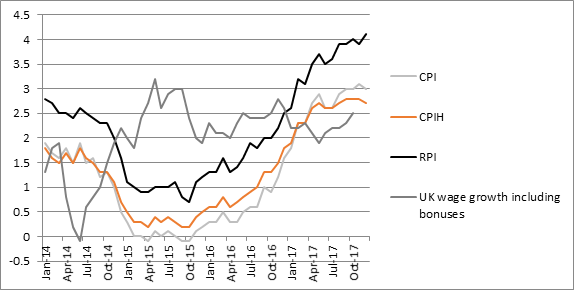

“The Office for National Statistics’ preferred CPIH inflation receded from 2.8% to 2.7% and CPI’s rate of increase slowed from 3.1% to 3.0%. In addition, producer price input cost growth slowed markedly to 4.9% and output costs came in below that at 3.3%, to suggest companies are not jacking up the price of finished goods. A stronger pound, which is now nearing $1.38 against the dollar and €1.13 against the dollar, should also help to crimp imported inflationary pressures, although oil’s gallop to the $70-a-barrel mark still needs to be watched carefully.

“Consumers will be less pleased to see RPI reach 4.1%, the highest reading since December 2011 and all of the major inflation benchmarks are still running ahead of wage growth, which was recorded at 2.5% year-on-year, including bonuses, for the three months to November.

Source: ONS

“Any acceleration in wage growth would keep the Bank of England on a state of alert, even if the markets seem to expect no more than one interest rate hike in 2018 from Governor Mark Carney, from 0.50% to 0.75%.

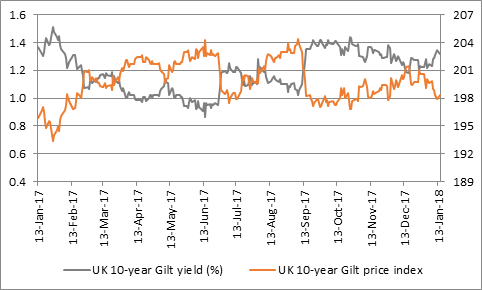

“This may explain why the yield on the benchmark UK 10-year Government bond, or Gilt, is no higher now than it was a year ago – a picture which hardly smacks of the bond market rout feared by many.

Source: Thomson Reuters Datastream

“But if there is to be a market shock in 2018, wage inflation could still be its source so bond investors cannot rest easy yet.

“If wages, broader prices and interest rates rise, that is a bad recipe for bonds, where lowly yields and coupons could be offset by both inflation and any capital losses suffered – since bond prices fall as interest rates go up and the yields on offer are unlikely to compensate for any capital losses that would accrue if interest rates were to rise more rapidly than expected.

“That in turn could inflict a lot of pain on bond ETF holders who have either been seeking “safe” yield from sovereign or investment-grade corporate debt or chasing yield from the high-yield or junk market and may find themselves unable to sell easily at the price they want when they would like to.

“Hefty losses here could even knock a hole in global liquidity flows, dampen investor sentiment and choke off appetite for the corporate debt which has been used to fund the share buybacks and takeovers which have helped to support stock markets.”