“BP’s shares are on the slide thanks to a messy set of third-quarter numbers, marred, just like those of Shell, by accounting losses linked to hedging oil and gas prices but the pledge to return another $1.25 billion to shareholders via buybacks and $1 billion a quarter in dividends shows that Big Oil still has some financial clout – even if that is not necessarily the message chief executive Bernard Looney will be looking to put out as the COP26 summit takes place in Glasgow,” says AJ Bell Investment Director Russ Mould.

“Higher oil and gas prices are stoking BP’s financial performance and leaving it with the cashflow to both invest in renewable and alternative energy sources and reward shareholders for their support. Environmental campaigners will welcome the former but argue that the money used for the latter could instead by deployed to accelerate the company’s transition away from hydrocarbons.

“Those investors who are, ultimately, prepared to put profit ahead of environmental principles will be grateful to see that latest upgrade to BP’s cash return plans. The $1.25 billion buyback, due for completion before the release of next February’s fourth-quarter and full-year results, takes the total buyback bonanza so far to £18 billion from 21 FTSE 100 companies, adding to the £78 billion analysts believe they will pay out in ordinary dividends this year.

|

Announced |

Company |

Buyback programme announced (£ million) |

|

02-Nov-21 |

BP (3) |

912 |

|

25-Oct-21 |

HSBC |

1,445 |

|

06-Oct-21 |

Tesco |

500 |

|

28-Sep-21 |

Ferguson (2) |

730 |

|

21-Sep-21 |

Kingfisher |

300 |

|

03-Sep-21 |

Sage (2) |

300 |

|

12-Aug-21 |

Aviva |

750 |

|

05-Aug-21 |

Glencore |

464 |

|

03-Aug-21 |

BP (2) |

643 |

|

03-Aug-21 |

Standard Chartered (2) |

179 |

|

29-Jul-21 |

BAE Systems |

500 |

|

29-Jul-21 |

Anglo American |

1,429 |

|

29-Jul-21 |

Royal Dutch Shell |

1,429 |

|

28-Jul-21 |

Barclays (2) |

500 |

|

30-Jun-21 |

CRH (2) |

217 |

|

19-May-21 |

Vodafone (2) |

340 |

|

12-May-21 |

Diageo |

1,000 |

|

29-Apr-21 |

Unilever |

2,609 |

|

27-Apr-21 |

BP |

360 |

|

19-Mar-21 |

Vodafone |

330 |

|

19-Mar-21 |

NatWest Group |

1,125 |

|

16-Mar-21 |

Ferguson |

290 |

|

11-Mar-21 |

WPP |

600 |

|

04-Mar-21 |

CRH |

216 |

|

04-Mar-21 |

Sage |

300 |

|

26-Feb-21 |

Rightmove |

TBC |

|

25-Feb-21 |

Standard Chartered |

181 |

|

25-Feb-21 |

Berkeley Group |

129 |

|

18-Feb-21 |

Barclays |

700 |

|

|

TOTAL |

£18,033 |

Source: Company accounts

• BP’s forecast dividend for 2021 comes to around £3.1 billion – enough for a yield of 4.5% - and the buybacks put another £1.9 billion into investors’ pockets. That total pay-out of £5 billion represents 7% of the oil major’s current market capitalisation, something which may appeal to income-hungry investors.

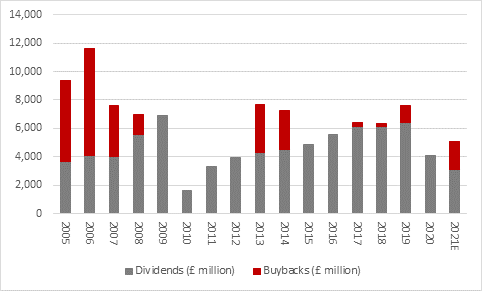

• Since the 2005-07 oil boom (and then bust), BP has already paid out £75 billion in dividends and £26 billion in buybacks – and that compares to the current £70 billion market cap. Anyone who had held on for the past fifteen years or so would have therefore got all of their investment back in cash, and more, and still have a stake in the company’s operations, which are once more generating cash.

Source: Company accounts

“Yet BP’s shares are no higher now than they were in late 1996.

“This doubtless reflects investors’ fears that BP’s transition to being Net Zero will be expensive and fraught with risk and that the current spike in oil and gas prices will prove to be transitory, as the world migrates toward more renewable sources of energy and leaves the firm sat on a pile of stranded assets over the long-term.

“Yet in the short-term, demand seems to be outstripping supply, as oil majors are actively discouraged from fresh exploration work and renewables output is still insufficient to reliably take up the slack. This could, ironically, support oil and gas prices in the near term, boosting BP’s profits and cash flow and leaving the shares looking temptingly cheap in the process. The question then is how many investors are prepared to hold their noses and buy the shares, or whether public and political pressure means the shares stay cheap owing to a lack of willing buyers.”