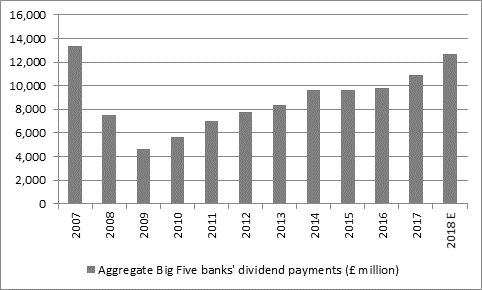

“In addition, Barclays and Lloyds raised their interim dividends and Standard Chartered and RBS resumed first-half payments, to put the quintet on track to make their biggest combined pay-out since 2007.”

Source: Company accounts

Source: Company accounts, Digital Look and analysts’ consensus forecasts for 2018E

“The puzzle for investors, given this glut of apparently good news, is why the shares are not doing better. The Banks sector is down around 7% for the year, against a broadly flat showing from the FTSE All-Share, a showing weak enough to leave Banks ranked 32nd out of the 39 industrial groupings which make up the All-Share.

“There are four possible reasons which could explain this turgid showing.

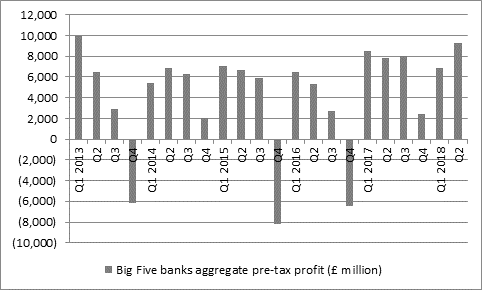

“First, the quality of the increase in banks’ earnings is modest, with the bulk of the improvement coming from lower restructuring charges, asset write-downs and legal bills, rather than loan growth. In the second quarter of 2018, pre-tax income rose by £1.4 billion year-on-year to £9.3 billion – loan and asset impairments fell by £2 billion, restructuring costs by £0.6 billion and conduct costs by £0.5 billion, so underlying progress was unimpressive.

“Second, the modest underlying performance is reflected in further declines in risk-weighted assets, loans and deposits across the Big Five. This shows they are still shrinking themselves back to health and also reflects how they generally operate in mature markets that are very competitive and tightly regulated, so – with the exception of HSBC and Standard Chartered’s Asian operations and the highly cyclical investment banks of HSBC and Barclays – prospects for sustained growth are limited. As such, the banks need to offer juicy dividends to compensate investors for the risks of owning them and, as yet, only HSBC and Lloyds really offer a fat enough yield for them to be perhaps worth the trouble. Further increases at Barclays, Standard Chartered and RBS in particular are therefore required.

| 2018E | |||

| P/E | Price/book | Dividend yield | Dividend cover |

HBSC | 12.9 x | 1.37 x | 5.5% | 1.4 x |

Lloyds | 8.6 x | 1.19 x | 5.5% | 2.1 x |

Royal Bank of Scotland | 9.8 x | 0.88 x | 3.2% | 3.2 x |

Standard Chartered | 12.7 x | 0.74 x | 2.6% | 3.1 x |

Barclays | 9.5 x | 0.73 x | 3.5% | 3.0 x |

Source: Thomson Reuters Datastream, Digital Look, consensus analysts’ forecasts

“Third, the UK banks are not alone in their poor share price performance. The banking sectors in Europe, the US and Japan have all underperformed the broader local indices in 2018. This suggests that someone, somewhere is worried about the state of the global economy and its ability to withstand higher interest rates and lower QE, the increases in global indebtedness since 2007, the state of the globe’s financial plumbing or perhaps something else altogether. In other words, is this as good as it gets?

“Finally, valuations are no longer in knockdown territory, even if the pre-crisis highs remain well out of reach. HSBC and Lloyds now trade at a premium to book value, thanks to their dividend yields. Standard Chartered, RBS and Barclays all trade at a discount to net asset value, but all three must sustainably improve profitability (and the quality as well as the quantity of their income) to close up the gap.”