As 2022 rapidly approaches, AJ Bell Youinvest’s end of year customer survey* has canvassed almost 3,000 DIY investors to find out their hopes and fears for the coming year. Highlights include:

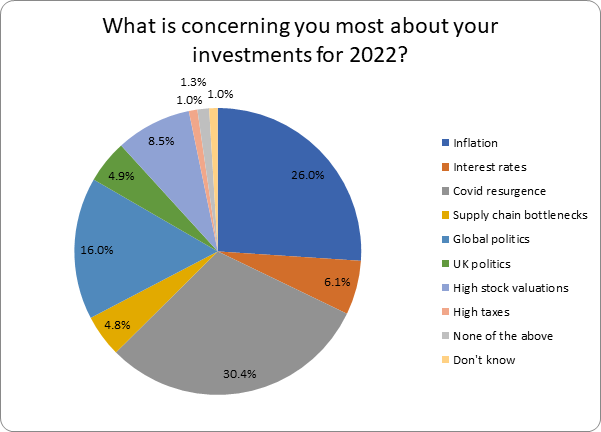

• Investors are more concerned about a COVID resurgence than inflation

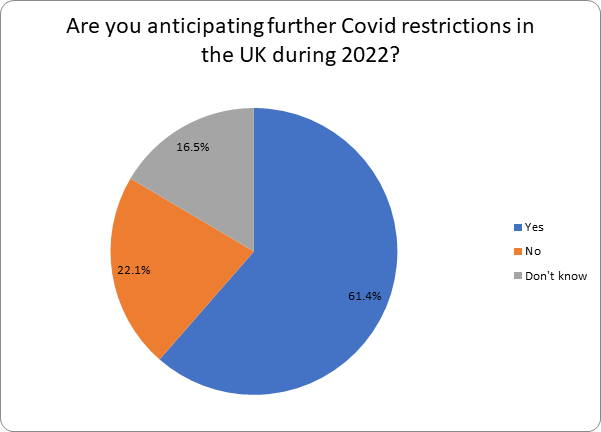

• Six in ten investors (61.4%) expect further COVID restrictions during 2022

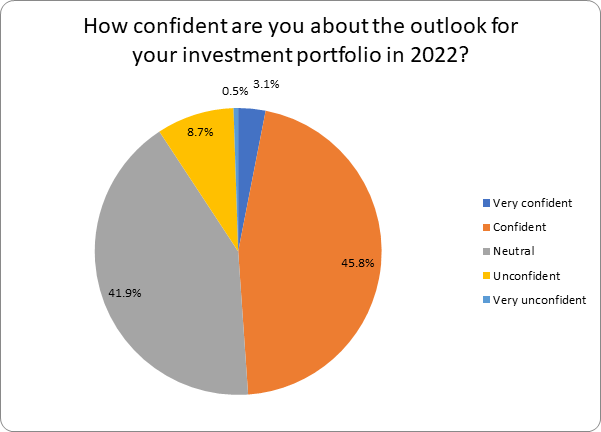

• However investors are generally confident about their investment portfolio

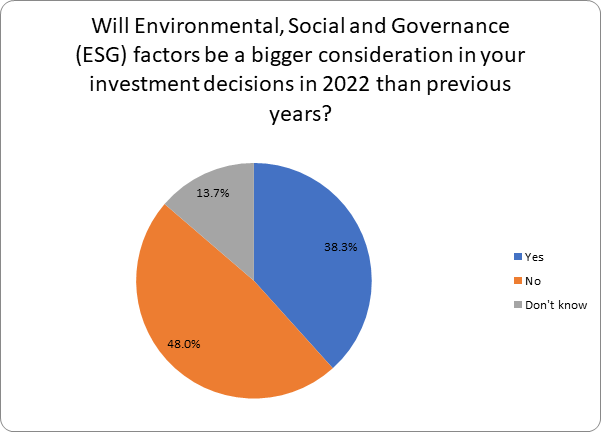

• Four in ten investors (38.3%) say ESG will be a bigger factor in their investment decisions in 2022

*Survey of 2,896 AJ Bell Youinvest customers between 6th and 10th December 2021.

Laith Khalaf, head of investment analysis at AJ Bell, comments:

“DIY investors are entering 2022 in a mood of constructive realism, recognising market risks, but also largely confident in their investments. Six in ten expect further COVID restrictions in 2022, and a resurgence in the pandemic is the number one worry for investors as we head into the new year. Indeed, COVID is seen as a greater risk than inflation, which makes sense seeing as the stock market provides some protection from price rises. Inflation comes a close second in the list of concerns for 2022 though, which shows investors are wary of price rises and the effect this may have on their portfolios. Global politics and high stock valuations are also cause for concern for some investors.

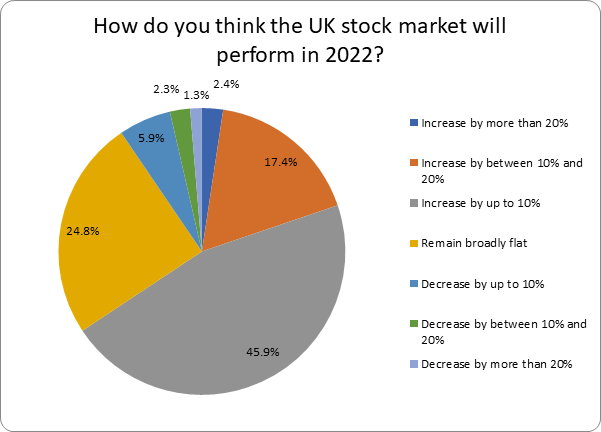

“On the whole though, investors see the glass as half full rather than half empty. About 50% were confident or very confident about their investments in 2022, and around four in ten were neutral. That’s also reflected in forecasts for the Footsie, with two thirds of investors (65.7%) expecting the UK stock market to make further ground over the course of the coming year. Almost half of investors expect single digit returns in 2022, which suggests investors aren’t getting carried away, and are settling in for a more modest year for growth than 2021.

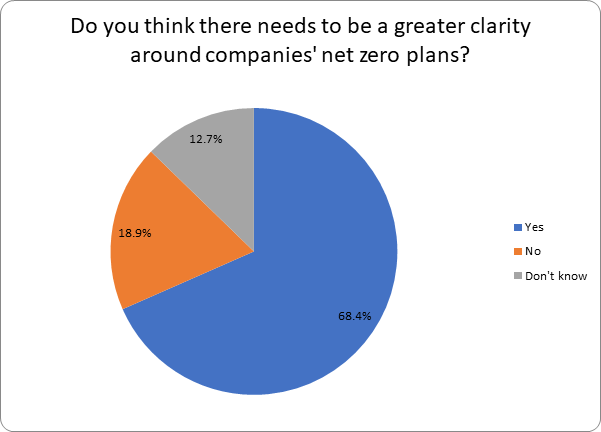

“Investors are also becoming more attuned to ESG considerations, with four in ten (38.3%) saying these were going to play a bigger part in investment decisions in 2022. There’s already been a groundswell of interest in ethical funds in the last two years, and our survey suggests this isn’t going to abate in 2022. More than two thirds of investors also said they think there should be grater clarity over companies’ net zero plans.

“The ESG agenda has developed so rapidly across the investment industry that the information available to investors is struggling to keep up. The FCA is formulating proposals on a new green labelling regime, expected in the first half of 2022, which should help make things a bit easier for investors seeking ESG investment options.”

AJ Bell Youinvest Customer Survey results in detail