housing market but the recessions of 2001 and 2008-09 mean that the Dow did badly across both of his terms.

“The economic booms of the 1950s and 1980s and the recovery from the 2007-09 (helped by Fed largesse) mean the stock market performance numbers under Truman, Eisenhower, Obama and Trump look very good.

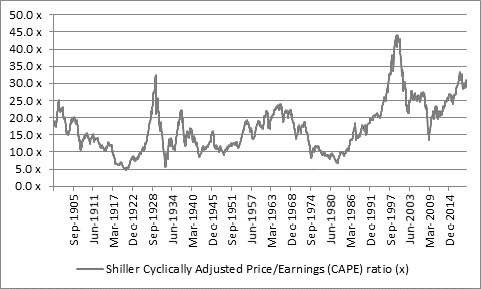

“Investors must also account for equity valuations. Using Professor Robert Shiller’s cyclically-adjusted price/earnings (CAPE) ratio as a benchmark, the S&P was trading on historically lowly valuations in 1949 and 1953 when Truman and Eisenhower took office, while the ravages of inflation in the 1970s meant that the valuations were rock bottom when Reagan took over in the early 1980s.

Source: http://www.econ.yale.edu/~shiller/data.htm

“That created plenty of potential for upside and the same could be said of when Obama became President in January 2009 just as the financial crisis was abating and a bear market had wreaked havoc.

“By contrast, George W. Bush came to power just as the TMT bubble had driven valuations that made even the dizzying (and disastrous) heights of 1929 seem modest. In his case, almost the only way was down and with the Shiller CAPE multiple back near historic highs, the next President and investors could be forgiven for wondering what may come next (although a real melt-up can still be justified by those bold enough to point to the 2000 peak valuation).”