“The shares do not seem terribly impressed in today’s early exchanges but don’t forget they have rallied by some 17% since early July, helped by rising oil and gas prices, and during that period the FTSE 100 is up by barely 2%. It may be that Shell is just pausing for breath as investors try to decide whether the latest gains in oil are sustainable or not, but the company is doing its bit to confound the doubters by racking up healthy profits and cash flow with $50 oil.”

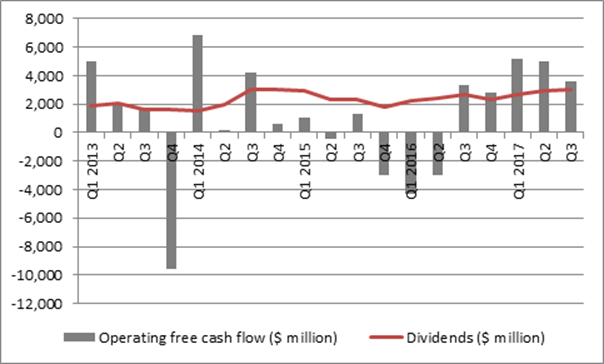

“Most investors will look at profits but the real key is cash flow – the amount the company has left after it has invested in its business, as that represents the cash the company can then hand back to shareholders.

“The good news is Shell’s cash flow has covered its quarterly dividend for five quarters in row (after a torrid spell of seven when it did not). The higher the oil price goes, the better cash flow will be (providing Shell maintains its cost disciplines) and the safer the company’s dividends will be and the bumper 6%-plus dividend yield is really the key to the investment case for the stock.

Source: Company accounts

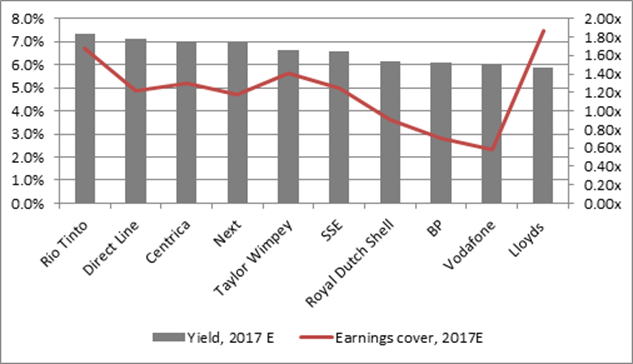

“Shell is the single biggest payer of dividends in the FTSE 100 (at 14% of the estimated total for 2017) and the seventh highest-yielding stock in the index.

“Cash flow is still not as high as you would like and there is more work to do, but if confidence rises that the dividend can be readily funded by strong profits and cash flow – and not short-term fixes like cutting investment, selling assets or raising debt (all of which weaken the company in the long-term) - then the shares could still prove popular, especially with income-seekers.”

Source: Digital Look, analysts’ consensus forecasts