“Investors must now consider the implications for the pound, bonds and the stock market.

“A very gradual series of rate increases looks unlikely to rock the boat too much, at least for now, although if the Bank is right and inflation is coming then investors may need to revise their stock-picking strategy, shifting from growth stocks (like technology) and high-yielding names to more cyclical or value names, like real estate plays or oils and miners, as well as index-linked bonds.

“Above-target inflation figures and low unemployment appear to have tipped the balance, while Governor Carney and colleagues have also flagged concerns over galloping growth in consumer debt.

“The vote of 7-2 in favour of the rate rise and the Monetary Policy Committee statement is as carefully couched as ever, noting that any future increases in the headline cost of borrowing would be gradual and limited.

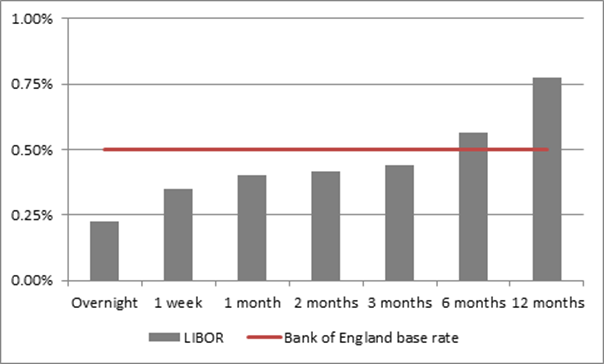

“Note that LIBOR – the interest rate at which banks are prepared to lend to each other – is just 0.75% for 12 months’ time, implying the market expects just one more 0.25% rate rise by this time next year.”

Source: www.global-rates.com

“This very gentle tightening of monetary policy is unlikely to spook markets too much, although investors need to focus on three different arenas:

Sterling. The pound actually fell on the news against the dollar from $1.3220 to $1.3115. On a trade weighted basis, sterling has still lost 11% since the Brexit vote in June 2016. A relatively weak pound may encourage investors to stick with the “pound down, FTSE 100 up” trade which has dominated since the referendum, and only a rapid-fire round of rate hikes is likely to take sterling markedly higher. If the pound does reclaim some of the lost ground, this could help retailers (owing to lower import costs, lower inflation and improved consumer spending power) and also focus attention on other downtrodden domestic sectors like real estate investment trusts, which have been ignored in favour of dollar earners, exporters and overseas asset plays like the engineers, miners and forestry and paper stocks.

Bonds. Whether you are investing in Government or corporate bonds, you face three key risks: credit risk, inflation risk and interest rate risk – and rising rates are generally bad news for bonds. Bond prices can go up (when yields and interest rates fall) but they can go down (when yields and interest rates rise). This is less of an issue if you buy an individual bond, hold it to maturity and all goes well. But it is a big issue for bond funds, whether they are active or passive, as they do not mature – so the fund’s value could fall – and do so by an amount which more than offsets the yield they offer, especially if interest rates start to move higher faster than the market currently thinks.

Stocks. The FTSE 100 took the announcement in its stride, adding to few points to a gain it had already made in early trading. In general, interest rate increases do make life harder for stock markets. This is because increased rates on cash and higher yields on bonds mean investors can get improved returns here so they become less inclined to take the risk associated with shares. There have been 10 interest rate increase cycles since the inception of the FTSE All-Share in 1962 and the index has done better when interest rates have been going down than when they have been going up, from the first to the last move:

However, the range of performance during rate-hike cycles is wide, with four drops and six gains and the overall average result is still a net increase. The UK stock market has historically been able to take the strain of higher borrowing costs providing underlying economic growth and corporate profits growth were robust.

“The strength of the UK economy remains the big question this time around. Growth looks stuck in the 2% range and if the Bank of England thinks this numbers merits a rate rise then that does not necessarily say that much for the UK economy, if such mediocre progress is the new normal.

“If growth does remain subdued and interest rates remain low by historic levels, then the strategies which have done well in the past few years – momentum and income – could keep working well.

“But if the Bank of England is on to something and inflation is accelerating, then those strategies could fall by the wayside. Superior inflation protection comes from value strategies and cyclical stocks – real estate and oils for example – along with miners, commodities and plays on real ‘stuff’ like property and gold and also index-linked bonds.”