“Investors must always resist the temptation to fall for the ‘cult of the CEO’ because one person cannot do everything at a firm, no matter how driven or talented, but the share price plunge shows how disappointed by Marco Gobbetti’s decision to step down from the top job at Burberry,” says AJ Bell Investment Director, Russ Mould. “The good news is there seems to be nothing malign behind the decision, merely an understandable desire to return to his native Italy after a period when travelling to catch up with friends and family has been very difficult, if not impossible.

“The best CEOs set tone and culture and allocate capital, both human and financial. Investors clearly feel Mr Gobbetti has done well in his tenure, especially given the additional challenges posed by the pandemic and global downturn. As of last Friday’s close, the shares had gained 35% since he became CEO in July 2017, compared to a 2% drop in the FTSE 100 over the same period.

|

|

|

% change in |

% change in |

|

CEO |

Tenure |

Burberry share price |

FTSE 100 |

|

Rose Maria Bravo |

Jul 2002 to Dec 2005* |

87% |

31% |

|

Angela Ahrendts |

Jan 2006 to Apr 2014 |

246% |

21% |

|

Christopher Bailey |

May 2014 to Jun 2017 |

12% |

8% |

|

Marco Gobbetti |

Jul 2017 to present |

35% |

(2%) |

Source: Refinitiv data. *Rose Maria Bravo became CEO in 1997 but Burberry only floated in July 2002. Data as of the close on Friday 25 June

“That might not match the spectacular share price gains forged under Angela Ahrendts or Rose Maria Bravo, but allowances must be made for the different economic and market backdrops, as well as Burberry’s higher valuation. The company was valued at just over £1 billion when it came to market in 2002 and £2 billion when Angela Ahrendts took over, while its price tag now is some £9 billion, so the law of large numbers will have some effect.

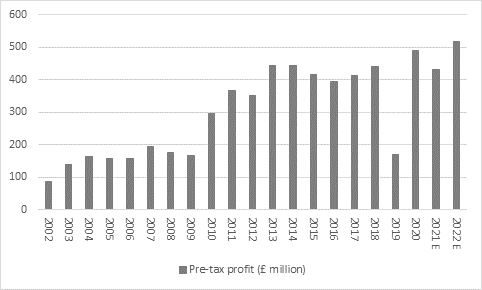

“The same iron law will apply to profits growth to some degree since Burberry’s profits for the year to March 2021 are forecast to be three times higher than those for its debut year on the stock market.

Source: Company accounts, Marketscreener, consensus analysts' forecasts. Financial year to March.

“Mr Gobbetti is due to step down at the end of 2021, after four-and-a-half years as Burberry’s CEO. That is slightly shorter than the current average FTSE 100 CEO’s tenure, which is 5.3 years, and some way ahead of the average football manager, whose current average stay across England’s 92 league clubs is just 1.7 years.

|

|

Average tenure |

||

|

|

Days |

Months |

Years |

|

FTSE 100 CEOs |

1,947 |

64.0 |

5.3 |

|

FTSE 100 CFOs |

1,817 |

151 |

5.0 |

|

|

|

|

|

|

English league managers |

|||

|

Premier League |

804 |

26.4 |

2.2 |

|

Championship |

658 |

21.6 |

1.8 |

|

League One |

523 |

17.2 |

1.4 |

|

League Two |

506 |

16.6 |

1.4 |

|

Average |

618 |

20.3 |

1.7 |

Source: Company accounts, club websites, BBC

“Mr Gobbetti is currently the 52nd-longest serving leader in the FTSE 100.

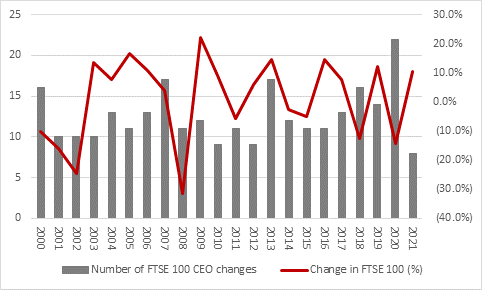

“He is also the eighth boss to leave or announce their departure in 2021, after Jean-Sebastian Jacques of Rio Tinto, Shay Segev of Entain, Antonio Horta-Osorio of Lloyds, Craig Heyman of AVEVA, Andy Reynolds-Smith of Smiths Group, Ivan Glasenberg of Glencore and Lloyds’ interim leader William Chalmers.

|

Changes in FTSE 100 in 2021, announced or actual |

|||

|

Company |

In |

Out |

|

|

Rio Tinto |

Jakob Stausholm |

Jean-Sebastian Jacques |

01-Jan-21 |

|

Entain |

Jette Nygaard-Andersen |

Shay Segev |

21-Jan-21 |

|

Lloyds |

William Chalmers (interim) |

Antonio Horta-Osorio |

01-May-21 |

|

AVEVA |

Peter Herweck |

Craig Hayman |

01-May-21 |

|

Smiths Group |

Paul Keel |

Andy Reynolds-Smith |

25-May-21 |

|

Glencore |

Gary Nagle |

Ivan Glasenberg |

01-Jul-21 |

|

Lloyds |

Charlie Nunn |

William Chalmers (interim) |

16-Aug-21 |

|

Burberry |

|

Marco Gobbetti |

End-2021 |

Source: Company accounts

“That is well down from the 22 changes at the top witnessed in 2021 and the twenty-first century average of 13 a year. Shareholders may well be pleased to see the drop in boardroom turnover as firms continue to adapt to a post-Brexit world and one where major issues such as the pandemic, changes in working patterns and technology and the relentless rise in global indebtedness will continue present both challenges and opportunity.”

Source: Company accounts, Refinitiv data