“Shares in the AIM-quoted Scottish firm, which supplies financial analysis, performance measurement and monitoring tools to hospitals in the USA, are down by almost a third after a profit warning,” says Russ Mould, AJ Bell investment director.

“Chief executive Keith Neilson has flagged that new business flows have disappointed in the second half of Craneware’s financial year that ends in June, while investment in product development has increased and a planned acquisition fell through, leaving the firm with a $1.5 million bill for advisors’ fees and nothing to show for them.

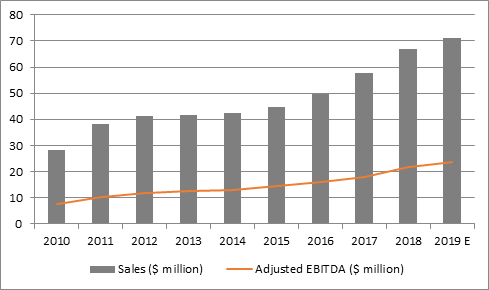

“This all means that sales are expected to rise by 6% and profits by 10%, using the company’s preferred metric of underlying EBITDA (earnings before interest, taxes, depreciation and amortisation).

Source: Company accounts, management guidance for 2019. Financial year to June.

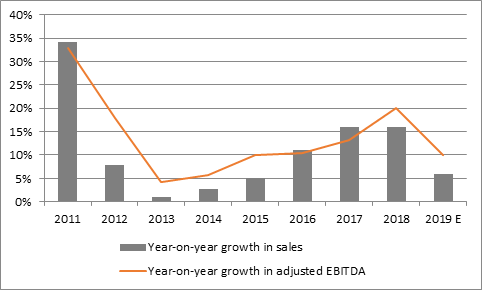

“This implies a marked deceleration in earnings growth after the double-digit increases generated over the past four or five years: since 2010 sales have grown at 11% and adjusted EBITDA by 14% respectively, on a compound annual basis.

Source: Company accounts, management guidance for 2019. Financial year to June.

“That in turn might not be such a problem, were it not for how the stock’s valuation allows little leeway for such a stumble.

“At yesterday’s close, Craneware shares were trading at £29.40 and analysts were expecting earnings per share to rise by more than 20% to 61p, for a price/earnings ratio of 48 times – a huge premium to the wider UK market which trades on closer to 13 times forward earnings.

“Such a rating is all well and good if earnings momentum remains strong and estimates continue to rise, but it offers little protection of anything at all goes wrong – as today’s events attest.

“Craneware now needs to show that this second-half slowdown is just a blip, as it moves beyond selling its Chargemaster toolkit and broadens out its offering with Value Cycle. If it is just a blip, then today’s tumble could be a buying opportunity but the heavy fall today shows that even buying quality companies – and Craneware fits that bill with its strong market position, excellent growth track record, recurring revenue base and powerful cash generation – is not a guarantee of safety if investors overpay for such stocks.”