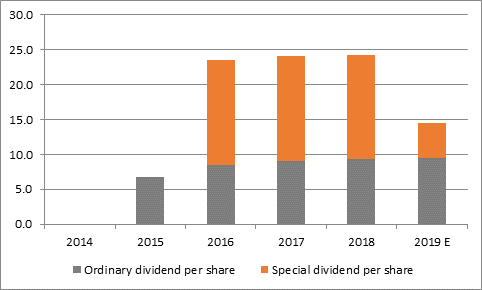

“This is what makes Card Factory an interesting test case, as boss Karen Hubbard suggests that the pain caused by a weak pound and higher (living) wage costs will start to ease in 2019 and prepares to pay another, albeit reduced, special dividend.

Source: Company accounts. 2019E based on consensus forecast and bottom end of company's guided range

“Stated operating profit fell by 12%, or £10.2 million, despite a £23.9 million advance in sales as a weaker pound added to purchasing and raw material costs and increases to the national living wage and minimum wage combined to saddle Card Factory with an additional £14.6 million in costs.

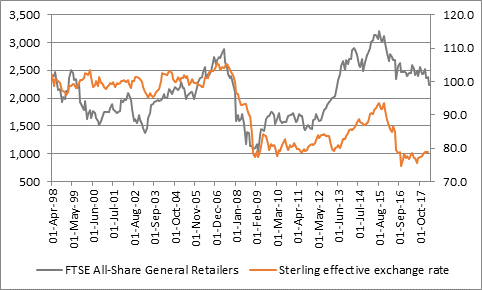

“The company is responding with its own efficiency programmes but sterling could start to provide a tailwind rather than a headwind, if it holds on to the ground made from the post-EU referendum lows. This will not only reduce purchasing costs but help to crimp inflation more generally, potentially to the benefit of consumer confidence, especially as wage growth is on the verge of outpacing increases in the costs of living once more.

“While history is not guaranteed to repeat itself – and Card Factory itself has only a short history as a public company – the data suggest that the General Retailers sector tends to do well when the pound is strong and badly when the currency is weak. If the pound does stay perky, this could at least offer some good news to a sector that many are writing off completely, especially when it comes to bricks and mortar retailers.

Source: Thomson Reuters Datastream

“Card Factory is looking to boost its multi-channel capabilities and there can be no doubt that sending cards through the post faces many challenges from alternative, cheaper forms of communication.

“But the company has just increased like-for-like sales yet again and the management team’s decision to sanction another dividend increase and a fourth consecutive special dividend points to some degree of confidence in the underlying business, even if the extra payment is likely to come in between 5p and 10p a share, down from 15p previously.

“Even so, a 5p special and a 9.5p ordinary payment for the year to January 2019 (assuming a similar rate of increase to fiscal 2018) make for a 14.5p total dividend. On a 200p share price that represents a yield of 7.25%, way better than anything that can be gleaned from cash in the bank or UK Government bonds, even if the risks associated with share ownership are a lot higher.

“What investors must do now is ensure the special dividend can be paid. The company’s valuation tumbled in 2017 as sterling and higher costs weighed on profit forecasts and knocked hopes for future special dividends of 15p a share.

“The company’s net debt position rose in the last year, not least due to the special dividend payment, and investors start to fight shy of the stock if it starts to rack up fresh borrowing in an attempt to maintain an unrealistic payout.

“An analysis of the company’s cash flow suggests a 5p-a-share special should not add undue strain and actually leave some cash left over, although that assumes that profits come in flat this year.

£ millions | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 E |

|

|

|

|

|

|

|

Sales | 326.9 | 353.3 | 381.6 | 398.2 | 422.1 | 422.1 |

Operating profit | 71.0 | 64.3 | 88.9 | 85.7 | 75.5 | 75.5 |

Depreciation & amortisation | 7.5 | 8.8 | 9.7 | 10.9 | 10.6 | 10.6 |

Net working capital | 0.6 | 1.1 | (10.2) | 1.7 | 6.9 | 0.0 |

Capital expenditure | (11.0) | (10.1) | (11.6) | (10.4) | (13.1) | (11.5) |

Operating Free Cash Flow | 68.1 | 64.1 | 76.8 | 87.9 | 79.9 | 74.6 |

|

|

|

|

|

|

|

Tax | (12.1) | (9.6) | (13.0) | (17.6) | (17.0) | (17.0) |

Interest | (40.9) | (21.6) | (5.2) | (2.9) | (2.9) | (2.9) |

Pension contribution | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Ordinary dividend | 0.0 | (23.2) | (31.7) | (30.0) | (31.7) | (31.7) |

Special dividend | 0.0 | 0.0 | (51.1) | (51.1) | (51.2) | (17.0) |

Remaining free cash flow | 15.1 | 9.7 | (24.2) | (13.7) | (22.9) | 6.0 |

Source: Company accounts. 2019E based on consensus forecasts and bottom end of company's guided range for the dividend