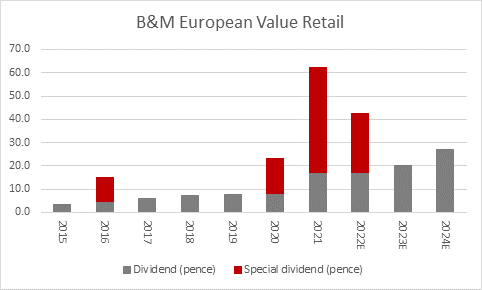

“B&M European Value Retail’s declaration of a 25p-a-share special dividend will mean this is the third year in a row when the firm has rewarded shareholders for their support with a payment over and above the regular dividend,” says AJ Bell Investment Director Russ Mould. “It also means the retailer is the twelfth FTSE 100 firm to declare a special in 2021 and its planned additional £250 million shareholder distribution takes the current total of FTSE 100 special dividends to just under £5 billion for the year.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

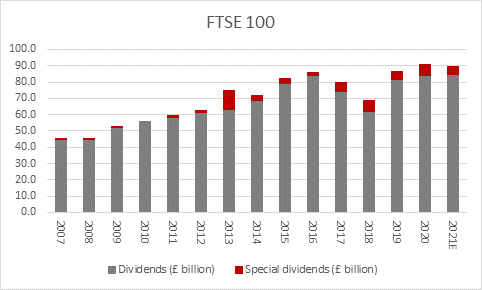

“That £5 billion comes on top of the FTSE 100’s regular dividends, estimated to exceed £80 billion in 2021, and a further £18.7 billion of cash returns in the form of share buybacks from no fewer than 22 members of the UK’s leading index (and that excludes another £230 million of buybacks from Darktrace and Johnson Matthey who were both in the FTSE 100 when they announced their buyback programmes but are about to drop out of the benchmark after the latest quarterly reshuffle).

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“The £4.9) billion special dividends declared by FTSE 100 members in 2021 does not match the £11.6 billion offered in 2013 (when Vodafone returned more than 30p-a-share in cash, or more than £8 billion, after the sale of its Verizon Wireless stake in the USA), but 12 firms have declared special dividends this year.

“They are Admiral, Anglo American, Associated British Foods, Berkeley, Ferguson, Glencore, Hargreaves Lansdown, Melrose Industries, Next, Rio Tinto, St James’s Place and now B&M European Retail, which can now point to four special dividends since its flotation in summer 2014.

“Their additional payments mean the total cash return from the FTSE 100 in 2021 is now set to reach £105 billion, according to the combination of consensus analysts’ forecasts for regular dividends, already declared special dividends and already declared buybacks.

“This figure is equivalent to 5.25% of the FTSE 100’s market cap and must surely catch the eye of income-seekers when they compare that cash return to the 0.1% Bank of England headline base rate and the 0.74% yield currently available from the benchmark UK ten-year Government bond, or Gilt.

“The potential for further largesse in 2022 forms a key part of the investment case for the UK and is already attracting the attention of corporate and financial raiders. Even if relative few FTSE 100 firms have been involved, with RSA a notable exception, nearly 80 UK listed firms have received takeover approaches in 2021. Even if sixteen of those have failed, lapsed or been rebuffed this wave of interest suggests that someone, somewhere thinks the UK equity market is cheap and its meaty yield and overall cash return may be one reason why.

“A further upside of the combination of regular dividends, special dividends, buybacks and proceeds from takeovers is that is puts cash into investors’ pockets and they may well be inclined to reinvest that cash, given the lousy returns available elsewhere.

“While new listing and secondary placement activity is picking up, the amounts raised do not come close to the £105 billion from dividends and buybacks, with takeover payments on top. According to the London Stock Exchange website, primary listings have totalled £14.7 billion and secondary offerings have soaked up a further £24.7 billion.

“That means investors are still better off to the tune of on a net basis and at least some of that cash may well find its way back into the market. Bearing in mind the old adage that ‘bull markets end when the money runs out,’ this does suggest the UK market has upside potential in 2022, providing the new offering pipeline is kept to sensible levels.”