“Based on consensus’ analysts forecasts for an unchanged full-year 2018 dividend of $0.40 per share (around 29p a share at current exchange rates) BP is the third biggest dividend payer overall within the FTSE 100 (at 7% of the index’s forecast total payout)

“The shares offer a yield of 5.3%, enough to place it on the fringes of the list of 20 highest-yielding stocks in the FTSE 100.

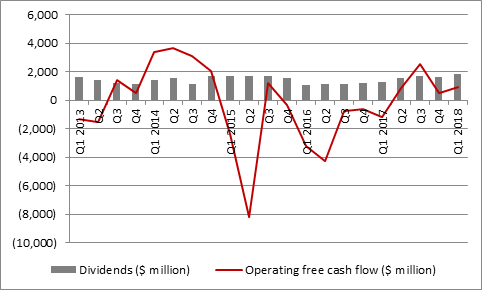

“The profit growth, helped by a surge in crude prices and a 6% increase in output should offer reassurance that the $0.10-per-share quarterly dividend payment is looking increasingly secure. For the past three years low oil prices and compensation payments relating to the 2010 Gulf of Mexico accident have had investors fretting over whether BP would be forced to cut its distribution for the third time since 1990.

“Earnings per share for the quarter reached $0.124 per share, although this still means earnings cover is lower than ideal. Investors will also need to keep a careful eye on cash flow, which, after taxes and capital expenditure, has failed to fully cover the quarterly $1.8 billion cost of the dividend for the second three-month period in a row.

“Operating profit of $4.5 billion added to depreciation of $4.4 billion gives $8.9 billion of cash flow – but net working capital drained $3.4 billion, capital investment came to $3.6 billion and tax $933 million, to leave just $921 million in the kitty.

Source: BP accounts

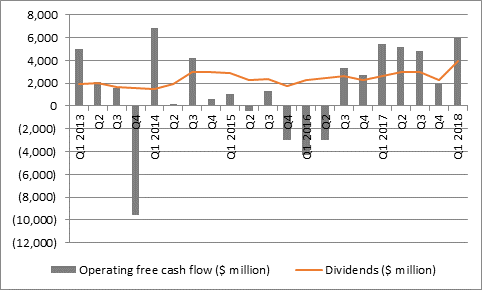

“This is a slightly unwelcome contrast with Shell, where cash flow after tax and capex has covered its dividend payment six times in the past seven quarters.

Source: Shell accounts

“However, BP shareholders may be inclined to give the company the benefit of the doubt, in the view that the cash outflow caused by working capital should normalise through the rest of the year and the Gulf of Mexico payments are coming to an end.

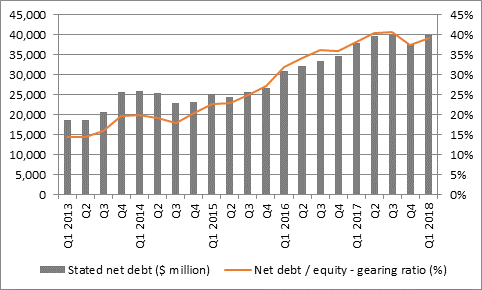

“Net debt increased modestly in the quarter, as the dividend again cost more than cash flow, although investors will doubtless be looking to see this drop as cash flow improves and dividends are maintained.

“The $40 billion net debt pile is far from a huge burden, given BP’s $102 billion equity base, and debt is a fraction lower than it was at the end of the third quarter.

“It would still be reassuring to see this figure come down, a substantial debt pile could crimp BP’s ability to increase (or even hold) dividend payments in the event of a fresh slump in oil prices or an unexpected increase in interest rates.”

Source: BP accounts