Cash pays the bills and cash funds investment in a business and its competitive position, so it is encouraging today to see cash flow improve markedly at Rolls-Royce as boss Warren East nears the end of his third year at the helm,” says Russ Mould, AJ Bell Investment Director.

“One quick test to tell if something odd is going on with a company’s accounting is to compare sales, profit and cash flow growth. If all is healthy, they will tend to rise or fall together, albeit by differing degrees. But a company where sales and profits grow but cash flow does not is one that requires further investigation, as it could mean the firm is deploying aggressive accounting techniques.

“There is nothing illegal in this but it could mean a company has been putting a flattering light on its profit and loss account.

Year-on-year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

Change |

|

|

|

|

|

|

|

Sales | 0.4% | 9.3% | 27.6% | (11.5%) | (0.1%) | 9.0% | 9.0% |

Operating profit | 5.0% | 16.2% | 11.4% | (9.4%) | 7.8% | (97.1%) | 2825.0% |

Operating cash flow | 5.4% | (26.5%) | 16.6% | (73.7%) | 210.3% | (167.8%) | 164.7% |

Source: Company accounts

“Rolls’ cash flow has been patchy over the past few years but has finally shown a marked improvement in 2017, helped by a big improvement in underlying profitability.

“Best of all, there is plenty of cash flow left over even once interest on debt has been paid, pension contributions made and shareholder dividends handed out.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

Sales | 11,085 | 11,124 | 12,161 | 15,513 | 13,736 | 13,725 | 14,955 | 16,307 |

Operating profit | 1,130.0 | 1,186.0 | 1,378.0 | 1,535.0 | 1,390.0 | 1,499.0 | 44.0 | 1,287.0 |

Tax | (168.0) | (208.0) | (219.0) | (238.0) | (276.0) | (160.0) | (157.0) | (180.0) |

Depreciation & amortisation | 367.0 | 410.0 | 487.0 | 800.0 | 742.0 | 810.0 | 1,054.0 | 880.0 |

Net working capital | 328.0 | 422.0 | (200.0) | (38.0) | (498.0) | (531.0) | 127.0 | 714.0 |

Capital expenditure | (675.0) | (775.0) | (685.0) | (1,172.0) | (1,125.0) | (895.0) | (1,558.0) | (1,404.0) |

Operating Free Cash Flow | 982.0 | 1,035.0 | 761.0 | 887.0 | 233.0 | 723.0 | (490.0) | 1,297.0 |

|

|

|

|

|

|

|

|

|

Interest | (54.0) | (31.0) | (41.0) | (43.0) | (45.0) | (63.0) | (70.0) | (78.0) |

Pension contribution | (282.0) | (304.0) | (299.0) | (315.0) | (322.0) | (259.0) | (271.0) | (249.0) |

Dividend | (266.0) | (315.0) | (318.0) | (357.0) | (406.0) | (421.0) | (216.0) | (216.0) |

Remaining free cash flow | 380.0 | 385.0 | 103.0 | 172.0 | (540.0) | (20.0) | (1,047.0) | 754.0 |

Share buy back |

|

|

|

| (69.0) | (433.0) |

|

|

Source: Company accounts

“If Mr. East and his team can continue to drive improvements in cash flow then Rolls’ ability to defend – and enhance – its competitive position through investment in its products and services at a time when one of its key rivals in the jet engine market, America’s General Electric, is finding trouble of its own, weighed down by debt, legacy issues surrounding its old insurance business and poor operational performance.

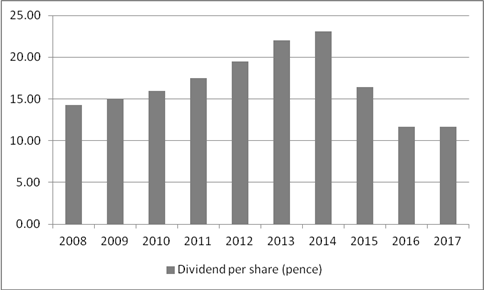

“Increased cash flow could also permit the company to give the ultimate signal of confidence in its future and increase its dividend, which peaked at 23.1p a share in 2014 and after two cuts and 2017’s unchanged payment has fallen to 11.7p a share.

Source: Company accounts

“That equates to a dividend yield of just 1.2%, well below the 4%-plus average across the FTSE 100.”