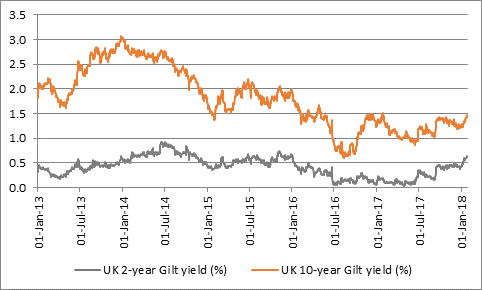

“Bond prices may be going down and bond yields higher either because markets are pricing in higher global growth and inflation, with low unemployment and higher oil playing a role here, or they are accepting that central banks are starting to tighten policy, or a combination of the two.

“Stock market investors may not feel inclined to fret about either explanation as both could be taken as a positive, since they suggest economic and corporate earnings growth could prove robust and dividend yields well underpinned.

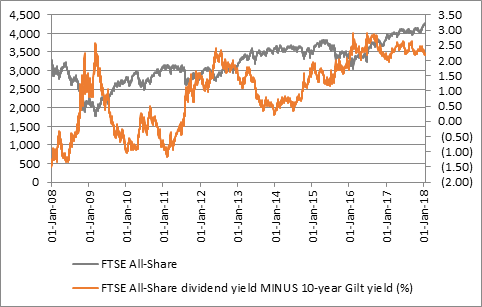

“But portfolio builders will also be well aware that a surge in bond yields could suck cash back to fixed income and away from stocks, although where that tipping point is remains a matter of some guesswork.

Source: Thomson Reuters Datastream

“One way of looking at this is to compare the equity yield on the FTSE All-Share and compare it to the benchmark UK 10-year Gilt yield. At around 3.6% the stock market’s yield beats the Government’s bond’s 1.44% yield hands down and a 2.00% (200 basis-point) yield premium from stocks (albeit in exchange for far greater capital risk) provided a floor to the FTSE All-Share during the stumbles of 2012, 2015 and 2016.

“This suggests there is still little real need to be wary of a bond-to-equity switch in the UK providing economic and earnings growth do not disappoint.

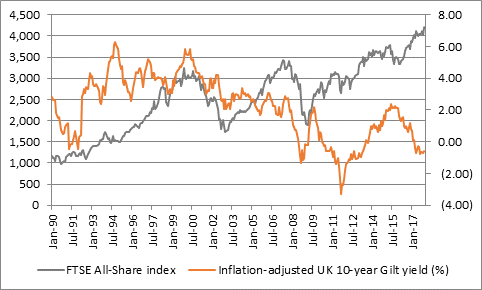

Source: Thomson Reuters Datastream

“A further way of checking how far the Government bond yield would have to go to really put UK stocks at a tipping point is to look at the real, inflation-adjusted 10-year Gilt yield, as it is inflation that would force the hands of the Bank of England and bond vigilantes alike.

“Analysis of the UK Gilt and UK stock markets since 1990 (and especially the corrections of 1994, 1997-98 and 2015 as well as the tops of 2000 and 2007), suggests that the UK 10-year Gilt yield needs to be at least 2.00% in real terms, or two percentage points higher than inflation.

Source: Thomson Reuters Datastream, ONS

“At the moment the 10-year Gilt yield is lower than inflation, let alone two percentage points higher, so if history is any guide then bond yields are not a long-term threat to the stock market bull run just yet – although if the economy disappoints, inflation sags and it turns out that central banks have already tightened too much (at least in America) then there could still be trouble ahead.”