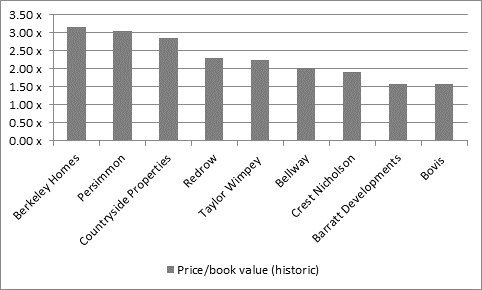

“This is reflected in how well the shares have done in absolute terms and also relative to its sector peers and even after that good run the stock is still one of the cheaper options for anyone seeking exposure to the UK house building sector, especially as there is now the prospect of Bovis joining the list of firms in the industry that pay a special dividend.

| Share price change, last 12 months (%) |

Berkeley Homes | 44.7% |

Bovis | 44.4% |

Redrow | 43.7% |

Countryside Properties | 43.2% |

Bellway | 39.1% |

Persimmon | 35.7% |

Barratt Developments | 25.3% |

Taylor Wimpey | 15.4% |

Crest Nicholson | 3.7% |

Source: Thomson Reuters Datastream

Source: Company accounts, Thomson Reuters Datastream

“This shows just how far Bovis has come in a short space of time, now that its focus is on delivery of quality homes and good customer service rather than simply upon the return on capital and profit targets which triggered executive remuneration packages. The company should therefore be well placed to benefit from the ongoing tightness between housing supply and demand, a tightness that is reflected in another year of solid price increases for Bovis even as it worked to fix 2016’s quality control and customer relations problems.

“Now that it is well on the way to resolving those self-inflicted difficulties, at a cost of £3.5 million, Bovis still has to face the risk that at some stage the housing cycle runs out of steam, owing to higher interest rates, prices which prove unsustainable for would-be buyers or a broader economic setback.

“Shares in Taylor Wimpey, Barratt and Persimmon did not respond as favourably to their trading updates as Bovis’ stock price did to its update. This is partly because those shares are more expensive and their dividend yields are already more generous, so Bovis is benefiting from a catch-up effect there. But it is also partly because of wider fears over the housing market.

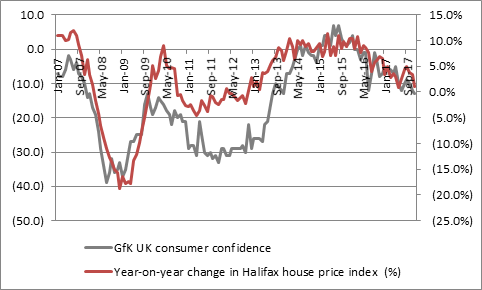

“Price growth has begun to soften and this is hardly surprising given how weak consumer confidence is, using the GfK monthly survey as a benchmark. History suggests that house price growth and consumer confidence are linked and if times remain tough, with wages lagging inflation, this could present the house builders (and their share prices) with a challenge.”

Source: GfK, Halifax Building Society